The world is at your fingertips and multi-currency support could be the key to unlocking the global market and introducing your software products to brand-new audiences. But — there’s always a but, isn’t there? — implementing the practice is not without its challenges and considerations. In particular, currency fluctuations and the (very) unfavorable conversion fees that software creators are expected to absorb with each payout withdrawal.

In addition to these factors, there are several other non-trivial challenges to navigate, such as invoicing and setting the right prices for specific markets. So what’s an intrepid software creator to do in a global market that’s becoming increasingly competitive?

Read on because we’re unpacking multi-currency support and pricing so that you can start mastering it 😉

Why Software Creators Need to Prioritize Multi-Currency Support and Pricing

According to a report by Morgan Stanley, the eCommerce market could potentially increase to $5.4 trillion in sales by 2026 🤯 How’s that for opportunity?

Companies like Dropbox and SurveyMonkey have leveraged this approach to expand their reach significantly. For instance, SurveyMonkey, with only 55% of its business rooted in the U.S., owes a substantial part of its success to multi-currency support and localization efforts. In addition, Shopify reported that 92% of shoppers prefer to make purchases on sites that price in their local currency, and 33% are likely to abandon a purchase if pricing is in US dollars only.

To capitalize on the ‘92%’, Shopify has a multi-currency toggle option for potential customers browsing products on-site (top right):

The above statistics drive home the importance of multi-currency support, highlighting the lucrative opportunity for software creators and their products. But as mentioned, it’s no mean feat to implement the practice successfully…

Global Multi-Currency Support Challenges and Considerations for Software Creators

First off, let’s set the story straight about two factors that could be perceived as challenges, but aren’t 😉

In terms of technicality, implementing multi-currency support is not rocket science and there are several relatively simple ways to tackle it.

One is to leverage exchange rate APIs to present real-time conversion at checkout, assuming your payment provider supports setting custom prices on demand. But this isn’t advisable because displayed numbers can easily look plain weird.

A smarter option is to implement intelligent logic that analyzes the real-time exchange rate and makes the numbers look ‘prettier’ by cleaning up the fractional fiasco that bad real-time conversion can cause.

These days, however, the general practice is to set static numbers. I.e. you define your US dollar, euro, and British pound prices, etc. so that they don’t relate to each other at checkout. Even so, this practice doesn’t fall into ‘technical’ per se.

But we wouldn’t be here if there weren’t hurdles and considerations standing in the way of implementing multi-currency support. So, let’s get down to exploring them so that you can dance around them 💃🕺

- Currency conversion and fluctuation: If you only localize the price presentation but charge in your primary currency, then you, as the product maker, are safe (providing your primary currency is typically stable). For example, a US-based seller presents the price as £100 GBP, but behind the scenes, they’re charging in US dollars.

But while you might be safe, this practice can be to the detriment of your customers…

If you sell subscriptions in your primary currency and it fluctuates, your buyer will likely be charged an unexpectedly high amount when the renewal is processed, which can lead to subscription cancellation. Customers want stability when it comes to pricing — in their minds, if they purchase a subscription for £100 GBP, then it should always be £100 GBP. No surprises.

On the flip side, if the same US-based seller charges in GBP as presented, then the customer is safe from fluctuations if that’s their primary currency — regardless of whether it’s lifetime or subscriptions. It’s really a matter of choosing who absorbs the costs of fluctuation — the seller or their customers.

If you sell in the native/local currency and avoid currencies of countries with crazy-high inflation, in the grand scheme of software monetization in our space, currency fluctuation is hardly going to kill your business. The loss isn’t meaningful. But if you sell enterprise software for $10k+, then dynamics are different, and you better be careful, especially when selling subscriptions.

- Pricing strategies: According to a report by NetSuite, when considering making international purchases, 76% of shoppers look for sites that price all products in their home currency, and 19% of shoppers across Canada, the UK, and the US cite a lack of payment options as the reason for abandoning digital carts.

Setting the right price in different markets is complex. What is considered affordable in one region might be expensive in another. This requires market research and dynamic pricing strategies to maximize sales without alienating potential customers.

- Invoicing: A good example of how invoicing can cause headaches is when software creators sell to buyers from the UK in a currency other than GBP. In these cases, the exchange calculation is tricky because the invoice must include the equivalent GBP values.

One problem is that if the British buyer pays with a credit card in foreign currency, you as the seller can’t know the exact conversion rate applied on their credit card statement. So it’s effectively impossible for the GBP numbers on the invoice to match the actual amount deducted from the buyer, which can lead to problematic situations when submitting invoices for tax returns. You can find out more here.

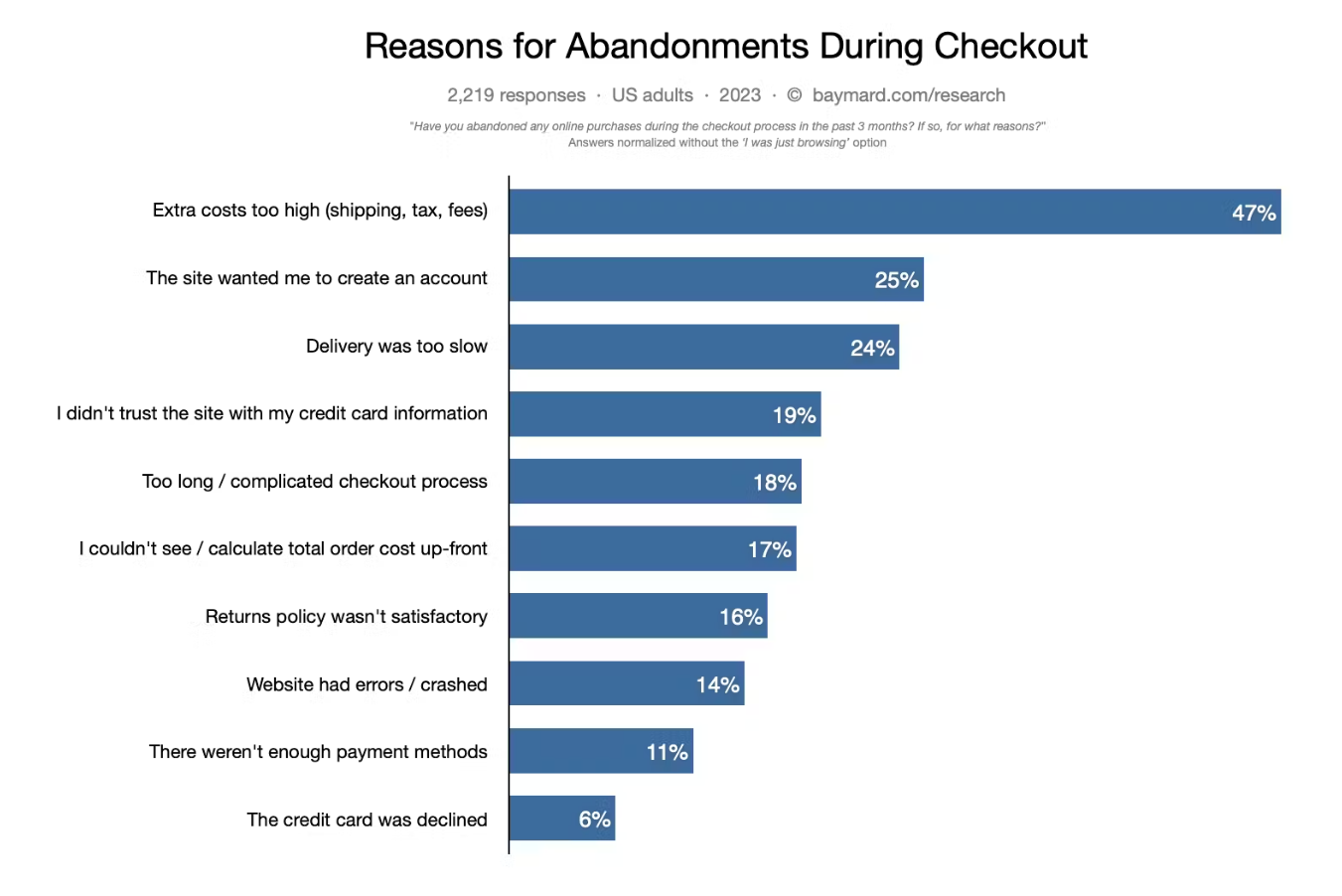

- Shopping cart abandonment: The Baymard Institute reports that 47% of online shoppers abandon their carts due to unexpected, extra costs (like taxes) being too high. Customers who abandon carts due to currency-related surprises are less likely to return, leading to lost sales and revenue opportunities. Software product creators must carefully consider what numbers to present at checkout to potential customers.

- Reduced competitive edge: In a market where competitors might offer multi-currency support, limiting currency options can put a software developer at a significant disadvantage. Because of this, there’s a loss of potential market share if you don’t employ this practice.

But it’s easier said than done — choosing how many currencies to sell in and what payment solutions to go with are not simple decisions as there are tax implications and the ‘conversion fee conundrum’ to consider (which we’ve mentioned and will unpack further down).

All of the above collectively contribute to a suboptimal shopping experience, impeding sales and revenue growth for software creators. But by leaping over (or dancing around!) these hurdles, there are plenty of opportunities to be leveraged…

The Benefits of Multi-Currency Support for Software Creators

Multi-currency support in software monetization is not just a convenient feature; it’s a strategic move that allows software creators to place their products on a global stage to boost revenue and brand recognition.

Let’s check out the benefits…

- Competitive advantage: In a market where customers have multiple software options, offering multi-currency support can be a meaningful differentiator. It positions you as customer-centric and globally oriented, which is particularly appealing to international customers who are probably used to seeing prices displayed in the standard US dollar or euro.

- Improved pricing strategy: The practice allows developers to implement nuanced region-specific pricing strategies. This flexibility can be used to adjust prices in different markets based on purchasing power, local competition, and other economic factors.

- Reduced cart abandonment rates and Increased sales: As noted earlier, unexpected costs at checkout are a major cause of cart abandonment. Giving customers the power of currency choice reduces friction and removes mental barriers, leading to higher conversion rates.

- Unlocking global markets: Yes, we mentioned this, but it bears repeating 😆 Multi-currency support has the potential to expand your customer base in a meaningful way across a diverse range of geographical locations. With this expansion comes a potential increase in revenue, which means software creators could find themselves with the freedom to expand their portfolios, focus more on new features, and make significant lifestyle changes.

But it’s not all fun and games, and this leads us to perhaps the biggest thorn in the side of software creators who implement multi-currency and the most significant deterrent for those who choose not to…

Multi-Currency Support and the High Conversion Fee Conundrum

Once you’ve got your multi-currency support up and running, it very much becomes a game of finding ways not to lose money 😱

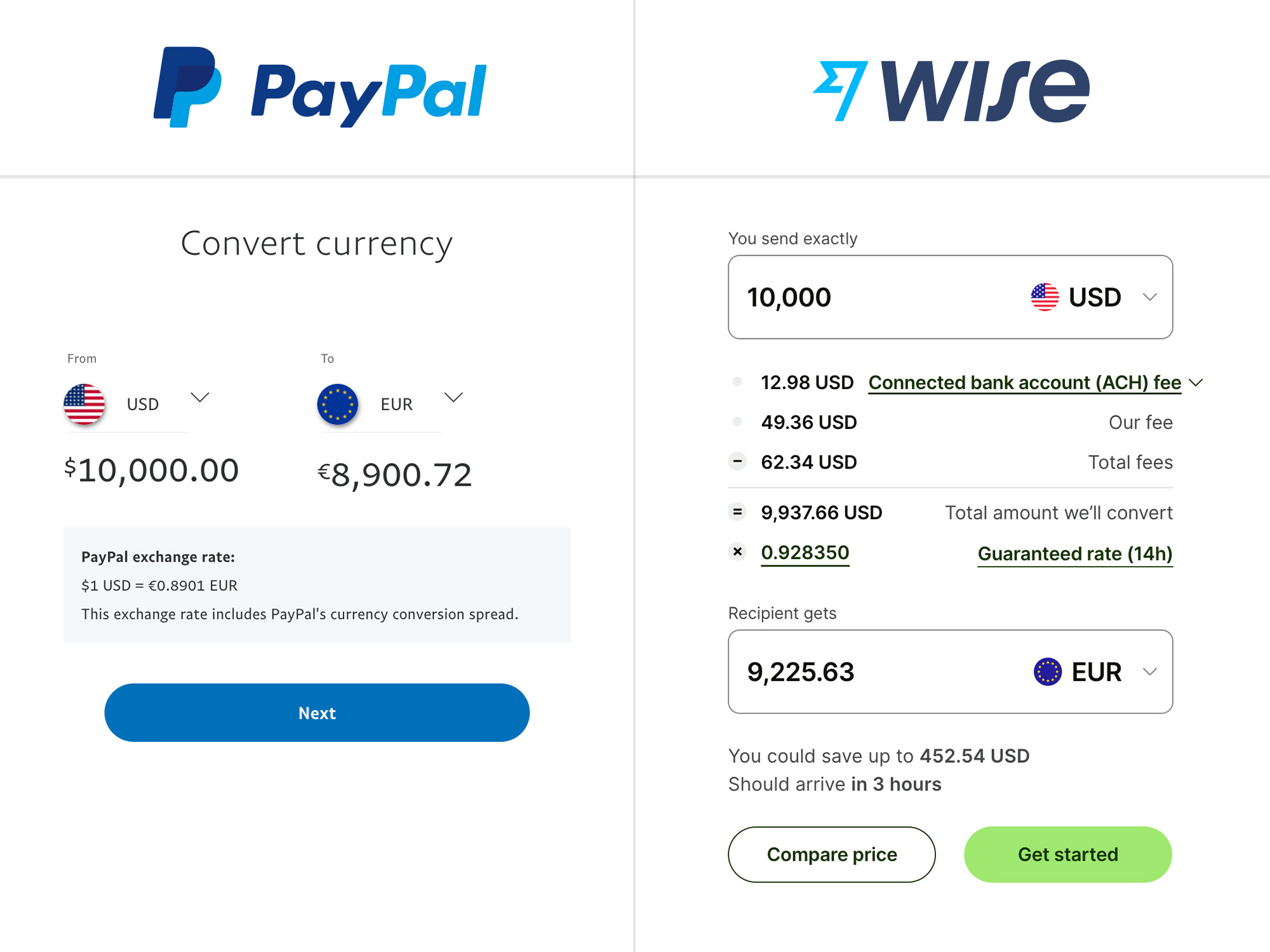

Payment gateways that facilitate purchases will almost always charge conversion fees upon withdrawal. Here’s an example of the ‘hit’ software makers take:

Say you’re a US-based seller. You’re ready to pull the trigger on selling in multiple currencies and you start researching potential solutions. Companies like Stripe and PayPal will tell you ‘No problem, that’s simple — let’s do this’.

Sounds good, right?

Not so much. When US-based software product makers withdraw money from different currencies, Stripe, PayPal, and similar will convert that well-earned revenue into US dollars at a 2 to 4% fee on top of the mid-market rate.

Here’s an example (from today): if you need to withdraw 10,000 USD in EUR from PayPal, you end up with 8,900 €. When at the same time, you can convert it on Wise and get 9,225 € — a whopping 3.65% more!

In many instances, this holds true for software creators in other parts of the world who don’t have different global bank accounts in different countries or are using payment solutions that force withdrawals in the primary local currency. Like their US-based peers, they too will have to bear the brunt of withdrawing in US dollars and the high fees that come with it.

Yes, Stripe and PayPal are transparent about the fees, but that doesn’t soften the blow — software creators stand to lose a lot of money from these transactions. The fact that companies like Stripe and PayPal have a borderline monopoly on the payment gateway sector makes the high conversion fees all the more egregious.

European Multi-Currency Support Conversion Fees Are Lower

But not by much.

Because each country has specific regulations and legalities, companies like Stripe have country-specific entities across Europe that offer different prices and conversion fees.

While it depends on the country, software product makers can open bank accounts in different currencies and then link them to the relevant accounts, such as Stripe’s Ireland or UK entities. By doing so, you’re able to withdraw money in the currencies you’re selling in.

This freedom of currency isn’t limited to the EU and its euros. Countries like Switzerland and Serbia are in Europe but don’t fall under the EU, and thus have their own currencies. This means that you can sell your software products in Swiss Francs and withdraw the funds in the same.

But while there is more flexibility in Europe, you won’t be able to withdraw in US dollars because it’s outside European borders and software creators will need to accept conversion fees and lose money, one way or the other.

But all hope’s not lost…

Subscribe and grab a free copy of our WordPress Plugin Business Book

Exactly how to create a prosperous WordPress plugin business in the subscription economy.

Alternative Multi-Currency Solutions That Offer Lower Conversion Fees

On the other (fairer) side of the multi-currency coin, you have fintech companies like Wise that offer considerably lower conversion fees for software creators who sell globally. Currently, Wise supports 40 currencies and 160 countries.

Solutions such as these help software product makers get paid in the currencies they sell in by mapping the relevant balances to country-specific accounts. For example, if you sell in GBP, you can have the funds allocated to a GBP account; if you earn in euros, a euro account.

Using solutions like Wise, software creators wrest power from bigger payment gateway companies and completely control when they convert their well-earned cash. Plus, the rates are typically better than what banks offer.

And this is exactly why we chose to integrate Wise with Freemius…

Here’s How Freemius Helps With Multi-Currency Transaction Support

As a payments platform that empowers our makers community by helping them monetize their software products globally, it’s our responsibility to ensure they get the best rates, no matter where in the world they’re withdrawing from.

We can pay out earnings in the same currency our makers are selling in so that they don’t lose out on revenue when withdrawing (regardless of whether the business is based in the US or not).

For example, if you’re selling your product(s) with both EUR and GBP, you can receive your EUR earnings in one account and your GBP in another. As mentioned, this is something that companies like Stripe and PayPal don’t do.

We also optimize for cost. If a customer from Europe buys with EUR, we’ll use our European payment processor, which has lower fees than the US Stripe account. Typically, software creators won’t register for payment processors in different countries due to the additional operational overhead it involves, so we help our makers by removing this barrier to entry.

But wait, there’s more 🦾

To empower our makers and their awesome products, the Freemius Developer Dashboard fully supports multi-currency transactions. Currently, we support three currencies:

- USD: $ U.S. Dollars (Default)

- EUR: € Euros

- GBP: £ British Pounds

Our makers simply need to log in to the dashboard, open any of their paid plans, and click the dropdown to select their desired currency. Here’s how our multi-currency support and pricing looks in practice:

We have plans to add more currencies (based on demand, of course 😉). So if you are processing high volumes from a specific geolocation that uses a particular currency currently not supported, please don’t hesitate to get in touch with the team!

You can find out more about our multi-currency support and pricing in our documentation.

Improving User Experience with Multi-Currency Support

We briefly — and lightly — touched on the benefits for users earlier, but let’s expand on those thoughts to drive home the significance:

Clarity in pricing fosters trust and confidence in your brand, as your customers feel that you acknowledge and value their local context. From a broader perspective, multi-currency support is an integral part of a localized user experience, which is increasingly a customer expectation in the global eCommerce landscape.

This is why we offer our makers’ users the option to change/select their preferred currency:

Master Multi-Currency Support and Unlock the Global Landscape

Ultimately, multi-currency support is not just a feature to monetize — it’s a strategic business decision that reflects your dedication to inclusivity and global accessibility. As the digital world continues to become more interconnected, your ability to cater to diverse monetary preferences will be an indispensable asset to making your mark on the international stage.

If you’re looking to elevate your multi-currency support and pricing, hit us up for a chat 🤠