|

|

As a former accountant who has made the transition into WordPress plugin development, I know how difficult it is to keep track of ever-changing tax laws, especially when you’re a freelancer or run a small business.

I’ve even developed a plugin to assist with 1099-MISC reporting for affiliates and multi-vendor marketplaces called WP1099 to simplify the 1099 filing process.

The United States has a number of tax laws on the Federal, State, and Local levels that WordPress theme and plugin developers need to be aware of. This post will talk about the tax implications of things like outsourcing work, incorporating your business, and sales tax, helping you understand how to always remain compliant, whether you work inside the US or abroad.

Incorporating Your Business

Many people with a WordPress theme or plugin business consider the job a “side hustle” and tend to treat it as such. However, these side jobs take real money from real customers. That means your side job can end up putting yourself in legal trouble if you start earning taxable income from it or if something goes wrong with a customer.

The best way to protect your personal assets is to incorporate your business. This isn’t a difficult process, and in many states, it is fairly inexpensive..

Incorporating creates a legal entity that is separate from the individual(s) who created it. With this legal designation, the business owner(s) are generally protected from personal liability from the company’s debts.

This means that if your company gets sued, your personal assets (your house, car, retirement accounts, etc.) can’t be attached to the lawsuit. At the same time, disclosing all your income on your tax return forms will reduce the possibility of issues with the IRS later on, as your side hustle grows.

Corporation or LLC?

Now, you may be wondering which legal entity type you should go for. Corporations (S-Corps and C-Corps) and Limited Liability Companies (LLC’s) both offer their owners personal liability protection described earlier. They each have their pros and cons, so it is important to choose the right model for your business.

LLC’s provide several advantages that benefit new businesses. An LLC protects business owners from personal liability for the actions of the LLC. They also have no formal management structure, or formal meeting requirements like a corporation has. Additionally, taxes are paid on the business owner’s personal tax return, which avoids “double taxation” that corporations pay.

Corporations, on the other hand, are taxed as separate entities, which creates what’s called double taxation. This means that they pay tax on their profits through their corporate tax return. Then the owners pay tax on the share of the profits that are distributed to them on their personal tax return.

Here’s an overview of key aspects and differences between an LLC or the two types of corporations.

| Feature | LLC | S Corp | C Corp |

|---|---|---|---|

| Liability protection | Yes | Yes | Yes |

| Flexibility in ownership structure | Yes (members can be individuals, corporations, or other LLCs) | Limited (must have 100 or fewer shareholders who are U.S. citizens or permanent residents) | More flexible (can have many different owners and classes of stock) |

| Ease of creation | Easy | Moderate | Moderate |

| Cost of creation | Affordable | Moderate | Moderate |

| Ease of maintenance | Easy | Moderate | More complex |

| Cost of maintenance | Affordable | Moderate | More expensive (due to corporate income tax filings) |

| Tax treatment | Pass-through taxation (profits and losses pass through to owners’ personal tax returns) | Pass-through taxation (profits and losses pass through to shareholders’ personal tax returns, but S corps must pay salaries to shareholders to avoid double taxation) | Double taxation (corporate income taxed at the corporate level, and dividends paid to shareholders are taxed again at the individual level) |

| Attractiveness to investors | Less attractive | Moderately attractive | More attractive (due to ability to offer multiple classes of stock) |

The choice between a corporation and an LLC depends on a number of factors, but generally, freelancers and “solopreneurs” will want to choose an LLC. If you are uncertain what the best legal entity is for your business, contact a business law attorney in your area.

Katelynn Minott, a CPA and the CEO of expat tax preparation service Bright!Tax, advises continuous evaluation of potential legal structures to make sure you’re always choosing the one that’s best for your business.

“Expat developers running a small team abroad should continuously evaluate whether their business structure is best suited for tax efficiency,” says Katelynn. “Factors such as earnings, team size, team location and your country of residence can all influence the best country of registration and the best business structure for your operation.”

Outsourcing Labor

In every software maker’s career, there comes a time when you become overwhelmed with the amount of work you have to do. Running a business is much different than being employed because as a business owner, you wear all the hats until you can afford to hire someone to do some of the work for you.

Running a business is a much different animal than being employed. As a business owner, you wear all the hats until you can afford to hire someone to do some of the work for you.

But what does it mean to hire someone? When you start a business relationship with a worker, how do you know if they’re supposed to be an employee or a contractor?

According to the IRS, you need to examine the relationship between your business and the worker to determine the correct classification:

There are three categories of factors to be looked at.

- Behavioral Control: Can you direct and control what work is done and how the worker does it?

- Financial Control: This includes how you pay the worker and whether or not the worker can make their services available to a wider market, whether you provide the worker with necessary tools to do the job, whether your reimburse their business expenses, etc.

- Relationship of the parties: Are there written contracts describing the relationship between you and the worker? Do you provide the worker with benefits like insurance, pension, vacation, or sick pay? Is the relationship considered permanent, or temporary? Is the work getting done considered a key business activity?

Any of these factors can cause the worker to be classified as an employee.But, what’s the big deal, right? An employee, contractor, what difference does it make?

The difference is if a worker is considered an employee, the business (also known as the employer) is responsible for paying payroll taxes and employee benefits: Medicare and Social Security taxes, workers compensation in the event of an on-the-job injury, and other similar matters.

An independent contractor doesn’t have the same rights. They’re responsible for paying their own taxes, referred to as self-employment taxes. An independent contractor is also responsible for their own insurance. This includes health insurance, long-term disability insurance, as well as business liability insurance that would be used in the event that a legal dispute arises in the course of doing business.

Example of an Employee Relationship

The definition of independent contractor vs. employee may slightly vary in different states, and you may refer to different tests to determine the status of your worker, like the ABC test in California.

But in general, a worker may be considered an employee if you’ve hired them at a set salary (or hourly rate), you provide them with employee benefits, have the ability to dictate how they work (where they must work from, hours they must be available, the equipment they must use, etc.).

Here’s an example.

Sally is hired by ABC Co., which designs websites for clients as a lead web designer. Her salary is $50,000 per year, and she is expected to work from the corporate headquarters Monday-Friday each week between the hours of 9 AM-5 PM.

Sally will also get a new laptop and software from ABC Co. that she must use for all company work. She gets two weeks paid vacation per year, receives health insurance, and retirement savings matching.

With all this in mind, Sally is considered an employee.

Example of an Independent Contractor Relationship

Let’s use the same example, with a few modifications, to illustrate a different business relationship.

ABC Co.’s lead web designer was out on maternity leave, and one of their major clients had a design update that needed to get done within the next two weeks. ABC Co. asked Sally to do the project for $1,500. Sally can do the work whenever and wherever she wants on her own laptop, as long as the job is done within two weeks.

ABC Co. has no objections to Sally taking on other clients during the same time period if she wants to. After the project is complete, ABC Co. will pay the invoice she issues to them, and has no obligation to provide any additional work to Sally.

Based on this description, Sally is considered an independent contractor.

Types of Independent Contractors

You may typically find the following types of workers in an independent contractor relationship with another business.

- Temporary workers that you might use for a one-off job. For example, a graphic designer to create your company’s logo and letterhead.

- Affiliates are considered independent contractors because there usually aren’t any rules as to when or where they need to work, and their only pay is generated when they bring in business. A salaried salesperson, on the other hand, might be considered an employee.

- Vendors in online marketplaces like ThemeForest, CodeCanyon, or other similar sites.

- Freelancers with ongoing engagements, but typically hired for non-core business activities, such as marketing or accounting.

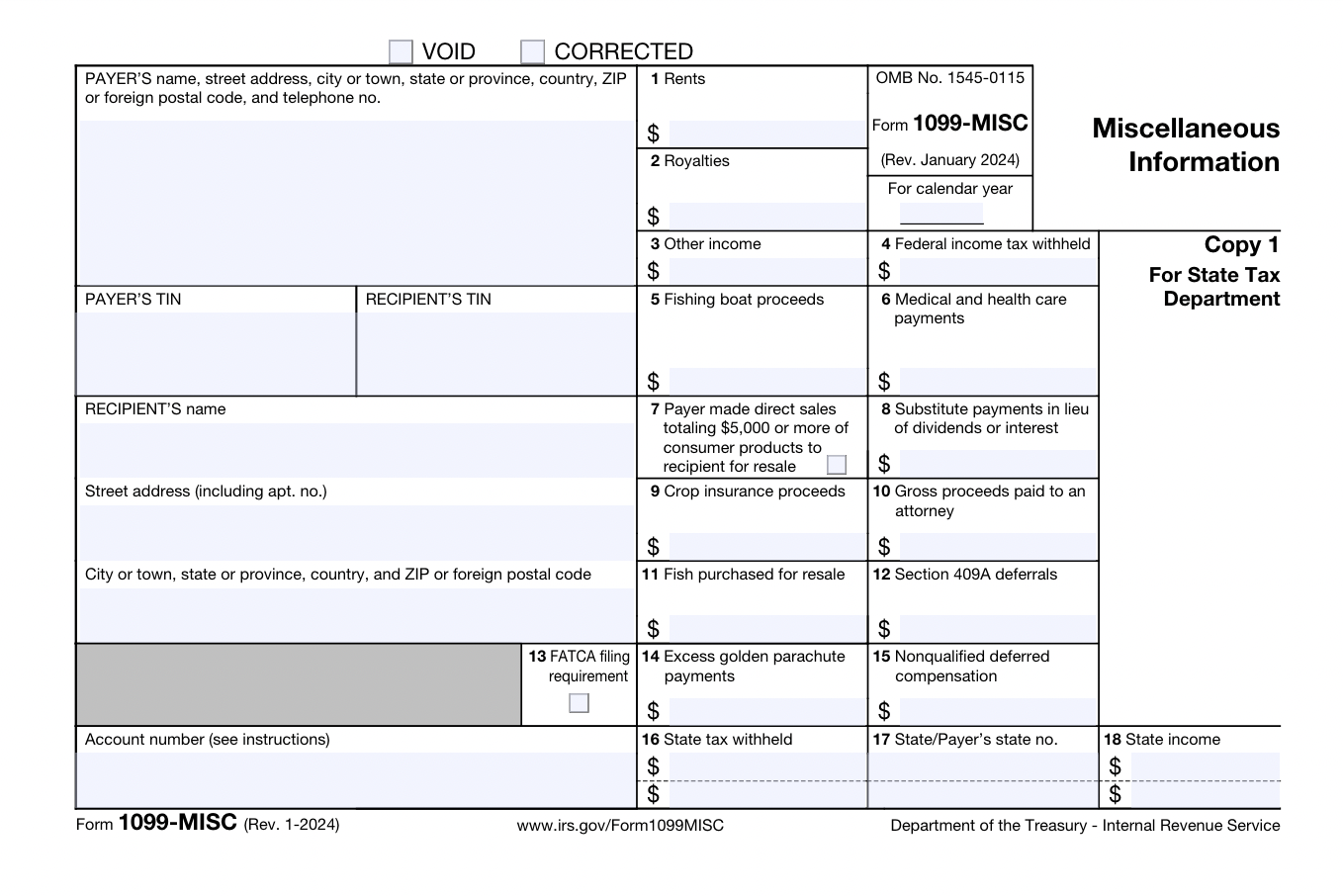

1099-MISC Reporting

As a business, you’re not responsible for paying an independent contractor’s payroll taxes. However, you are responsible for reporting the income they’ve earned from you to the IRS if they’ve made over a certain amount on Form 1099-MISC.

In most cases, that amount is $600, however, it could be as little as $10.

Yep, you read that right — $10.

Generally, any royalty payments totaling over $10 for the year need to be reported, while most other payments need to total $600 or more. Payments are considered royalties when you pay another person for their intellectual property.

For example, when you sell a theme on ThemeForest, ThemeForest is selling your intellectual property on your behalf. The money they pay you are considered royalties. As long as you earn $10 or more during the year, ThemeForest will be sending you a 1099-MISC.

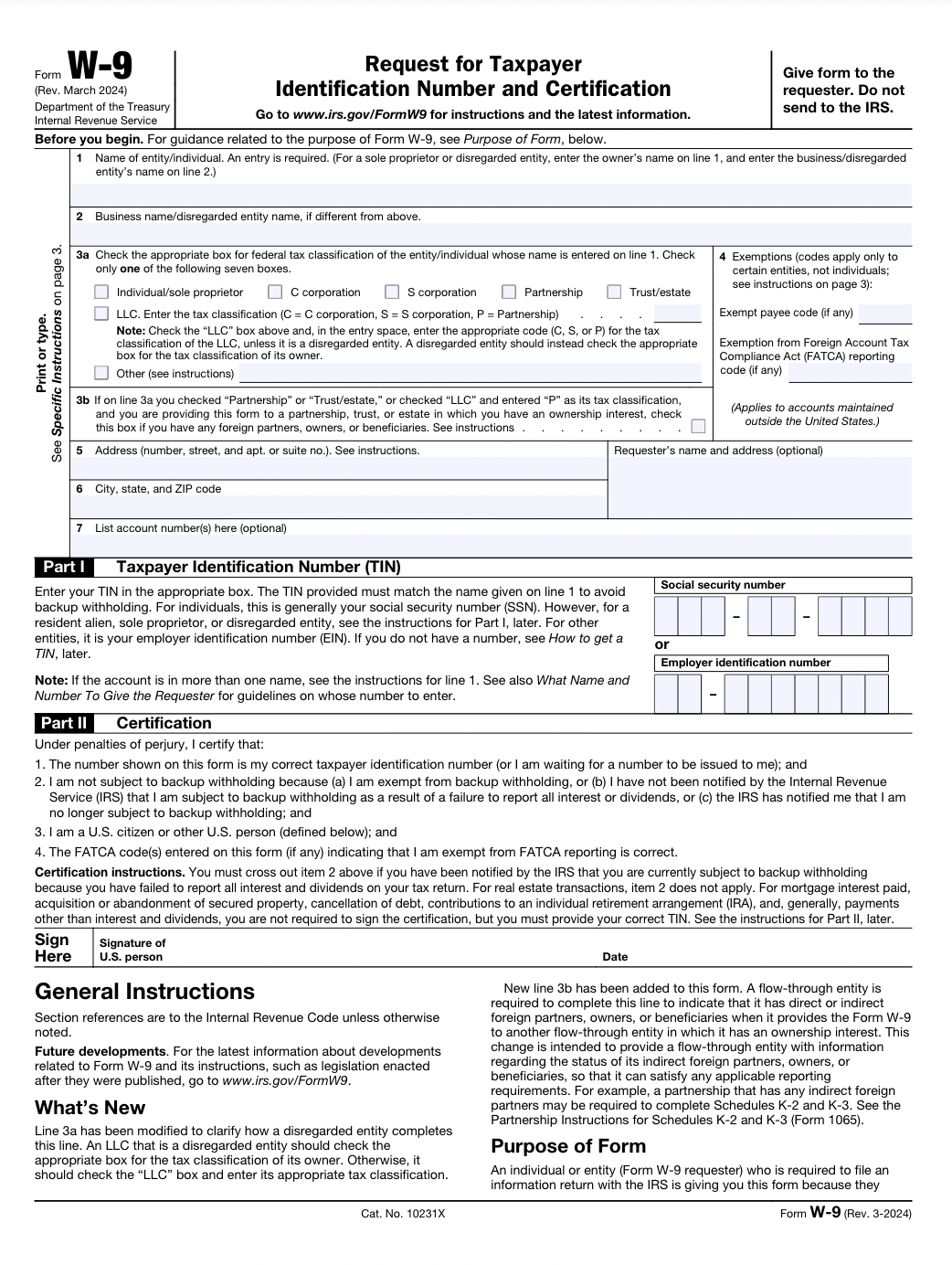

In order to report earnings on a 1099-MISC, you will need to collect the worker’s information on an IRS form W-9.

It’s always advisable to request this information when the contractor begins doing work for you.

The IRS requires that you have this information on file before making payments that exceed the minimum threshold. If the contractor refuses to provide the information, the business is required to withhold 28% of the payments and submit it to the IRS.

This isn’t fun for either party, so it is best to make sure your contractors provide the W-9 information up front to avoid the unpleasant situation of having a lighter-than-expected check come through.

If the contractor is not based in the US, you will need a W-8BEN (or W-8BEN-E if they operate as a business entity) as documentation that they do not require a 1099-MISC.

To make things a little easier if you’re hiring a US-based corporation, you’re not responsible for reporting their income on a 1099-MISC. However, a W-9 will identify the type of legal entity that you are working with, so it’s important to get the form filled out from each worker.

Running Your Business Abroad: Expat Taxes

Today, when there’s an increasing number of digital nomads, you may find yourself working and running your business from a country outside of the US.

Since the US is one of the few countries of the world with citizenship-based taxation, don’t forget that your income will be subject to US taxes for as long as you remain a US citizen.

When filing your taxes from abroad, you will need to collect a different set of tax forms, depending on your specific situation. These forms may include:

- Form 1040, to report individual income

- Schedule C, to report individual business profits and losses

- Schedule SE, to report self-employment taxes

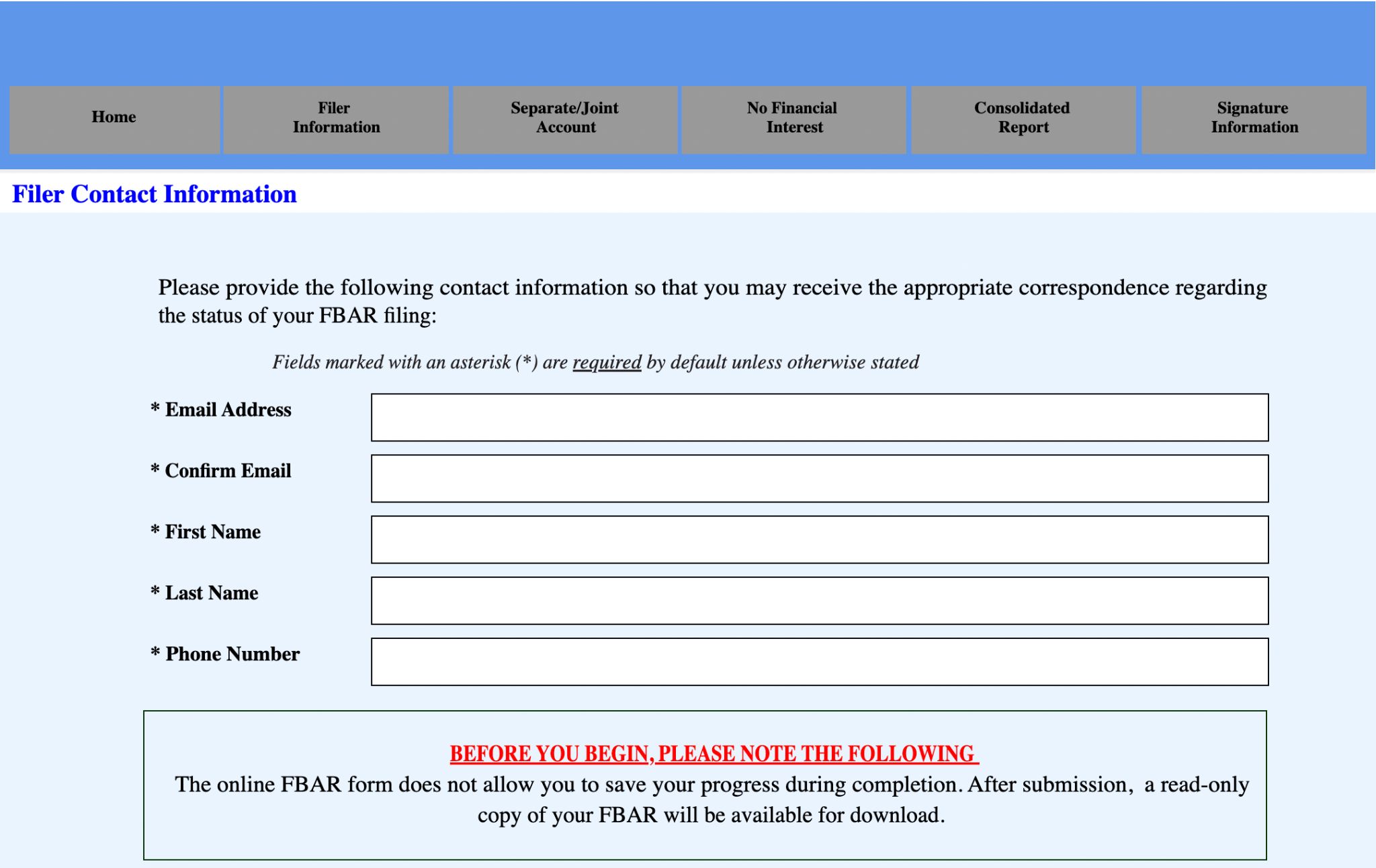

You also need to report income from your foreign-regustered financial accounts, using the FBAR form. You’re required to file this form if you have $10,000 or more in any of your foreign accounts at any point throughout the year — and you can submit the document online.

If you’re starting to worry about potentially being subject to taxes both in the US and your current country of residence, don’t worry. There are many tax breaks and agreements you can use to reduce (or even eliminate) your US tax bill if you’re already paying income taxes abroad, some of them being:

- Foreign Tax Credit (FTC)

- Foreign Housing Deduction (FHD)

- Tax treaties

- Totalization agreements

Katelynn from Bright!Tax explains that US expats working in a foreign country often overlook the tax benefits of being outside the US in the first place, giving the Foreign Earned Income Exclusion as an example.

“One of these is the FEIE, which you can use to reduce your taxable income up to $126,500 (in 2024). Additionally, if there is a Totalization Agreement in place with your country of residence, you may be able to eliminate self-employment tax on your US tax return altogether,” Katelynn reminds.

These are just some examples of forms you may need to file when reporting your income from abroad. Read more about expat LLC owner tax filing requirements in this guide.

Payroll Taxes

As an employer with employees, you are required to withhold payroll taxes from each paycheck.

The basic formula for an employee’s paycheck looks something like:

- Gross pay for the pay period (salary or hourly rate x hours worked)

- Less required payroll tax deductions

- Less voluntary payroll tax deductions

By law, employers must withhold the following taxes:

- Federal income tax. The amount to be withheld varies based on the amount that the employee earns. See Publication 15 for more details.

- Social Security tax. The total amount is 12.4% (6.2% for the employer and 6.2% for the employee).

- Medicare tax. The total amount is 2.9% (1.45% for the employer and 1.45% for the employee).

- State income tax. The amount varies by state, so check with your local state taxation authorities.

- Local taxes. Cities, counties, and other local governments may have additional income taxes that need to be withheld. Again, check with your local government for more information.

Voluntary payroll deductions include items that the employee has agreed to have deducted from their paycheck. These can include:

- Life and health insurance premiums.

- Retirement plan contributions.

- Employee stock purchase plans.

- Union dues, and other similar job-related expenses.

For many businesses, it may make a lot of sense to hire an accountant or payroll agency to handle the calculations for you. Just learning the ever-changing rules can be enough of a distraction from your business that it keeps you from getting the work done that you need to do to stay in business.

Just learning the ever-changing rules can be enough of a distraction from your business that it keeps you from getting the work done that you need to do to stay in business.

Business Finances

When working on your theme or plugin business, it’s easy to use your personal bank account for any business-related income and expenses. However, it’s important that you set up a separate bank account that is only used for business purposes.

All of your income should be deposited into this account, and any expenses you have related to your business should be paid out of the account.

Grab a free copy of our Cheat Sheet for

Selling Plugins and Themes

A growth roadmap with concise, actionable tips for every milestone of WordPress product development.

It is OK to put personal money into, and eventually pay yourself out of the business account. Actually, it’s pretty common to do so. When a business gets started, it will need money so the owner will typically deposit money into the business account. This is called an owner investment.

When you eventually need to take money out of the business, it’s a good idea to put the funds directly into your personal account. This is called an owner’s draw. So, in this case, you’ll pay yourself ($2,000), rather than paying directly for an item ($7.39 for a coffee at Starbucks).

When you avoid using your business account to pay for personal items directly, it makes life so much easier when it is time to do your taxes. At tax time you will know that the expenses and income in your business account are only for business purposes. There’s no need to hunt around dozens of other personal transactions in your bank statement when reconciling your books.

Sales Taxes

Your business will likely sell a product or service to your customers. In many cases, there are sales taxes that you have to collect as well.

In the United States, there is no sales tax on the federal level that applies nationwide. The downside to this is that the sales taxes we have to collect vary from state to state, and in some cases from city to city.

To further complicate things, each local sales tax applies to different things. For example, in some areas services are not taxable, while digital products are. Some types of software are considered taxable, while others are exempt. Each jurisdiction can charge different sales tax rates on different classes of items, so just because something is taxable, doesn’t mean that it is taxed at the same rate as everything else.

Read our guide to US sales tax for more details about sales tax rates for each state and tips on how you can manage this tax hassle-free.

EU VAT

Just because you might be a US-based business, doesn’t mean that other countries aren’t going to tax the sales you make in their jurisdictions.

The European Union charges a Value Added Tax (VAT) to most sales that are made in the EU.

“But wait,” you may think. “I don’t sell in the EU, I’m located in America!”

Maybe so, but where your customers are also matters. Technically, as a supplier of digital products to customers in the EU, your business is responsible for charging VAT and submitting it to the individual governments. The VAT isn’t a simple flat percentage though, as each country has its own rate and their own tax authority that you need to submit to.

If you are a B2B operation, you may not need to collect VAT as it becomes the buyer’s responsibility to pay the VAT. However, you will need to collect and verify the customer’s VAT number to make sure they aren’t an individual who is trying to avoid paying the tax with a bogus VAT number.

The VAT isn’t a simple flat percentage, as each country has its own rate and their own tax authority that you need to submit to.

Just like sales taxes and 1099-MISC reporting, EU VAT is a complicated topic that could require its own series of blog posts. Just know that it is your responsibility to file and pay VAT to the appropriate European tax authorities.

A solution like Freemius to sell your WordPress products frees you from that liability by handling it for your business.

Don’t Let Taxes Hold Your Thriving Business Back

There’s a saying “if you think hiring a professional is expensive, wait until you hire an amateur”.

I think that saying is especially applicable when deciding whether or not to take care of business tax related matters on your own. There are penalties for failing to file or withhold enough money, from paying thousands of dollars in fines and owed taxes to damaged business reputation.

If that wasn’t enough to scare someone into hiring a professional tax accountant, you should also know that the tax rules change all the time. So, even if you have a good grasp on what your business is responsible for this year, chances are good that next year will bring about a whole new set of changes.

If you are uncertain about what your business is responsible for from a tax perspective, my recommendation would be to hire a CPA or tax accountant to help guide you down the right path.

More questions about paying taxes on your WordPress plugin & theme sales income? Get in touch with us at [email protected].