|

|

Many SaaS businesses lose 5%–9% of revenue to failed payments yet they classify it as product churn instead of a billing system problem.

In conversations with guest founders like Roman Malyshev (Linkbuilder), Chris M. Walker (Legiit), and others, a pattern emerged. When they dug into their numbers, a large percentage of what they assumed was churn wasn’t customers leaving. It was expired cards, silent declines, and failed retries.

At Freemius, we’ve processed millions of subscription renewals across thousands of software businesses. Our data tells the same story:

If you want to reduce SaaS failed payments, you first need to separate product churn from billing failure.

Why Failed Payments Distort Your Churn Metrics

Churn is a customer decision. When failed payments get grouped into that same bucket, billing friction gets misread as product dissatisfaction.

The critical difference:

- Voluntary churn: Driven by dissatisfaction, pricing misalignment, or a change in need

- Involuntary churn: Payment fails despite the customer’s intent to stay subscribed

According to Freemius retention research, involuntary churn can quietly eat up to 9% of your revenue if left unmanaged.

Roman Malyshev, co-founder and CEO of LinkBuilder, experienced this firsthand:

“In Q2 2023, we saw 8%–9% of customers leaving us monthly. When we looked closer, we found that 30% of this churn wasn’t people consciously cancelling. These were failed card charges due to expired cards or insufficient funds. We were losing customers who wanted to stay, simply because of technical payment issues.”

Why Mislabeling Costs You Twice

When billing failures get misclassified as churn, founders optimize the wrong thing:

- Adjust pricing unnecessarily

- Add features customers didn’t ask for

- Double down on retention campaigns that miss the real issue

Those efforts may help with genuine cancellations. They do nothing for mechanical billing failures.

A $12K Wake-Up Call

Chris M. Walker, founder and CEO of Legiit, learned this lesson the expensive way.

The assumption: Failed payments were edge cases their billing system handled automatically.

The reality: Failed payments were responsible for nearly 30% of what they initially assumed was normal churn. In 2022, monthly recurring revenue dropped by 12% in a single quarter due to silent card declines — over $12K in lost MRR that could have been recovered.

“Our mistake was assuming customers who left simply lost interest. In reality many wanted to stay but their billing failed.”

When you look closely at failed SaaS payments, the causes are usually mechanical (and thus fixable).

If you want to reduce SaaS failed payments, you need to understand what actually causes them.

The Real Causes of Failed Payments

- Expired or replaced cards: Cards rotate every 2–5 years. Unless updated, renewals fail automatically.

- Temporary insufficient funds: A renewal that hits before payday can fail even when the customer intends to continue.

- Bank or network rejections: Issuers regularly decline recurring charges without clear explanations, especially for cross-border payments.

- Strong Customer Authentication (SCA) issues: Payments fail when customers don’t complete required verification steps.

These failures are situational and time-bound. They follow patterns and can be resolved with the right timing, communication, and retry logic.

How to Reduce SaaS Failed Payments With Smarter Retry Logic

1. Retry Timing Should Reflect Real-World Conditions

Nothing has changed. The card is still expired. The funds are still unavailable. Build in deliberate gaps so something meaningful can change.

- Funds have time to replenish

- Temporary bank declines can clear

- Customers are able to complete authentication steps

Roman Malyshev found that reminders 7 days before charging worked 20+ percentage points better than 2 days before.

His sequence:

- Reminder 7 days out

- Warning at 3 days

- Notification on day of failure

- Personal outreach after 3 days

- Final notice after 7 days

2. Retry Schedules Must Reflect Pay Cycles

Many failed payments are tied to cash flow timing, not willingness to pay.

Better retry logic:

- avoids clustering retries at the very start of the month

- spaces attempts to catch common paydays

- varies timing instead of retrying at the same hour repeatedly

Gregory Shein‘s team at Corcava noticed: “Success rates were significantly higher when retries aligned with local business hours and typical salary deposit windows.”

3. Recognize Diminishing Returns Early and Escalate Purposefully

Repeated declines with the same failure reason? Retries alone won’t fix it.

The Legiit team learned: “After three retries response rates declined and frustration increased. Respectful persistence proved more effective than endless retries.”

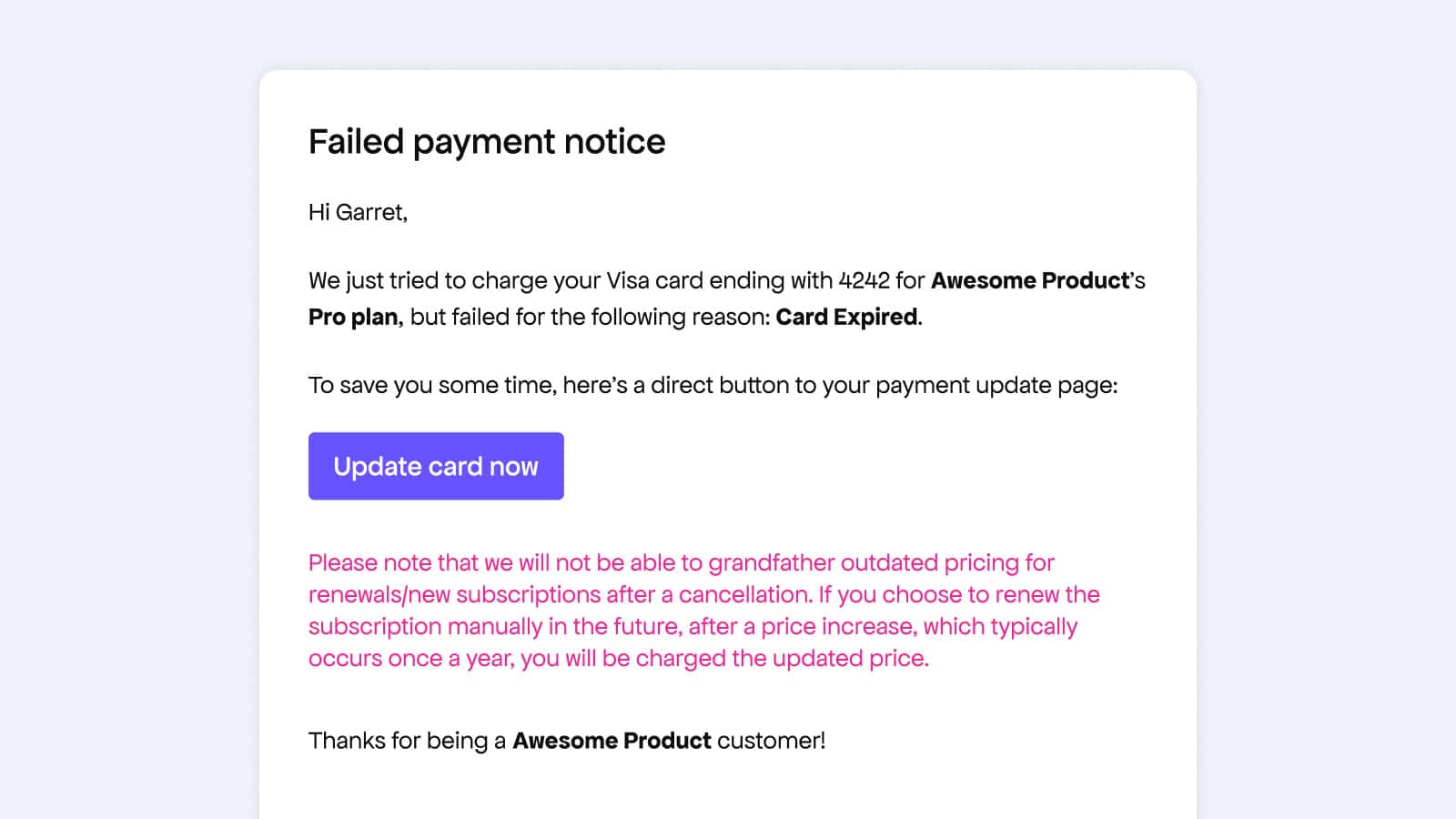

Generic “your payment failed” emails get ignored because they require interpretation.

Effective escalation:

- Triggers only when customer action is required

- Explains what failed and why in plain terms

- Makes resolution simple

Customer Communication That Prevents Churn

Good communication treats payment failures as solvable moments, not customer failings.

Gregory saw this at Corcava:

“Customers reached out asking why their account was suspended. Support tickets included phrases like ‘I thought I paid already.’

When we checked logs the emails had technically been sent, but they landed in promotions or spam, looked automated and low-urgency, and didn’t clearly explain required action. That’s when we realized: A sent email ≠ a received or understood message.”

Three Communication Traps to Avoid

Trap #1: Vague messaging puts the fix in the hands of the user

Instead of clarifying the issue, many failed payment emails stay generic. They notify the customer that something went wrong but don’t explain what or why.

When customers have to interpret the problem before fixing it, many won’t.

Trap #2: They create pressure instead of clarity

Urgency without clarity backfires because customers will likely delay if they feel accused or rushed.

Chris Walker’s team found that personalized dunning emails combined with structured retry timing had the biggest impact. “Customers responded positively when communication was clear and respectful.”

Trap #3: Communications add friction at the worst moment

Every extra step between the inbox and the fix increases the chance the issue is ignored.

What Actually Works

A failed payment message should:

- Tell the customer exactly what happened (“your card expired” or “your bank requires an extra step”)

- Include a single, obvious action, ideally a direct link to update payment details

- Remove every other decision from the moment

Roman changed his tone entirely: “Instead of corporate text, we wrote simply and humanly.”

The result:

- Drop in “angry” support tickets

- Failed payments no longer felt like “punishment”

- 14-day grace period turned stressful moments into professional interactions

Roman also received direct confirmation:

“We got emails saying, ‘Thanks for the heads-up, my card was compromised and I forgot to update it.’ It signaled that we weren’t just a ‘billing machine,’ but a partner that understands real-life hurdles.”

Tone and timing matter but recovery still depends on execution.

Automation vs. Manual Recovery for Failed Payments

Manually chasing failed payments works when volume is low. But once renewals stack up, recovery speed becomes the deciding factor. The longer a failed payment sits unresolved, the harder it becomes to recover.

The Case for Automation

At minimum, automated recovery includes:

- Scheduled retries spaced over several days

- Failure-aware customer notifications

- Grace periods that keep access active while recovery runs

- Clear escalation only when retries stop working

| Aspect | Manual recovery | Automated recovery |

| Speed | A founder notices a failed renewal hours or days later during review | Retry logic fires when recovery odds are highest |

| Consistency | Follow-ups depend on memory and availability | The same retry and notification logic runs every time |

| Coverage | Friday night failures sit untouched until Monday | Retries and emails run overnight, on weekends, and during holidays |

| Scalability | Works at 5–10 failures per month, collapses at 50+ | Handles hundreds or thousands without added effort |

| Recovery timing | Contact often begins after access is revoked | First retries happen while access is still active |

Manual recovery feels effective because the wins are visible. The silent failures never are.

Automation handles predictable declines. But when retries, notifications, and access rules drift out of sync, recovery quietly breaks down.

That’s why some platforms coordinate recovery inside the renewal flow itself.

Failed Payment Recovery Is a System, Not a Feature

Many founders treat failed payment recovery as a setting. It isn’t. It’s a coordinated system of retries, messaging, timing, and access control working in sequence.

Pavan Kamat, co-founder and CEO of Panto AI, learned this early:

“Wrong assumptions we made:

(a) ‘The processor will handle retries’ — they don’t cover timing, messaging, or UX

(b) ‘generic emails work’ — they don’t

(c) ‘finance owns it alone’ — it’s a cross-functional revenue ops problem.”

Most billing systems treat retries, emails, and access rules as separate actions. When they aren’t coordinated, recovery breaks.

What Coordinated Failed Payments Recovery Looks Like

Quiet recovery only works when every step supports the next:

- Retries happen when success is likely, not just on a fixed schedule

- Notifications arrive when customer action is actually required

- Access isn’t cut off while retries and customer follow-ups are still running

- Escalation happens only when retries stop being effective

Roman Malyshev adds:

“Founders treat it as a ‘set-and-forget’ feature. It’s not. It’s a system of communication, timing, and empathy. You aren’t just ‘retrying a card’; you are managing a customer relationship during a friction point.

Don’t obsess over the number of retries. Obsess over the Time-to-Recovery. If it takes you 25 days to recover a payment, you’ve likely already lost the user’s momentum. Focus on the first 7 days.”

The Real Impact of Effective Failed Payments Recovery

Here’s what changed for our featured SaaS founders when recovery became deliberate and systematic.

Chris M. Walker / Legiit

Before:

- Nearly 30% of churn was actually failed payments

- 12% MRR drop in a single quarter from silent card declines

After implementing structured retries, personalized dunning, and clear ownership:

- Involuntary churn reduced to under 8%

- Lifetime value rose by 18%

- Unexpected benefit: Recovery campaigns generated goodwill

Roman Malyshev / Linkbuilder

Before:

- Involuntary churn: 2.5%–3% of monthly revenue

- Recovery rate: only 15%–18% of failed payments

After implementing reminder and retry system:

- Involuntary churn dropped to 1.2%

- Recovery rate jumped to 58–62%

- Lifetime value increased by 18–22%

- In dollar terms: $12–15K in monthly recurring revenue they were losing before

Pavan Kamat / Panto AI

After implementing structured recovery program:

- Revenue recovery: 35%–55% of revenue at risk

- LTV lift: 10%-20% for cohorts most affected by card failures

- Net dollar retention improved by 4-6 points

Gregory Shein / Corcava

When they separated voluntary from involuntary churn:

- 25%–35% of “churn” was actually involuntary

- In some billing cohorts: climbed to 40%+

After improving retry logic and recovery flows:

- Recovered meaningful revenue without changing product or pricing

- ROI similar to launching a major feature but with far less risk and cost

What to Check in Your Own SaaS Setup

Before writing off failed payments as inevitable churn, audit how recovery works in your stack today.

1. How Many Failed Payments Are You Actually Recovering?

Ask yourself:

- Of all failed renewals last month, how many eventually recovered?

- How many were still recoverable when access was cut off?

- How many quietly expired without any follow-up?

If you don’t know the answers, recovery is being assumed.

2. Are Customers Notified Clearly and Early?

Check:

- Does the first notification go out immediately after failure, or days later?

- Does it explain why the payment failed, or just that it did?

- Is there a single, direct path to fix the issue, or multiple steps and logins?

Example of actionable, high-performing messaging:

Your card ending in 4242 was declined due to insufficient funds. No action is required right now—we’ll retry automatically in 24 hours. If you’d like to update your card, you can do so here: [Update payment method]

3. Does Retry Timing Match How Your Customers Get Paid?

Look at:

- Are retries clustered early in the month, regardless of pay cycles?

- Do retries happen at the same hour each time?

- Are there gaps long enough for funds to replenish or restrictions to clear?

If retries fire before anything can change, they’re just repeating failure.

4. Where Is Manual Effort Attempting to Fill System Gaps?

Common signs:

- Manually emailing customers after spotting failures in dashboards

- Chasing renewals at the end of the week or month

- Reacting to cancellations that could have been prevented earlier

If recovery often depends on someone remembering to intervene, it will fail silently under load.

5. Are Access Rules Helping or Hurting Recovery?

Check:

- Does access stop immediately after a failed renewal?

- Is there a grace period while retries and notifications run?

- Can customers still log in to update payment details?

Systems that allow a short grace period during recovery consistently outperform hard cutoffs.

For example, at Freemius, licenses can enter a temporary Expired mode while a renewal is retried — instead of immediately cutting off access — giving recovery time to work without disrupting the customer experience.

Find a Solution That Offers Revenue Protection Built In

Failed payment recovery is strongest when retries, notifications, and access rules stay aligned. Platforms like Freemius manage that inside the subscription flow itself, so you don’t stitch together separate retry logic, email tools, and license status updates.

When a renewal fails:

- Retries are attempted on a structured schedule built for subscriptions

- Customers receive contextual notifications with direct payment update links

Recovery runs automatically in the background. Customers are prompted only when they need to update payment details.

Freemius coordinates retries, notifications, and access rules inside the subscription flow so recovery doesn’t depend on manual follow-up.

Failed Payments Aren’t Churn. They’re Recoverable Revenue

Failed payments may have been quietly eroding your revenue for years, often misclassified as churn and left unexamined.

What’s changed isn’t their existence — it’s your ability to isolate, measure, and recover them.

The founders in this article didn’t build new features or redesign pricing. They simply stopped letting fixable billing failures masquerade as customer decisions.

Ready to see what you’re really losing?

Freemius coordinates retries, notifications, grace periods, and access control directly inside your subscription flow.

Talk to our team about your current setup. We’ll show you how much revenue is slipping through the cracks and how to recover it.