|

|

Subscription businesses have come a long way from magazines and daily milk deliveries. With an average American spending close to $1,000 per year on different types of subscriptions, it’s not a surprise that the market is predicted to grow by 68% between 2024 and 2028.

Subscription models keep customers happy (think: convenience!) and businesses thriving (think: predictable revenue!), but with great power comes, well, tax responsibility.

Wondering how sales tax applies to your subscription-based software business? This article will untangle everything you need to know about your tax obligations and help you understand your risks and liabilities, and how to optimize your sales tax.

What Is Sales Tax for Digital Subscriptions?

Sales tax is a levy that some countries impose on the retail sale of certain goods and services. Think of it as a small percentage added to the purchase price that gets remitted to the government.

So, what’s the problem with subscriptions to digital products and services?

Well, digital products are relatively new — compared to most traditional sales tax laws around the world, which mostly refer to physical items. But unlike physical products, which are considered tangible and generally taxable, software is considered intangible. This has led to a debate about whether digital subscriptions like yours should be taxed and ongoing changes in sales tax laws.

To make things even more complicated, each country (and even state) has its own rules. Some governments tax all digital products, while others only tax those with a physical counterpart (like downloadable software with a physical disc option).

However, this complexity doesn’t make a good excuse for not charging sales tax if you’re supposed to. Ignoring the law can be a costly mistake, as penalties and interest can add up quickly, and in severe cases, you might even face legal repercussions. Not to mention that neglecting your tax obligations can seriously hurt your business finances and reputation.

Is My Software Taxable?

When it comes to taxes, playing it safe by understanding your sales tax obligations ensures you’re operating above board and avoids future headaches. But, how do you know if your software subscription is taxable?

Unfortunately, there’s no one-size-fits-all answer, when and how you’ll add sales tax on your software subscriptions depends on many factors, such as:

Location

Whether you’ll charge sales tax on your software depends on your main business location — nexus. Nexus, in this context, is the connection your business has with a particular country or state, determining if you have a sales tax filing and collection obligation to that government.

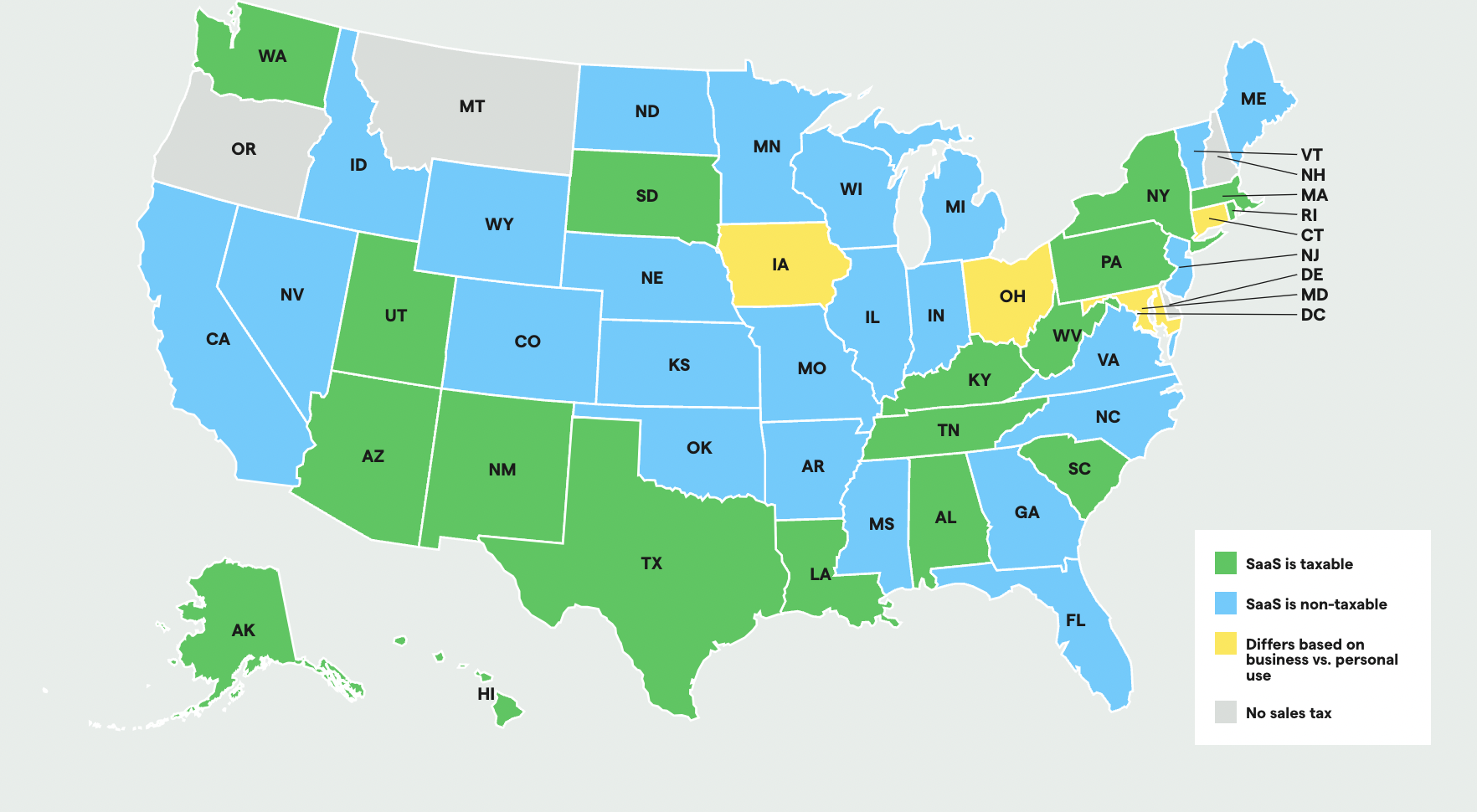

In the US, each state has its own definition of what constitutes a taxable digital product. Some states tax all digital products, while others only tax those with a physical counterpart.

You can check out where your product is subject to sales tax and the exact amounts for each state in our table here — you’ll see that SaaS is taxable in most of them, with some specific rules for software for business vs. personal use.

Read more: Complete US Tax Cheat Sheet for WordPress Plugin and Theme Developers

Here’s an example to illustrate how customer location can impact sales tax: California vs. Iowa.

- California: SaaS is typically non-taxable in California.

- Iowa: SaaS is generally taxable in Iowa at 6%, unless it’s purchased for business purposes — which makes it exempt.

But be careful, because there’s another catch.

Since the Supreme Court’s decision in 2018, your subscription-based business may also have an economic nexus in a state where you don’t have a physical presence. That means your sales exceed a specific threshold set by that state (for example, $100,000 or 200 transactions, in most of them) within a 12-month period, and your software becomes subject to sales tax.

Other countries may also consider the economic nexus when determining if your software is subject to sales tax — and the thresholds vary based on business location. Sometimes, a single customer could be enough to require tax collection.

For example, the UK requires VAT collection from the first sale for foreign businesses, with a £90,000 threshold for UK-based businesses. This was also the case for EU VAT, but in 2019, a €10,000 threshold was added for electronic services sold online. The threshold is calculated based on all sales within the EEA (European Economic Area) and is only applicable to EU-based businesses.

If you have it in a country or state that taxes digital products, you’re likely responsible for collecting and remitting sales tax.

Australia requires you to charge the GST in case you exceed A$75,000 in sales per year. In the EU, however, the threshold for SaaS businesses doesn’t exist. Sales tax (or consumption tax, better known as value-added tax or VAT) depends on the type of transaction (B2B vs. B2C), but you must register for it anyway.

Some other countries that have no thresholds and require you to register are India, South Korea, and Turkey.

Software Type

Some states in the US exempt specific software categories, like educational software or certain types of business software. It’s crucial to research the specific exemptions in your location.

Also, if your subscription offers a primarily service-based experience (like cloud-based software with ongoing updates and support), some states or countries might not consider it a taxable product. However, this distinction can be blurry, so consulting a local tax professional is always recommended.

While the ultimate responsibility for collecting and remitting sales tax lies with your business, some jurisdictions require users to pay “use tax” on untaxed purchases.

Why is Managing Sales Tax for Software Subscriptions so Complicated?

You may now understand how sales tax for SaaS subscriptions can vary depending on your business geolocation, what you sell, and where you sell it, but you might still be unsure about how to be tax-compliant.

The main challenge of managing sales tax on software subscriptions is that the only constant thing about it is — change:

- State or country sales tax regulations and rates may change

- Customer jurisdiction or the jurisdiction where you pay taxes may change

- Customer who used to be a consumer may become a business entity

- Customer who may not have been exempt now has an exemption

These are followed by technical challenges of modifying your processes each time there’s a change.

You need to figure out the APIs for your payment process and introduce the new rules for subscription renewals.

As you create an automated process and don’t calculate the sales tax manually on each payment renewal, you need to communicate the change to the API, identify subscriptions that need to be adjusted both in the payment processor and in your platform — and communicate the information to the customers.

Another concern is the customer billing information — how do you store it in your system? The way you store customer and subscription data plays a crucial role in efficiently identifying affected subscriptions when there’s a sales tax change that affects your software subscriptions.

Let’s say you store all billing information per customer. A customer relocates from France (where they subscribed to your service) to Germany. They use the same account to purchase another subscription from your store, but this time with a German credit card and billing address.

Now, if a VAT increase hits France, your system might mistakenly update both subscriptions since they’re tied to the same customer. This could lead to overcharging the customer for the German subscription.

Storing billing information per subscription offers greater control and flexibility. In the example above, each subscription would have its own distinct billing address. So, only the French subscription would be flagged for a VAT increase, ensuring accurate tax application.

Proactive vs. Reactive Approach to Tax Regulation Changes

You could take two approaches to staying on top of these changes:

- Proactive approach: Regularly monitor tax regulation changes and proactively update subscriptions that will be affected.

- Reactive approach: Check for changes and make adjustments before each subscription renewal.

The Proactive Approach

The essence of the proactive approach to sales tax compliance is anticipating changes, not reacting to them after they happen. Say you sell software in Germany; your customers are happy, but then Germany reduces its VAT rate to stimulate the economy. This is great news for most people, but for you, it means proactively updating all your German subscriptions to reflect the new rate.

So, if you take the proactive approach, you will keep yourself updated on tax regulation changes across all your sales jurisdictions, including VAT rates, new sales tax implementations, and even changes to existing exemptions.

Once you know about a change, use your customer data to pinpoint subscriptions that will be impacted. This could involve filtering by country, state, or even zip code, depending on the regulation. Before the change takes effect, proactively update the tax rates for those subscriptions. This ensures your customers pay the correct amount and avoids any surprises during renewals.

The benefits of this approach are clear: happy customers (because no one likes unpleasant surprises, especially when it comes to bills) and guaranteed compliance.

Still, the proactive approach can be time-consuming as it requires staying on top of tax regulation changes across multiple jurisdictions. This can be a time-consuming task. Also, what happens when a previously untaxed jurisdiction decides to start charging sales tax? You’ll need to update subscriptions and send clear, informative emails to customers explaining the changes and the impact on their renewals.

That said, the proactive approach is also about managing customer expectations.

- Be upfront with your customers about any upcoming tax changes that will affect their subscriptions.

- Craft informative emails that explain the changes in a way that’s easy to understand and avoids triggering cancellations.

- Be prepared to answer customer questions and address any concerns they may have about the new tax rates.

The Reactive Approach

The reactive approach to sales tax compliance might seem appealing at first glance. It involves waiting until just before a subscription renews and then checking for any changes that need to be addressed.

This approach seems efficient because it avoids updating subscriptions that might eventually be canceled.

Also, when a customer updates their billing information or provides a VAT number, you’re essentially reacting to their proactive action. When you process this information and update their subscription accordingly, you’re ensuring the customer is charged the correct amount moving forward.

Still, there are a few drawbacks to this approach. The biggest risk is missing important updates. If a regulation changes or a customer relocates between renewals, the reactive approach could miss these changes and lead to inaccurate tax calculations. This could result in undercharging or overcharging your customers, both of which can cause headaches.

At the same time, you’re risking customer dissatisfaction, as the reactive approach may give you less time to notify your customers of tax-related changes.

The choice between proactive and reactive approaches often comes down to finding the right balance for your business. Here are some things to consider:

- Subscription volume: If you have a small number of subscriptions, the reactive approach might be manageable. However, for businesses with a large subscriber base, the proactive approach becomes essential for efficiency and accuracy.

- Customer impact: The potential impact of missed tax updates on your customers should be a major consideration. If inaccurate tax charges could cause significant inconvenience or financial burden, then a proactive approach is crucial.

- Available resources: Implementing a proactive approach requires investment in technology and processes. Evaluate your resources to determine if a proactive approach is feasible.

Remember, your ultimate goal is to achieve a balance that lets you achieve full compliance and provide a smooth customer experience at the same time.

Grab a free copy of our Cheat Sheet for

Selling Plugins and Themes

A growth roadmap with concise, actionable tips for every milestone of WordPress product development.

Calculating Sales Tax on Your Subscriptions: 7 Steps

Now you know how complex sales tax can be — but that’s not all. There may be a feeling of “where do I actually begin?” Below, we outline the seven key steps of calculating and implementing sales tax in your subscription payment process.

1. Map Your Sales Tax Landscape

It all starts with understanding your tax obligations in each state or country you serve. Do you sell to customers located in the EU? Then you must include the VAT in calculating the final price of your subscription. Sales tax regulations vary widely by location, so this can be a complex task. Consider consulting a tax professional to ensure you’re on the right track.

2. Pinpoint Your Customers

Since sales tax is based on the customer’s location, not yours (unless you have a nexus in a location), accurately identifying your customer base is crucial. You can do this manually, but for businesses with customers in multiple jurisdictions, automated solutions can save time and minimize errors.

3. Calculate the Numbers

Once you know the tax rate for your customer’s location and the subscription price, it’s time to calculate the sales tax amount. This might involve some complex calculations if you offer bundled services or have customers in multiple tax jurisdictions.

Have you tried online sales tax calculators? These can help if you decide to skip professional help and crunch the numbers on your own.

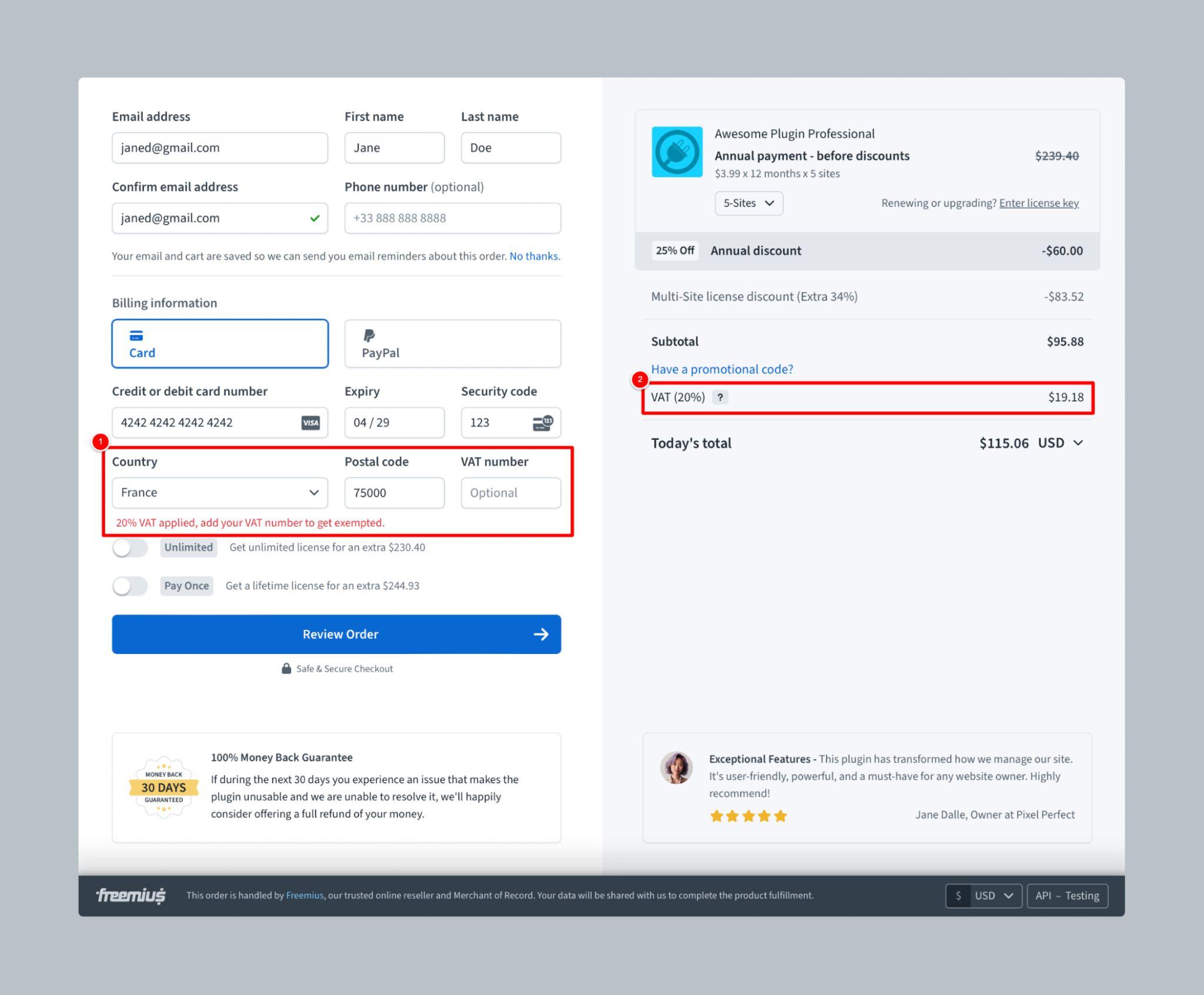

4. Collect from Your Customers

Transparency is key. Clearly display the sales tax amount during checkout or include it in the subscription fee. In some countries, like Australia, you’re even required to be transparent by local law. Avoid adding the sales tax in the last step of the subscription process to — it could be an unpleasant surprise for your customers prompting them to abandon the cart and give up on subscribing.

5. File Sales Tax Returns Timeously

The frequency of sales tax filing depends on your business’s total sales volume within each jurisdiction. Some countries require monthly filing, while others allow for quarterly or even annual filings for businesses below a certain threshold. Research the specific requirements for each jurisdiction where you sell your subscriptions. If filing monthly, the deadline is usually the 20th of the month for the previous month.

6. Keep Detailed Records

Maintaining meticulous records of your sales tax collections is essential. Here’s what you should keep:

- Receipts or invoices with information about your business, customer, date of purchase, amount of sales tax, etc.

- Refund documentation, including credit notes

7. Stay Vigilant

The work doesn’t stop there. Monitor your sales activity across locations to see if you’ve surpassed nexus thresholds. Exceeding these thresholds might trigger additional filing and remittance requirements.

Best Practices for Managing Sales Tax for Your Subscription-Based Business

Below, we’re sharing some of the best practices when it comes to sales tax management. Whether you decide to outsource taxes to dedicated professionals or handle them in-house, these tips will come in handy to ensure compliance for your SaaS business.

Automate Sales Tax Calculations

Sales tax calculations for subscription businesses can get complex, especially with customers across multiple jurisdictions and potentially bundled services.

Automated sales tax solutions integrate with your existing billing system, automatically calculating the correct tax rate based on the customer’s location. This eliminates manual calculations and saves your team valuable time.

You’ll also be sure you’re always applying the correct tax rates, reducing the risk of non-compliance issues.

Stay Updated on Tax Laws

Sales tax laws are constantly evolving, so staying informed is crucial. Regularly check for updates and consider consulting with your tax professional to ensure your business remains compliant.

Here are some resources to help you stay in the loop:

- State/Country official government websites: Every state or country has a dedicated website with information on sales tax laws and filing procedures. Search for “[State/Country Name] Department of Revenue” or “Sales Tax” on the official government website.

- Tax association resources: For example, for the US, the Federation of Tax Administrators (FTA) offers a directory of state tax agencies if you’re looking to keep up with the US taxes.

- Tax software & services: Several software programs and services can automate sales tax calculations, filing, and compliance. These can be helpful for businesses with complex sales tax scenarios.

Consult a Tax Professional

For definitive guidance and to ensure sales tax compliance for your software, it’s always a good idea to consult with a qualified tax professional familiar with SaaS businesses and sales tax regulations in your specific location.

Beyond just compliance, a tax professional can also help you identify opportunities to minimize your tax liability legally. They can advise on strategies like product structuring and service offerings to potentially reduce your overall tax burden.

Sell Through a Merchant of Record

Sometimes, the best way to ensure tax compliance and get peace of mind while selling subscriptions for your software is to outsource.

In this case, consider a merchant of record as your trusted partner for streamlining payment processing. A merchant of record acts as a reseller for your software, taking on the responsibility of authorizing and processing credit and debit card transactions on your behalf:

- Handles payment processing, freeing you to focus on your core business

- Assumes liability for certain aspects of transactions, including potential tax issues

- Stays current on complex regulations regarding sales tax and transactions (so you don’t have to)

For example, Freemius uses the consumer’s IP address for initial country identification and auto-selects the billing country. If the country is changed, the system relies on the address provided in the billing. The IP is used to show the correct amount of tax based on the geolocation, but the final tax rate is determined by the billing address.

We also monitor tax rates and update subscriptions periodically, maintaining a database of relevant tax rates and comparing subscription addresses against this database to identify any changes affecting your subscriptions. Your customers are also always notified in advance of any tax rate adjustments.

Let Freemius Take Care of Your Sales Tax

If you’ve got a backlog of undeclared sales taxes, it’s in your best interest to contact an accountant to help you get your affairs in order.

And if you’d like to keep your house squeaky clean going forward, a managed platform like Freemius can take care of your sales tax affairs, whether they’re US or EU-related, so you can focus your time and energy on developing awesome software products.

As a merchant of record, we’re liable for sales tax compliance: if we get things wrong, this liability is our problem and you simply don’t need to worry about it.

If you have additional questions on sales tax or would like to sign up for our services, please get in touch with us at [email protected].