|

|

Starting cheap might feel like a fast way to grow, but it’s a trap.

Yes, a $5 or $10 plan lowers friction and helps you hit that first sweet MRR milestone. But what looks like momentum quickly becomes a hamster wheel: thin margins, high churn, and customers (read: bargain hunters) who flood your support inbox yet rarely stick around to bring in revenue.

Founders trapped in underpricing cycles also struggle to raise prices later, with SaaS companies seeing churn spikes of 15%–30% after abrupt increases.

If you want pricing that fuels sustainable growth instead of busywork, this guide will help you:

- Avoid underpricing traps that attract the wrong customers

- Choose a pricing model that scales as your product grows

- Raise prices without losing your best-fit users

- Test, validate, and iterate using data instead of guesswork

Let’s begin with the most common (and most dangerous) misstep founders make.

The Dangerous Appeal of “Cheap and Easy” Pricing

Low prices don’t just limit profit — they attract customers who cost more to support than they bring in revenue. A $9 plan looks like a safe bet, but it usually leads to:

- Competing in a race to the bottom

- Serving high-support, low-LTV customers

- Burning out while overbuilding just to make a small price seem worth it to attract more users

It’s a conundrum, because price is a signal of value, which means lower numbers also make worthy customers assume your product is cheap because it’s low quality.

Is It Time to Rethink Your Pricing?

If growth looks fine on paper but cash isn’t moving… It’s not “bad luck” or a “tough market.” The problem is your pricing. The good news is that even tiny price shifts can have an outsized impact.

A 1% price increase drives an 11% boost in profit. — Harvard Business Review

Real-world founders prove it:

- Sean M Clancy from SEO Gold Coast worked with a SaaS stuck at a flat $29/month (12% churn). After switching to three tiers ($29, $59, $99) average revenue per user (ARPU) grew from $31 to $54, churn dropped below 7%, and LTV rose by 40%. Nearly 1 in 3 users picked the $99 tier within six months.

- Liam Derbyshire, founder of Influize, priced flat at £49 but hit a growth ceiling with 11% churn. Moving to a three-tier structure (£29, £79, £199) lifted ARPU 38%, churn halved, and the top tier contributed 22% of revenue despite few adopters.

That’s what happens when pricing finally matches the value you deliver. But if you’re still stuck in the “steady MRR, no real profit” phase, here are a few clues that your pricing needs attention.

- Rising CAC vs flat LTV: Paying $120 to acquire a $100-worth customer (for example through ads or promo offers) means you’re incurring losses.

- Churn after onboarding: Cheap plans attract dabblers and bargain hunters who leave soon after signing up. Constant churn kills growth no matter how many customers you add.

- No price changes despite feature growth: If you’ve added value but never raised prices, you’re giving upgrades away for free.

- Discounts as your default sales tactic: Training customers to wait for 30% off devalues your product.

- Competitors charging 2–3x more and still growing: The market supports higher pricing; you’re just leaving money on the table.

Not sure if this hits home? Run a quick self-audit:

- Average revenue per user (ARPU): If this hasn’t grown with your product, you’re likely under-monetizing.

- Net revenue retention (NRR): Tracks whether existing customers spend more or less over time. Healthy SaaS stays above 100%. Below that, your pricing blocks expansion.

- Discount rate: If “full price” is rare, you’re stuck in perpetual sales mode.

- Support load: If low-value users (free or entry-tier customers) eat 60% of support but give only 10% of revenue, you’ve misaligned pricing and effort.

If two or more of these apply, the only way forward is to start testing new pricing.

Picking a Pricing Model That Fits (and Scales)

Choosing how you charge is just as important as how much. It all comes down to your pricing model, and each one has its own strengths and trade-offs:

| Model | Strength | Risk / Limitation |

| Flat pricing | Simple and predictable | Heavy users drain resources while light users feel overcharged because everyone pays the same no matter how much they use |

| Per-user (seat) pricing | Familiar and scalable for bigger teams | Small startups often share logins, which stunts adoption |

| Tiered pricing | Flexible and familiar (“Basic, Pro, Enterprise”) | Can confuse customers if too many tiers are added |

| Usage-based pricing | Fair because cost matches actual use | Customers may see costs as unpredictable |

So which one is best for you?

You often find the right model only after seeing what doesn’t fit. Value has a way of revealing itself through trial and error.

For example, Stefano Bertoli at RuleInside began with a one-time project fee for AI voice agents. It seemed straightforward, but revenue stopped after delivery while his team continued supporting and optimizing the systems. He eventually shifted to a setup fee, monthly subscription, and usage-based charges tied to call volume.

”Lifetime value tripled, conversions improved because the upfront cost was lower, churn dropped since pricing only rose with usage, and customers trusted us more because they could see exactly how minutes and calls translated into cost.” — Stefano Bertoli

| Pro tip: Don’t copy a model blindly. Choose one that mirrors how your product delivers value over time. |

The Strategies Behind The Models

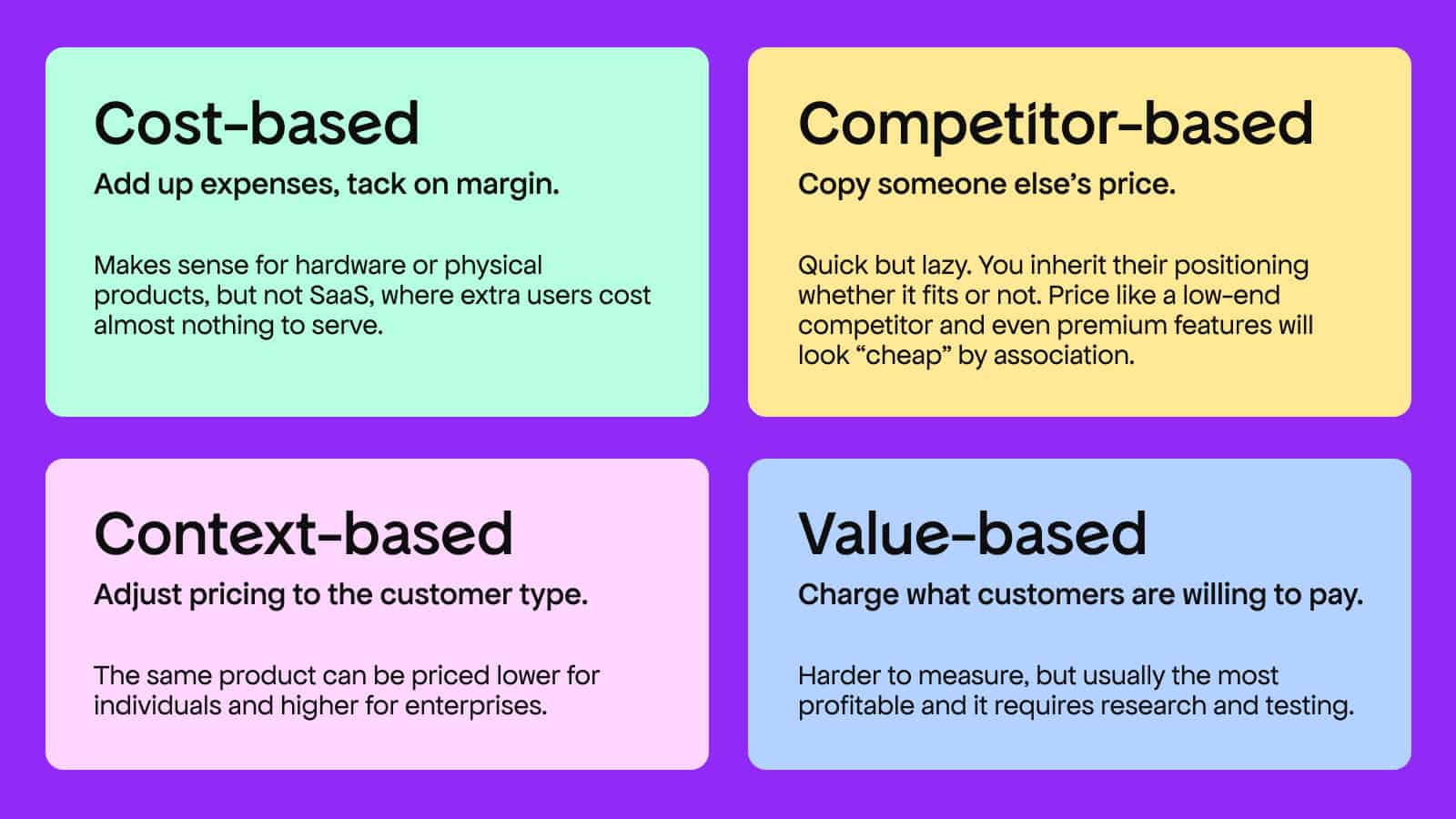

Pricing models are just the wrapper. It’s your sales strategy that determines whether they actually make money.

Here are four common approaches founders use:

“Pricing is not about mathematics. It’s about psychology, strategy, and value. If you treat it only as a cost exercise, you’re already losing.” — Maciej Wilczyński, Valueships

| Pro tip: Start higher than feels comfortable. Lowering prices later is painless; raising them risks backlash. |

Entry Strategies: Free, Freemium, or Paid-Only

How you start charging sets the tone for how customers perceive your product and what they expect in the future. Each approach comes with strengths and risks:

| Strategy | Strength | Risk / Limitation |

| Freemium | Works best when the product is used daily and naturally nudges upgrades | Free users who never convert can drag down growth |

| Free trial | Lets people experience value before committing | If the product isn’t sticky (like Slack or Asana, which teams use daily), trial users churn quickly |

| Paid-only launch | Filters out tire-kickers and sets expectations from day one | Riskier upfront; fewer signups unless targeting a niche audience (like developers using Tailwind UI or marketers paying for Ahrefs) |

The choice you make here sets long-term expectations, but the good news is that you can always adjust as you learn how your customers behave.

Take James Oliver, co-founder of AnswerSocrates, for instance. He launched with a fully free plan and quickly hit 10,000+ users. When he later introduced paid tiers, some long-time users pushed back. Instead of losing momentum, James adapted: he introduced a freemium model with a regionally priced “Lite” plan for lower-income markets.

That way, he monetized users who would otherwise never pay, while keeping premium tiers for developed markets. The shift increased MRR without alienating the community, but he says that if he were starting over, he’d launch with freemium from day one to set the right expectations.

| Pro tip: Don’t just pick what feels trendy. Match your entry strategy to how (and where) people actually use your product. |

Read also: Why Offering Multi-Currency Support & Pricing is Essential for Software Creators

Once your pricing works globally, the next challenge is knowing when and how to raise it without upsetting your best customers.

Raising Prices Without Losing Your Best Customers

A 2025 study found that just 4% of SaaS companies saw a slowdown after changing pricing, while the remaining 96% grew faster. When tied to clear value and communicated with empathy, price increases can boost loyalty as well as margins.

Here’s how to pull it off:

- Identify your best customers: Focus on those who stay longest, use your product deeply, and pay reliably. If bargain hunters churn, that’s margin recovery.

When Jon Yongfook raised Bannerbear’s price from $9 to $49, churn actually went down — dabblers left, while serious users stayed and paid more. - Add visible value first: Ship a feature customers have been asking for or improve support before announcing an increase.

ConvertKit rolled out a major update, then raised prices after testing with new customers. Churn stayed steady and they crossed $2M MRR. - Communicate with empathy and transparency: Explain why prices are changing, give notice, and keep it human.

Close.io reassured existing users their current seats would stay at old rates. Only new seats would cost more, boosting LTV by 10% in two weeks. - Grandfather or ease in old users: Reward early adopters with their old rate or phased increases.

Sean M Clancy introduced new $29/$59/$99 tiers but gave early adopters six months at their old $29 rate. That goodwill nearly halved churn while ARPU climbed. - Test before rolling out widely: Experiment with new prices on new customers first and track churn %, MRR, and ARPU.

With help from Nick Mikhalenkov, an SEO and growth strategist at Nine Peaks Media, a SaaS tested new tiers ($15, $39, $99) via a 50/50 in-app split (half of new users saw the old pricing, half saw the new). In 90 days:- ARPU rose 48%,

- MRR grew from $38k to $56k, and

- Churn dropped from 5.8% to 4.5%.

| Pro tip: Tie every price increase to visible progress. Customers will pay more when they feel they’re getting more. The ones who leave are usually the ones costing you the most for the least revenue. |

Pricing Psychology Tactics That Nudge Customers to Yes

Pricing is as much psychology as math. Smart framing on your pricing page can make all the difference.

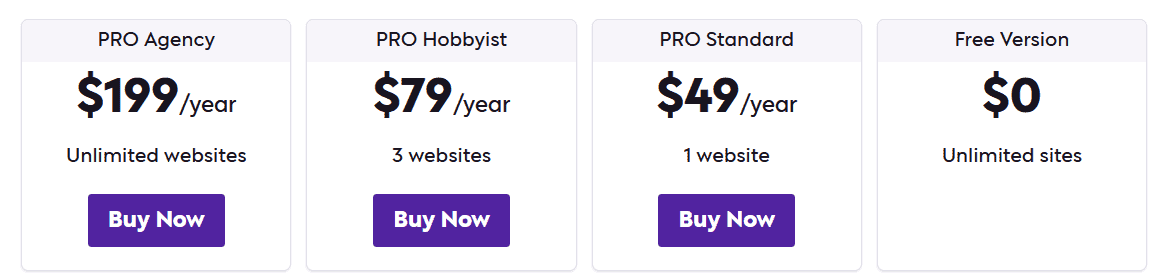

- Anchoring: Show the highest plan first so others feel more affordable.

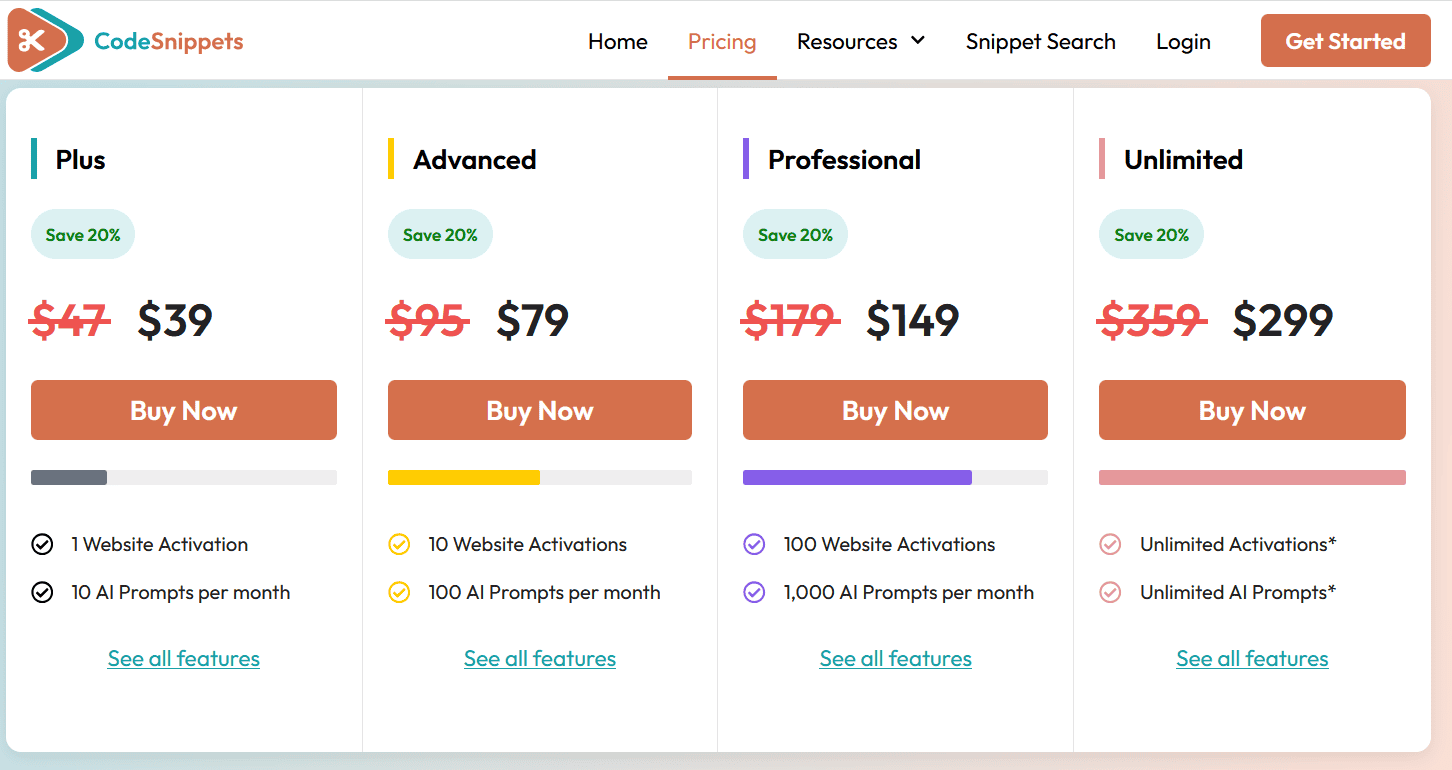

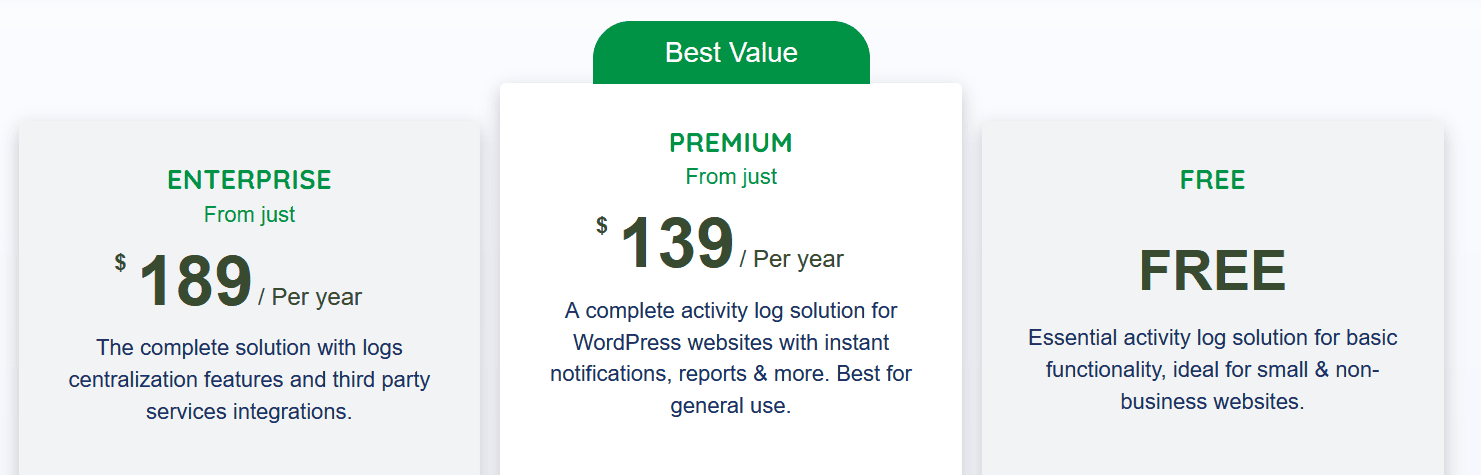

Source: Independent Analytics - Charm pricing: End with “9” to make prices look lighter ($49 vs $50).

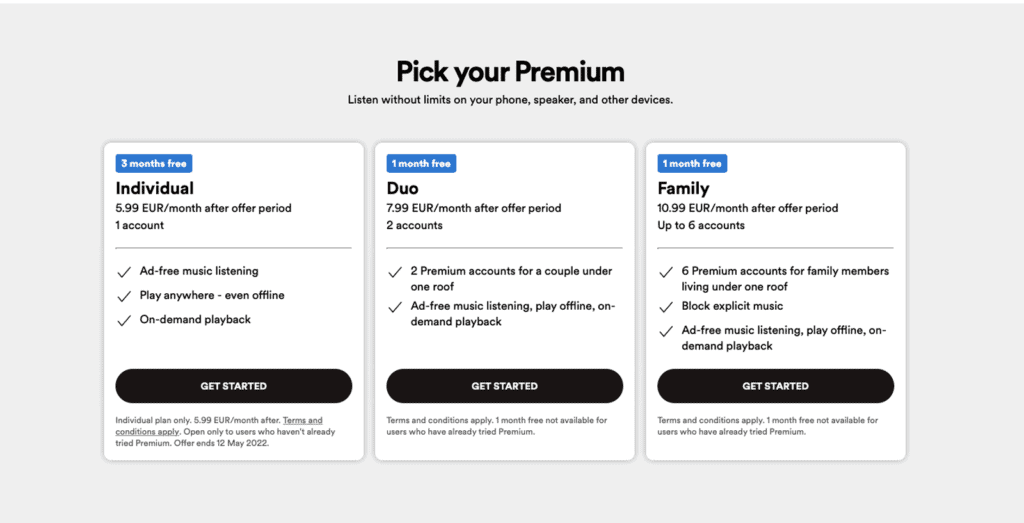

Source: CodeSnippets Pro - Decoy effect: Add an intentionally unappealing plan (like Spotify’s Individual plan) to steer customers toward your target choice (Duo or Family).

- Urgency & labels: Mark a plan as “Most Popular” or run a limited-time offer to reduce hesitation.

Source: Melapress

These tactics don’t replace real value, but they make it easier for customers to say yes.

One founder who put this into practice is Matt Bowman from Thrive Local. He introduced an “anchor tier” with advanced features like predictive analytics and white-labeling. Few chose it, but its presence reframed the Pro plan as the balanced option. Uptake of Pro rose about 30% in test markets, proving that even rarely chosen tiers can shape behavior.

| Pro tip: Don’t guess; test different arrangements, visuals, and messages and let customer behavior be the judge. If you’re not sure where to start, our guide on pricing page best practices breaks down what works and why. |

Testing is essential, but even the smartest experiments can fail if you fall into the same pricing traps many founders do.

Avoiding Common Founder Pricing Pitfalls

Many pricing mistakes come from fear, lack of data, or chasing short-term wins instead of building for sustainability. Beyond underpricing, here are the traps to avoid:

- Copying competitors blindly: Just because your rival charges $19 doesn’t mean you should. Their costs, market, and goals aren’t yours.

Alexey Karnaukh, co-founder of LinkBuilder.com worked with a SaaS client who fell into this trap by matching a competitor’s low pricing. After running A/B tests and introducing tiered plans, ARPU rose 35% and churn dropped 10% in just three months. - Overcomplicating tiers: Three or four plans are enough. If your pricing page looks like a tax form, you’ve gone too far.

Andrii Shum from Seoprofy saw upgrades jump 12% after helping a SaaS cut to three plans and give them more aspirational names like “Starter Growth,” “Scale Up,” and “Market Leader.” The new labels nudged users toward identifying with growth and choosing higher tiers. - Offering unlimited lifetime licenses: Tempting for quick cash, but it’s a revenue time bomb. You’ll be supporting users forever with no new income.

Fyenance launched with a $5 lifetime license. It drew early buyers, but many questioned whether the product would still be supported or updated years down the line. Without recurring revenue to fund ongoing development, the model quickly proved unsustainable, so the founder eventually shifted to a monthly plan. - Giving away too much for free: A free plan can work as a funnel, but not if it cannibalizes paid tiers.

After launching a generous free plan, the form-builder Reform hit a six-month revenue plateau. The free tier attracted abuse, added support overhead, and drove almost no referrals. When Peter Suhm quietly removed it and raised the Pro plan from $25 to $35, the pace of new customers jumped from 5 in three weeks to 14 in just ten days. - Putting off repricing for “later”: Your product won’t stay the same, and neither should your pricing.

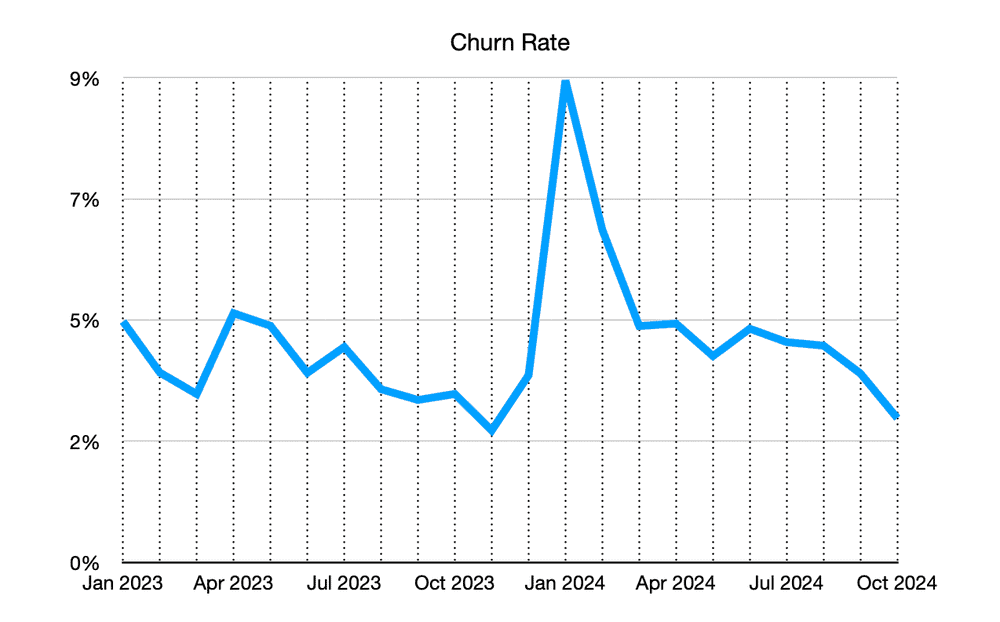

Inkdrop founder Takuya Matsuyama kept his note-taking app at $4.90/month for seven years. When he finally doubled it to $9.98, churn briefly hit 9% but dropped below 3% within nine months as he focused on transparency, customer education, and building a loyal community around his product. That’s when MRR started growing as well.

Source: DevAsLife

| Pro tip: Keep pricing simple, test with real data, and revisit it regularly. Fear and inertia are your biggest risks (not your customers’ reactions). |

How Freemius Helps You Price Smarter

The hardest part of pricing isn’t picking a number — it’s seeing whether it drives profit or leaves money on the table. Too often, founders guess or copy competitors, then hope churn or ARPU will tell the story months later.

Freemius takes out the guesswork by giving micro-SaaS founders a pricing toolkit usually reserved for bigger companies.

- Built-in analytics: Track LTV, churn, ARPU, and usage cohorts to see which customers bring long-term value.

- Flexible pricing: Test new tiers, usage caps, or price points without building custom billing logic.

- Affiliate program infrastructure: Grow through affiliates to offset churn and reach new markets.

- Conversion boosters: Cart abandonment recovery, renewal nudges, and dunning emails — the basics that protect recurring revenue but are easy to overlook.

- Multi-currency support: Let customers pay in USD, EUR, or GBP, boosting conversion rates in Europe and other regions by showing prices in their local currency.

Instead of duct-taping Stripe + Zapier + “hope,” you get one system built to help you:

- Avoid underpricing traps

- Align your pricing with market value

- Build sustainable recurring revenue

Building a Micro-SaaS That Lasts

Pricing is the lever that turns a side project into a sustainable business. Signups alone won’t buy you time, freedom, or stability, but even small shifts in ARPU or churn can compound into meaningful long-term profit.

The good news: pricing isn’t fixed. With the right data, ongoing experiments, and tools like Freemius, you can keep adjusting until you find the balance that works for both you and your customers.

Because the real endgame isn’t just traction — it’s building a micro-SaaS that lasts.

So where do you start? Run one experiment this month. Test a new tier, adjust your trial length, or nudge up your base plan by a few dollars. You’ll learn more from how real customers respond than from any amount of guessing or spreadsheet modeling.