|

|

EU VAT reverse charge can be a real challenge for makers and businesses selling software products across the European Union. With different VAT rates in each country and strict rules to follow, it often leads to administrative stress, potential fines, and unhappy customers if mistakes are made.

We spoke with three experts to give you clarity and help you tackle these challenges:

- Vova Feldman, CEO of Freemius, has over a decade of experience in tax compliance for digital goods.

- Senior SEO Manager at Donorbox Maneesh Sharma shares his experience managing EU VAT reverse charges for subscription services.

- Alex Vasylenko, founder of The Frontend Company, discusses the challenges of implementing the mechanism for subscription-based front-end projects.

What is the EU VAT Reverse Charge?

The EU VAT reverse charge mechanism is designed to make VAT collection easier in business-to-business (B2B) transactions across the European Union. Typically, when selling goods or services, the seller charges VAT. However, with the reverse charge mechanism, this responsibility shifts to the buyer.

The reverse charge applies when:

- A business sells to another VAT-registered business in a different EU country.

- A non-EU business sells to a business in the EU.

Why the EU VAT Reverse Charge Exists

The reverse charge was introduced as part of an action plan to simplify taxing cross-border B2B transactions within the European Union and prevent illegal practices like “carousel fraud,” when businesses claim VAT refunds for goods sold cross-border without actually having paid the VAT.

How the EU VAT Reverse Charge Works

With the reverse charge, the buyer, rather than the seller, handles the VAT. For most EU businesses, this means they report and reclaim VAT, so there’s no additional tax cost — conceptually as VAT exemption.

However, for sectors like finance, healthcare, or real estate, where VAT exemptions apply, reclaiming VAT can be more complex. These businesses may only reclaim a portion of the VAT, which is based on a mix of their taxable and exempt activities.

In short, fully taxable businesses generally reclaim VAT in full, while exempt sectors often reclaim only part of it.

Besides Buyers, Who Else Benefits?

This mechanism is especially useful for businesses selling digital products, SaaS, and other software in the EU, as their customers are often spread across many countries. By shifting responsibility to the buyer and not having to register in each customer’s country, makers avoid an otherwise complex, burdensome process.

Who It Doesn’t Affect

EU VAT reverse charge does not apply to business-to-consumer (B2C) transactions, where the seller must charge VAT based on the consumer’s location.

Challenges of the EU VAT Reverse Charge for Software Sellers

While the EU VAT reverse charge mechanism helps alleviate some complexities, software sellers still face hurdles when dealing with VAT compliance.

Compliance Services Shortcomings

While VAT compliance services offer automation, they can introduce their own difficulties.

Alex’s company was frustrated with their service provider, Avalara. Despite Avalara’s strong reputation for global VAT compliance, Alex found that its user interface was not intuitive, and VAT rate updates were often delayed.

That experience taught us how important it is to not just trust a provider’s name but ensure their platform meets your specific business needs.

Similarly, Maneesh’s company, Donorbox, turned to compliance services after struggling with manual VAT tracking. Like Alex, he found that many solutions failed to handle complex VAT scenarios, including the reverse charge.

Dealing with the disappointments of compliance services is frustrating enough, but getting customers to fully understand the EU VAT reverse charge process throws another spanner in the works.

Setting Clear Expectations With Customers

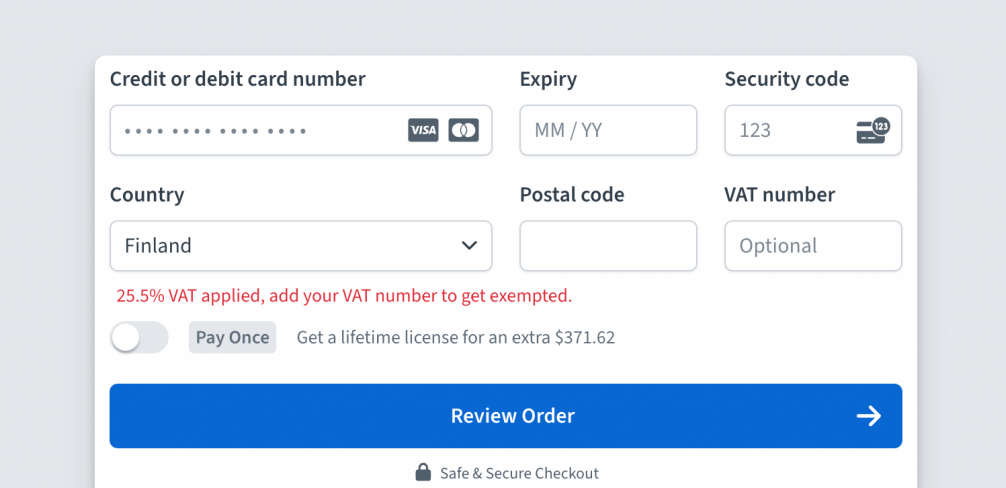

Some users may not be familiar with EU VAT reverse charge due to varying rules across EU countries, a general lack of awareness, or misunderstandings during checkout.

Alex had an issue where an EU customer — unaware of how the process works — felt overcharged and requested a refund. Despite Alex’s best efforts to explain the process, the additional steps left the customer frustrated and ended the relationship.

To avoid such situations, it’s essential to highlight EU VAT fields and related information at checkout (see below), provide clear messaging in post-purchase emails, and ensure customer support is trained to handle VAT-related inquiries.

Invoicing and Reporting

Generating VAT-compliant invoices for B2B transactions is another time and energy-sapping hurdle.

“Businesses must ensure that invoices clearly state when the reverse charge applies and include the buyer’s VAT number,” Vova says. “Additionally, keeping track of VAT for reporting purposes — across multiple EU countries — requires meticulous record-keeping, which can lead to mistakes when done manually.”

Like many businesses, Donorbox faced challenges with VAT reporting, including fines due to misunderstandings about VAT exemptions for specific services. “These experiences underscored the importance of thorough compliance and clear communication with tax authorities,” Maneesh notes.

Refund Requests and Manual Errors

One of the most significant challenges is when customers breeze through checkout, forgetting to enter their VAT numbers.

“Customers often contact the seller post-purchase asking for a VAT refund,” Vova explains. “Previously, the only solution was to cancel the original subscription or lifetime purchase and recreate it to ensure the customer enters their VAT number correctly this time around. The process is time-consuming and prone to errors, often leading to lost revenue due to payment processor fees.”

Maneesh recounts a situation where a customer later requested a refund due to an error in their VAT details. “While we managed to resolve it without losing the customer, the process highlighted how critical accurate VAT handling is for maintaining trust.”

There’s no denying it: dealing with EU VAT and reverse charges can be a real headache. Luckily for software makers, a merchant of record like Freemius can help.

How Freemius Handles EU VAT Reverse Charge for Software Sellers

As a merchant of record (MoR), we handle every aspect of VAT for software makers, ensuring accurate calculations for every transaction across the EU to minimize the risk of incorrect charges.

VAT Automation and Refunds

Freemius automatically calculates VAT at checkout based on the buyer’s location. If the buyer provides a valid VAT number, we verify it through the EU’s VAT validation service and apply the reverse charge, generating a VAT-compliant invoice.

If a customer forgets to enter their VAT number and later requests a refund, sellers no longer need to cancel the subscription. They can now issue a VAT refund directly from the Developer Dashboard. The subscription is then adjusted to exclude the VAT amount for all future renewals.

Here’s how:

Alongside handling VAT refunds, Freemius also ensures that software makers are protected from incurring unnecessary gateway fees associated with refund transactions.

Avoid Double Payment Gateway Fees for Refunds

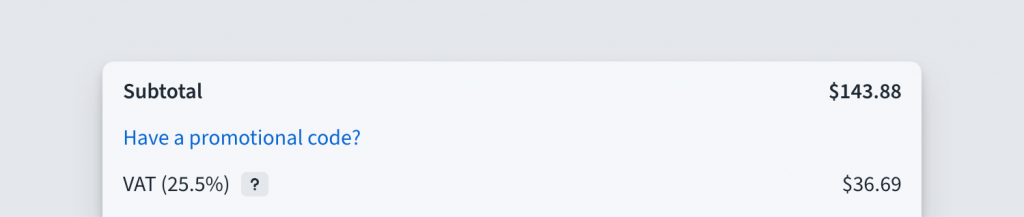

As shown, if a customer neglects to provide their VAT number during checkout, the system applies the full VAT amount. For instance:

- A French customer subscribes to a software plan for $100 annually

- Since they didn’t enter their VAT number, 20% VAT is applied, making the total payment $120

Later, the customer realizes the mistake and provides their VAT number, requesting an exemption and a refund for the previously charged amount. Since the VAT reverse charge applies, B2B customers with valid VAT numbers shouldn’t be taxed.

Before our solution, the typical way to resolve this issue would be to:

- Issue a full refund of the payment and cancel the subscription.

- Ask the customer to re-subscribe, this time without VAT, ensuring their VAT number is correctly applied during the checkout process.

This process not only creates a poor user experience but also carries a financial downside.

Payment processors like Stripe typically keep their transaction fees (around 4%) even after a refund. In this example, the software maker would lose approximately $4.80 on the $120 payment, as Stripe keeps 4% of the total.

If the customer re-subscribes at $100 without VAT, the software maker would lose an additional $4 in transaction fees, bringing the total loss to $8.80 — $4.80 from the original transaction and $4 from the new subscription.

Freemius helps makers avoid this scenario. As seen in the video, instead of processing a full refund, software makers can issue a partial refund for only the VAT portion, keeping the subscription active.

Here’s how it works:

- The software maker only refunds the $20 VAT

- The maker then only loses 4% of the refunded VAT ($20), amounting to 80c instead of the full $4.80 on the original transaction

- Freemius handles the technical details behind the scenes by automatically generating two additional invoices to comply with VAT regulations. When an invoice includes VAT, the entire invoice must be refunded before issuing a corrected one. Once a valid VAT number is provided, a new invoice is created without the VAT.

Here’s how the process works:

-

- The original invoice: This includes the VAT charged at the time of purchase.

- A full refund invoice: This documents the refund of the original payment as required by VAT rules.

- A new invoice: This reflects the corrected subscription, excluding VAT under the reverse charge scheme against the VAT number of the buyer.

With this process, Freemius ensures that all VAT adjustments comply with bookkeeping practices and EU VAT regulations. And, by keeping subscriptions intact and refunding only the VAT, software makers avoid duplicate gateway fees and offer customers a smoother experience.

Subscribe and grab a free copy of our WordPress Plugin Business Book

Exactly how to create a prosperous WordPress plugin business in the subscription economy.

Simplifying EU VAT Reverse Charge is Easier Than You Think

While managing VAT can be complex, the reverse charge mechanism simplifies compliance and cancels out additional accounting admin in B2B transactions. Freemius takes this further by automating the entire VAT process, from calculating taxes to issuing refunds, helping software makers meet requirements with minimal effort.

By using Freemius, software makers can save time, reduce errors, and focus on growing their businesses while leaving the complexities of VAT to a trusted platform. If you’d like to learn more about VAT compliance and how Freemius can help your business, get in touch here.