|

|

You design incredible products, and it’s driving profitable growth for your WordPress business. With an ‘official’ declaration that WordPress powers 43.1% of the internet at last year’s State of the Word, it’s an exciting time to be a plugin developer — especially now with more buyers on the market looking to acquire (or acqui-hire) businesses like yours.

But how do you ensure you get top dollar for the company you built?

The first step is determining how much your WordPress business is worth. And that’s what we’ll discuss today, starting with the recent uptick in mergers and acquisitions (M&A) in the WordPress space.

Demand Is Increasing for WordPress Businesses

There’s a shift happening on the WordPress front — money’s pouring into the hands of plugin developers from investors/business owners and sales across WordPress companies increased significantly last year. Couple that with ‘cheap’ money and the result is a record year for WordPress acquisitions.

Some are buying out WordPress businesses and investing in the products and teams around them, while others are doing it to add more talent to their teams. This burning topic, plus what the M&A increase means for the WordPress landscape and smaller businesses, is explored thoroughly here.

Recently, we also discussed the 52% increase in WordPress searches. Plus, we uncovered how consumers are showing a deep interest in plugins over themes. Even COVID isn’t slowing down the buzz around WordPress. This speaks volumes about the potential of your WordPress plugin business, especially if you’re already generating a decent income. So if you’re contemplating selling your WordPress business, now’s an excellent time to do so.

How Your Valuation Ties to Different Types of Exits

Finding a buyer to purchase your WordPress business is only one hurdle. You have several others to leap over, like considering the type of exit you want to pursue and whether or not you want to continue vesting your time into the business afterward.

Acqui-Hire: Keeping It in the Business

An acqui-hire is a sales agreement where the buyer acquires the company for its talent (or part of it) and typically the founder(s), developers and product people. It’s an ideal setup if you enjoy building plugins and extensions, but don’t particularly care for the business side of things.

One example is GoDaddy’s acquisition of Rich Tabor’s products (CoBlocks, ThemeBeans, and Block Gallery). GoDaddy identified that the future of WP lies in Gutenberg and the block editor. So instead of developing the skills, know-how, and products’ infrastructure in-house, they snapped up Rich to join as a Senior Product Manager in their WordPress Experience team. The primary reason being that he was one of the influential early adopters of Gutenberg and had a proven track record of building successful products.

Earn-Out: Buy Now and Pay Later

In an earn-out acquisition, a buyer purchases a company and gains ownership of the product, its team, and any other assets it has. The seller’s team continues working on the purchased product under the buyer’s company. This form of acquisition can happen when two parties can’t reach consensus on an upfront price, or on larger sums, making it common for future payments to be conditional on the acquired business hitting agreed-upon milestones.

You’re more likely to see these kinds of acquisitions with service-based businesses. An earn-out puts the balance of power in the acquirer’s court, so it tends to be something to avoid if you can.

Clean Exit: Walking Away, Cash in Hand

A clean exit is when the seller of a business agrees to sell without any further attachments to or payments from the company. While the specifics will vary deal-to-deal, the founder often walks away clean from the business, though it’s common for the teams to remain. It’s an ideal settlement if you want a fresh start and no longer want to work in the business (and are comfortable with the agreed-upon sales price).

This is the decision Sandhills made with its acquisition. Pippin lost passion for developing WordPress assets after his father suffered a heart attack. Yet, he wanted to make sure the business continued and his team was taken care of. So he decided to do a clean exit acquisition, which took place with Awesome Motive. In the launch episode of Freemius’s WordPress acquisition video series, Syed Balkhi (CEO of Awesome Motive) details much of what goes into a successful acquisition, as well as what he looks for in a business before undertaking the process:

Valuations Are Linked to What Buyers Are Willing to Pay

It’d be great if buyers purchased your WordPress business at your requested price — no questions asked. But the reality is that the price you sell it for heavily depends on whether buyers have been historically willing to pay that price for similar businesses.

To determine this, you need a target acquirer.

Investors buy businesses for various reasons. So it’s crucial to understand your offer to identify what a potential buyer looks like and how best to attract them. For instance, if your industry attracts buyers looking for clean exits, then ensure you have everything in order to make that a seamless process.

This is important to consider, whether it’s a small acquisition or one that’s in the multi-millions as I’d expect the Sandhills acquisition to be. Smaller acquisitions tend to have faster transitions — in some cases it takes just one month. This wouldn’t be possible with larger businesses that have in-house M&A teams.

It’s typical for businesses with over $1 million ARR and a team to receive bids from hosts. They may decide on this process to keep the wheels turning without interruption. In these scenarios, valuations can creep up to over 3–4x ARR. In the right conditions, if your WordPress business solves a strategic need for the acquirer you can possibly sell for huge or even infinite multiples.

A great example is the acquisition of StudioPress by WP Engine. In this case, the hosting company wanted to offer a collection of high-quality premium themes to their customers for free to gain a strategic competitive edge.

When an acquirer considers a strategic acquisition, they look at whether it’s a build or a straight buy. In the first scenario, the buyer wants to continue building with the current team to ensure momentum isn’t lost. In the second scenario, the buyer wants to take over the reins with their own team and direction.

When negotiating with an acquirer, aim to quantify the annual value of the acquisition. For instance, if the business drives in an average of $500K per year, then acquiring the business for 2x should be reasonable, since they can turn a profit within two years (even if the 2x is 10x your current ARR — this can be agreeable if your business is showing rapid growth year over year).

It’s also common for public companies to buy strategic business pieces to move the needle of their stock. Maybe they need its users or customers to drive growth or perhaps they want to access strategic data or technology to gain a competitive edge.

At the end of the day, the value of your company all comes down to the potential acquirer and their business goals. So it’s critical to understand the motivations behind the acquisition, with an aim to evaluate your business from their POV to better gauge your business’s value, for example:

- Founders looking to expand products or acquire competitors

- M&A teams desiring favourable revenue potential

- M&A teams wanting to meet strategic needs

If you can do this, then the odds of making an irresistible offer increase.

Grab a free copy of our Cheat Sheet for

Selling Plugins and Themes

A growth roadmap with concise, actionable tips for every milestone of WordPress product development.

How to Evaluate the Worth of Your WordPress Business

What’s the typical WordPress business worth?

It depends on several factors. For instance, ‘typical’ relies on your renewal rate being in the 50%+ range, your revenue being recurring rather than one-off, and your revenue increasing at least a little year-on-year.

For a ‘typical’ WordPress business, your asking price on a sale should be somewhere between 2–4x your ARR. If you’re a ‘regular’ WordPress business, then 2–3x is a typical range. However, if you’re in a competitive or fast-growing space, then 3–4x is the sweet spot.

‘From what we are seeing, it’s 3–4x when the interest to acquire originates from a buyer. When a plugin/theme author initiates an M&A discussion, most of those deals are closed within 2–3x annual gross (annual gross <> ARR).’

— Vova Feldman, Founder & CEO of Freemius

Here’s an example:

A WordPress form plugin making $10k/month (with all of this as annual recurring revenue), growing at 20% YoY, could ask for $10k x 12 mo x 3 = $360k

Or:

A WordPress membership plugin (a hot space) doing $20k/month, growing 30% YoY, could ask for $20k x 12 mo x 4 = $960k

Now that we’ve discussed identifying your annual recurring revenue, how do you determine it? Do you look at the last 12 months or further back?

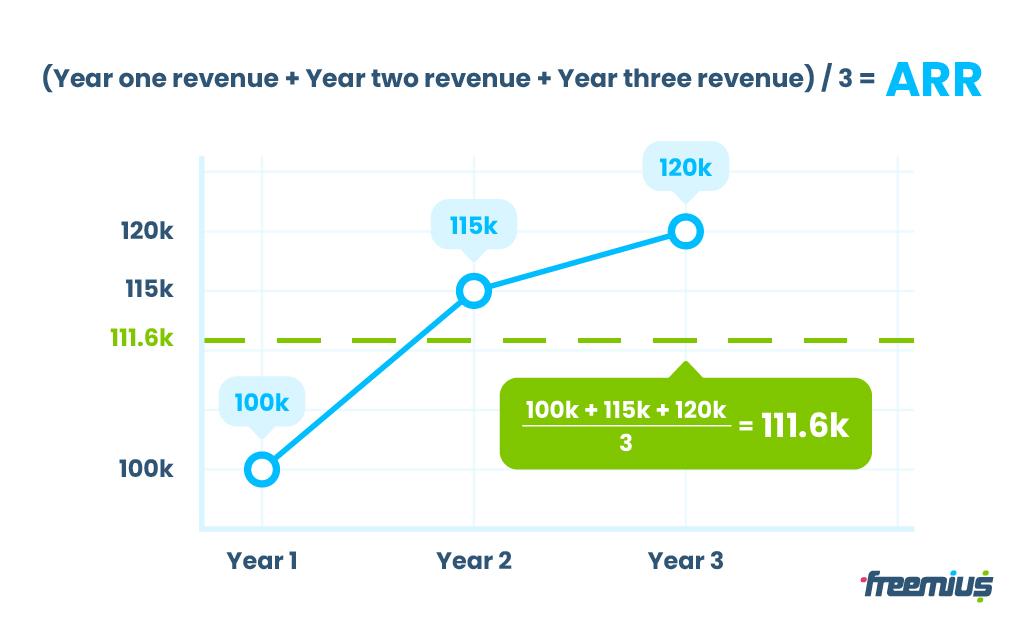

Ideally, you want to take the last three years and calculate the average. Here’s a simple formula for businesses with recurring revenue models:

(Year one revenue + Year two revenue + Year three revenue) / 3 = ARR

Now, what if you have a non-subscription revenue model? If this is the case, analyse your growth and decline, alongside your upgrades. Over the past three years, did you see an increase, decline, or stagnance in your revenue? Do you offer upgrades you can promote to customers to get them to return and purchase again? This can potentially sweeten the deal if your revenue isn’t overly impressive.

Use the EBITDA Formula

EBITDA stands for Earnings Before Interest, Taxes, Depreciation and Amortization. It’s typically used as a proxy for cash flow. You can use this metric to compare against other similar businesses. Now, there are some caveats when using this metric, for instance:

- It doesn’t account for depreciation costs which could skew results

- It does not include any tax benefits

- It only accounts for operating expenses

- It excludes capital expenditures like marketing spend

However, this method can be used to determine the profitability of a business. Here’s the formula:

EBITDA = Net Income + Taxes + Interest Expense + Depreciation & Amortization

Get Your Financial Documents in Order

Don’t wait until the last minute to do your due diligence. You need clean and organized financials to make the sales process seamless. This is easier to do when you use a platform like Freemius to sell your WordPress plugin business.

With your financials and customer data in hand, you’re ready to begin connecting with prospective buyers. But where should you begin your search?

Finding Your Buyer

Firstly, clarify what you want to maximize when you sell, be it revenue, making sure your entire team retains their jobs, or ensuring operations remain friction-free so that customers don’t experience any interference. This is a major decision and it will directly impact who your potential buyers are.

Once you’ve decided on the above, create a list of potential buyers — this can include direct competitors and other players in the ecosystem who would have a strategic value in acquiring your business. A ‘best case’ scenario of strategic value is when your offer is aligned with a potential acquirer’s long-term plans and a meaningful component that they would have difficulty replicating (or take many years to do so). This ‘replication’ could apply to your product, brand, the community, or the team, etc.

The more strategic value there is, the greater the chance that the buyer will continue investing resources into the business after the acquisition has been completed.

You’ll need to weigh up the financials too. How much money does your business make? Does a potential acquirer have enough capital to acquire you or will they need to raise money? For example, if a business is pulling in $25 million a year, there’s a very slim chance that a company making $5 million per year will be able to acquire it.

Once you’ve filtered your list of potential acquirers, a good place to begin the outreach is with your existing network. Find out if any of your contacts are able to put you in touch with senior executives of the companies you’ve shortlisted (if you don’t already have personal connections there).

One way of approaching this is to send an email that hints at a founder who is potentially looking to sell their business. You’ve heard that the contact’s company has received similar acquisition requests in the past and you believe that there is strategic synchronization for both parties.

At this time, there’s no need to fully disclose all of the details — these initial messages are to test the waters to see if there’s interest.

While ‘warm openings’ are always preferable, there’ll be times when a ‘cold email’ can get the ball rolling. A large organization like a hosting company will have a corporate development team whose job is to assess the strategic value of proposed acquisitions. If they read your email and see potential, they’ll most likely reach out to engage in conversations.

As you move forward with the outreach, you’ll start to gauge where the interest lies and whether you’re well-positioned for a profitable sale. Sometimes there won’t be any interest, or the interest that’s there doesn’t measure up to your requirements for the acquisition.

When this situation arises, an option is to list your business on a marketplace to see if there’s a good fit for a sale. Marketplaces like FlipWP can expedite the acquisitions process by pairing buyers and sellers who are looking for deals that are ready to go now. Because the intent to buy is already there, business owners looking to make a quick exit for a profit may find their solution on one of these platforms.

The next step:

Decide if you’re ready to sell. Get your documents and data in order. And take the leap!

Alex Denning is the Managing Director of Ellipsis Marketing and Co-Founder of FlipWP.

This is also a subject on WP podcasts but this is the best explanation :) I will check FlipWP out. I was hoping there was a specialized WP site like that.

Thanks freemius :) You guys rock,

Jamie