VAT Collection and Remittance Now Supported for Norway

We are glad to announce that we have started collecting, reporting, and remitting VAT in Norway for all B2C transactions. The VAT handling follows the same model used for other European authorities.

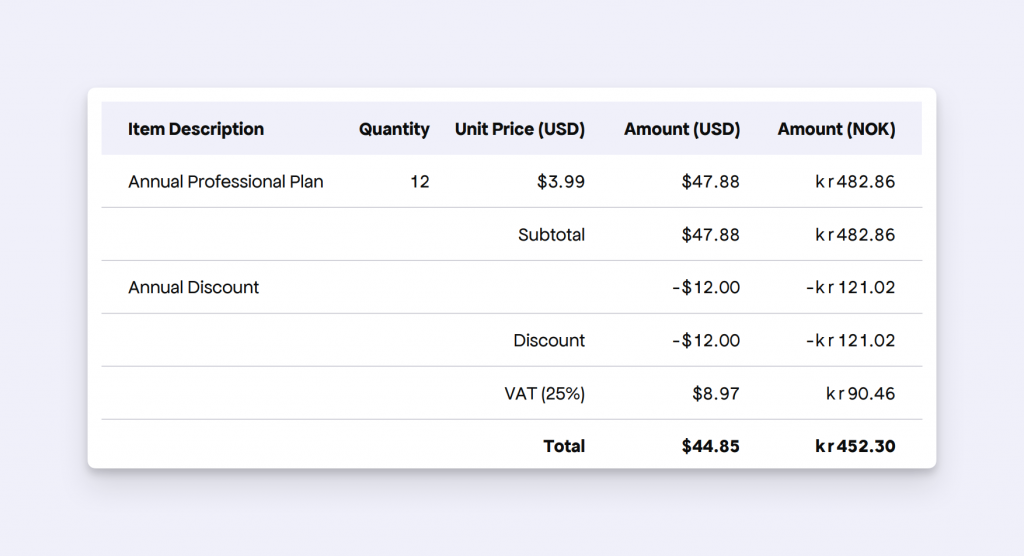

For applicable transactions where VAT is collected, a compliant VAT invoice is automatically generated.

The invoice clearly shows the VAT amounts in both the original transaction currency and the local NOK currency, as required by regulations.

For B2C transactions, companies can enter their Norwegian VAT number and, after validation, will be exempt via the reverse-charge scheme.

The rollout is automatic and applies to all Norwegian transactions from now on.