|

|

SaaS kept growing in 2025, but the source of growth changed.

Momentum shifted from large platforms to solo founders and small teams shipping focused products faster.

This pace is possible because busywork is no longer in the way. AI tools now handle tasks that used to slow small teams down.

This shift isn’t happening on the margins. According to BetterCloud’s 2025 State of SaaS report (surveying nearly 600 IT decision-makers at mid-sized to enterprise companies), SaaS is now a $295–$300B industry growing at ~20% a year.

And across industry data, nearly all modern businesses now rely on SaaS tools.

If you’re building a micro-SaaS with limited time, budget, and headcount, this report shows how the shift is playing out and how to apply it as you build and grow.

TL:DR — Micro-SaaS in 2025 at a Glance

- AI leveled the field: Solo founders can now ship and operate products that once required full teams.

- Pricing got flexible: Usage-based and hybrid models outperformed flat subscriptions.

- Growth shifted from ads to ecosystems: Integrations, referrals, and community-led distribution proved more reliable than paid acquisition for indie teams.

- Trials beat freemium: Short and reverse trials converted better than permanent free tiers and were easier to sustain.

- Profitability took center stage: The focus shifted from scale-at-all-costs to building sustainable, profitable businesses from day one.

AI Became the Great Equalizer

AI is now embedded in how small teams build and run SaaS.

SaaS Capital’s 2025 annual survey of bootstrapped and equity-backed SaaS teams shows that 69% of respondents use AI to eliminate bottlenecks that would otherwise slow them down:

- Developer assistance: code generation, refactors, reviews

- Content creation: docs, onboarding, marketing copy

- Customer support: first-line replies, ticket routing, summaries

- Data work: analytics queries, usage summaries, pattern detection

This is especially visible in developer workflows. Stack Overflow’s 2025 Developer Survey collected responses from 33,169 developers worldwide. The respondents range from students to senior engineers, spanning companies of all sizes, and the results show that:

- 84% are using or planning to use AI tools in their development process

- 75,9% use AI to help write code

- 52% say AI tools or agents have improved their productivity

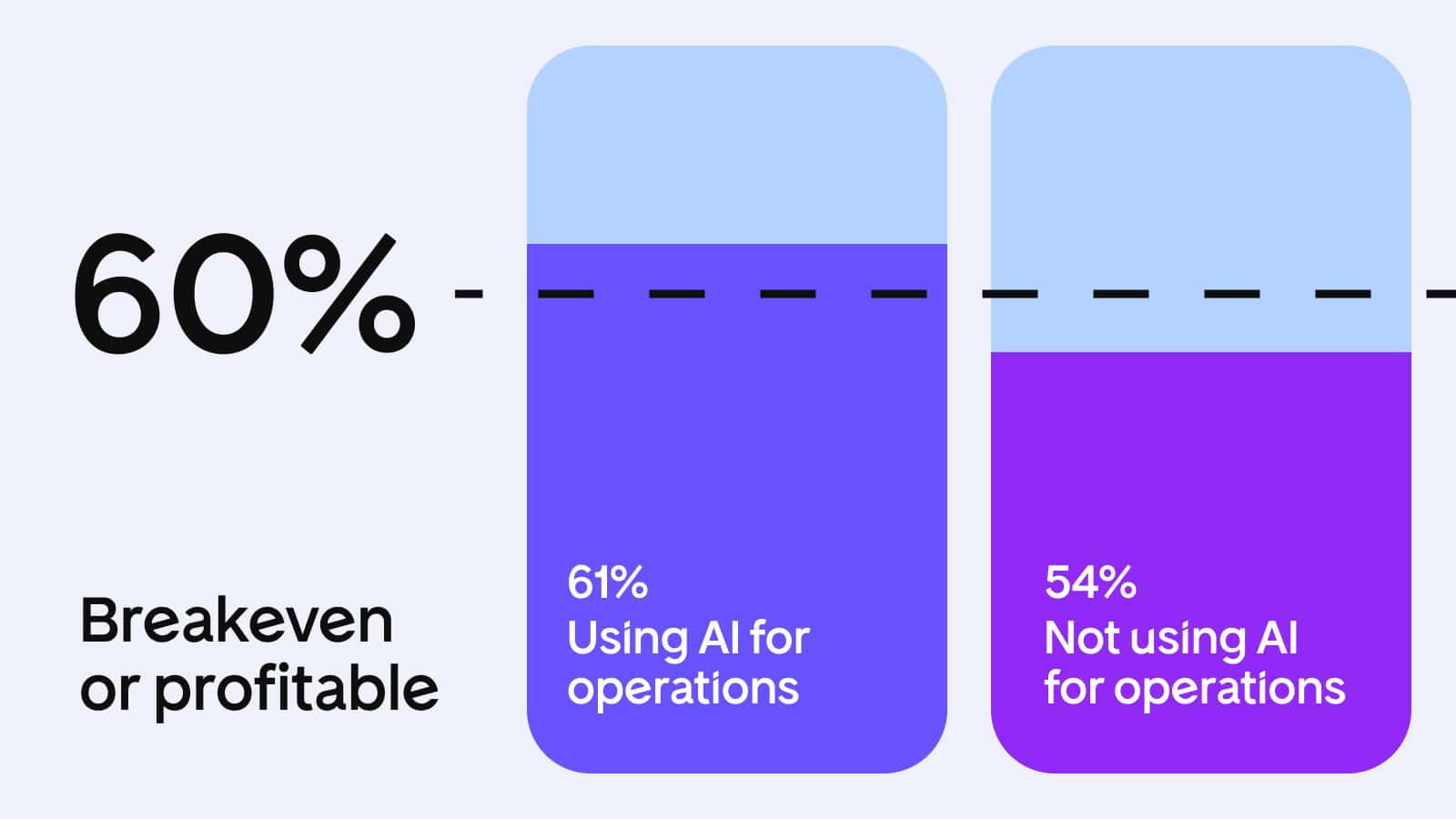

You can see the impact in outcomes. SaaS Capital’s survey (mentioned earlier) data shows that teams using AI are more likely to be at breakeven or profitable than those that don’t.

With AI: 61% at or above breakeven

Without AI: 54% at or above breakeven

A solo maker can now move with the output of a much larger team. Brad Vincent, a product maker using Freemius, documented building an entire SaaS from scratch with Lovable.

John Rush takes a similar approach across his 24 small SaaS products. In an interview with e-Residency he explains his workflow:

Vibe coding tools are great to start, but they’re not meant for production. I use Lovable or Wrapifai to build my first MVPs, and Unicorn Platform if the product is very simple. Then, I copy the whole project into Cursor when I need production-grade. You can and you should move between tools and talk to them as though they’re your co-founders.

Interestingly, SaaS Capital also noticed that 88% of companies with AI in their operations are also using it in their product.

In an analysis of 1,000+ micro-SaaS products, Rocking Web found that products with AI features grow about 2× faster than those without them. This finding applies primarily to early-stage, founder-led products.

We see similarities in Freemius data. Among our active indie SaaS makers, 50% have built AI-powered products. In practice, they’re using AI internally to move faster, and externally as part of what customers pay for.

Even so, faster growth does not yet translate into higher margins. In the same SaaS Capital dataset, profitability looks similar for AI and non-AI products, with roughly the same share of companies operating at breakeven or better.

58% of SaaS products with AI features are at or above breakeven

For products without AI features, that share is 59%

This matches what we see anecdotally: some makers rush to add AI features too early, investing time in capabilities users didn’t ask for. Products succeed or fail based on fundamentals like product-market fit, pricing, and execution, regardless of whether they use AI.

What This Means for You

AI belongs in your infrastructure before your feature set. Use it first to:

- Speed up shipping: Scaffold, refactor, generate tests, and review code so you can release faster without adding headcount.

- Offload recurring work: Draft support replies, summarize tickets, auto-tag issues, and maintain internal docs to keep day-to-day load manageable.

- Surface insights earlier: Summarize usage data, flag churn signals, and spot patterns you’d otherwise notice too late.

Once AI consistently saves time and reduces operational drag, you can look at product-facing AI. Start only when customers clearly understand the value (and are willing to pay for it).

Pricing As a Strategic Growth Lever

Across surveys, pricing experimentation shows up as the top growth lever for bootstrapped SaaS founders.

As growth cooled down and acquisition costs stayed high, founders moved beyond flat plans toward models that adapt to usage and outcomes.

One signal comes from Maxio’s 2025 Pricing Trends Report, based on data from 316 SaaS companies collected via Benchmarkit.

In this mid-market–leaning SaaS sample, usage-based pricing is now the norm:

- 91% report using some form of it:

- 67% rely on fully usage-based pricing

- 24% use hybrid models that combine a base subscription with usage-based expansion

- Separately, 57% say they apply value-based pricing principles

In the same dataset, hybrid models also show stronger revenue performance than flat plans:

| Pricing model | Median revenue uplift |

| Base subscription + usage based expansion | 21% |

| Flat pricing | 18% |

The appeal is straightforward: revenue scales with usage and outcomes, not with how many new users you can afford to acquire.

Another dataset points to downstream effects of pricing changes, particularly among smaller, founder-led businesses.

Rocking Web’s analysis found that:

- Annual upfront plans cut churn by 30%

- The same plans lift LTV by 27%

- Many bootstrapped SaaS increased ARPU after moving to tiered or hybrid pricing

These findings aren’t directly comparable, since they come from companies of different sizes and stages.

Still, the takeaway is consistent: across mid-market and bootstrapped SaaS teams, pricing tied to usage, commitment, or value outperforms flat plans.

This pattern can be seen in Adam Robinson’s experience with RB2B. He launched with a simple flat price and let usage run. Nearly 5,000 users signed up in the first 45 days, but only 13 paid.

We realized our pricing was broken at both ends: too expensive for small teams, not structured enough for larger ones, and way too generous for the free version.

We fixed that by tightening free usage, adding lower entry paid plans, and creating clear upgrade moments tied to volume and real workflows. Paid conversions followed quickly and ARR crossed $1M shortly after.

At Freemius, we built pricing flexibility into the platform specifically to support these different billing models:

- Traditional tiered plans for straightforward pricing

- Usage-based billing and custom pricing units for consumption-based models

- Annual vs. monthly billing cycle options to improve retention

- Top-ups and overage handling for hybrid pricing

Early-stage products often start with simple tiers, then add usage components as they learn how customers actually use the product.

What This Means for You

Treat pricing as an ongoing system, not a one-time decision. In practice, that means:

- Anchor pricing to real usage: Launch with a simple base plan and expand into tiers or usage pricing as you learn where customers get the most value.

- Build pricing with retention in mind: Encourage annual plans, make upgrades intuitive, and structure tiers around long-term value.

- Let power users fund growth: Usage-based expansion allows revenue to rise without relying on constant new signups.

If customers see value grow, revenue increases without increasing acquisition spend.

Read also: How to Price Your Micro-SaaS for Long-Term Profit

Growth Came from Ecosystems, Not Ad Budgets

In 2025, throwing more money at paid ads stopped being a reliable way to grow. Costs rose, results became harder to predict, and many bootstrapped makers found themselves spending time and cash without clear payback.

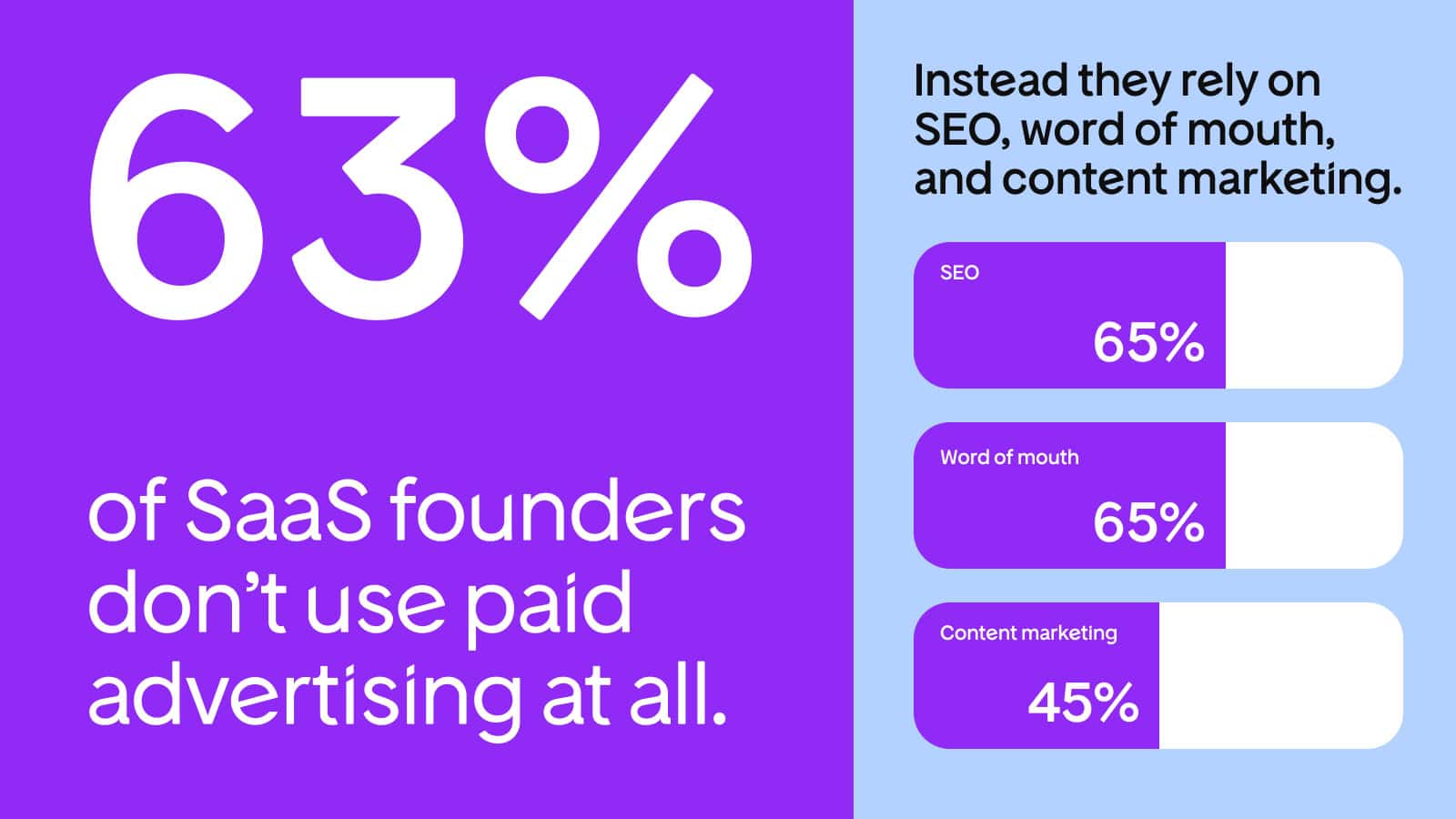

That uncertainty shows up in how founders actually market their products today. Based on MicroConf’s State of Independent SaaS survey of nearly 700 founders:

- Among founders who run ads, 57% either:

- Wait 7+ months to see ROI or

- Can’t tell whether ads are working.

Faced with that tradeoff, many founders shifted toward channels they could understand and control.

47% say that integrations, partnerships, communities, and forums became a more dependable source of growth.

When a product integrates into a platform like WordPress, Shopify, or Notion, discovery happens inside an existing workflow. Users encounter the product while trying to solve a real problem, not because they clicked an ad.

That context makes intent clearer and conversion easier to reason about.

Trust plays a big role here too. A Wynter survey of 100 B2B SaaS marketing executives from companies with 200+ employees shows:

- 73% of B2B buyers trust peer recommendations over other sources

- 58% start the buying process with a referral or recommendation

When trust drives buying decisions, it shapes growth channels too. MicroConf data shows that 50% of founders lean on communities and referrals, reporting stronger LTV — especially in the early stages.

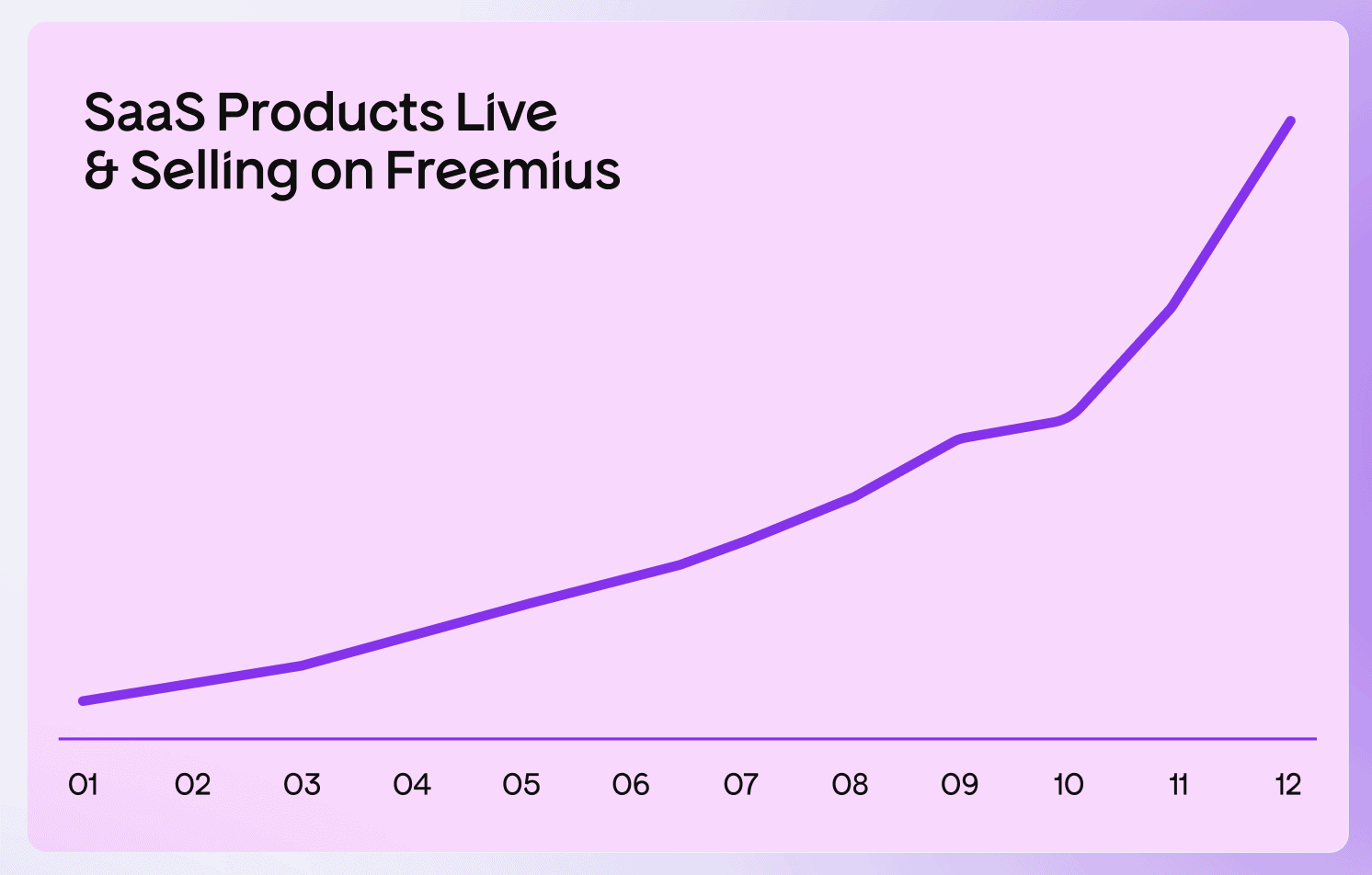

We saw this playout firsthand when expanding Freemius to SaaS.

In 2024, fewer than ten SaaS products were using the platform.

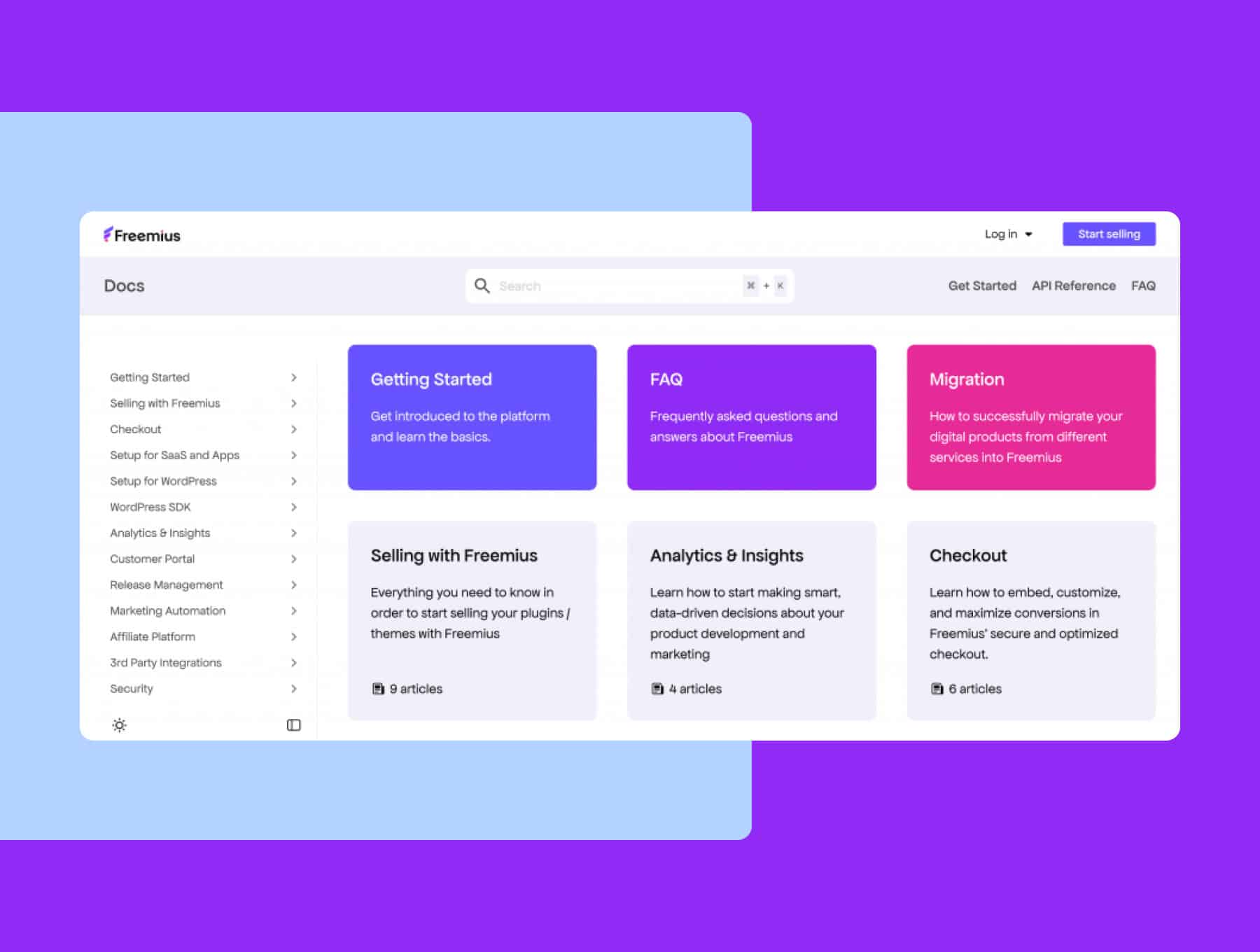

In 2025, we committed to building for SaaS-first makers. That meant shipping SaaS-focused features like our JavaScript SDK, React Starter Kit, and custom pricing units — and showing up in the micro-SaaS communities where those builders actually operate.

We also redesigned our documentation hub to better serve SaaS and app developers.

The result was clear. By the end of 2025, weekly SaaS product launches on the platform had tripled.

What This Means for You

Choose growth channels that reduce uncertainty and compound over time:

- Build where your customers already are: Focus on one platform or ecosystem your users rely on daily. A well-placed integration often beats months of ad testing.

- Earn visibility through participation: Show up where users ask questions, compare tools, and share solutions — forums, Slack groups, app directories, or partner marketplaces within the ecosystem you’re targeting.

- Treat ads as a measured experiment: Use them only when you can tie spend to a clear outcome, like trial starts or demo bookings, and shut them off if payback isn’t predictable.

As these channels mature, the payoff shifts from short-term spikes to predictable signups and expansion you can plan around.

Read also: Where Indie SaaS Founders Actually Get Customers

Free Trials Outperformed the Freemium Model

Many founders dropped the freemium model in favor of short or reverse trials that expose full value early and surface serious buyers sooner.

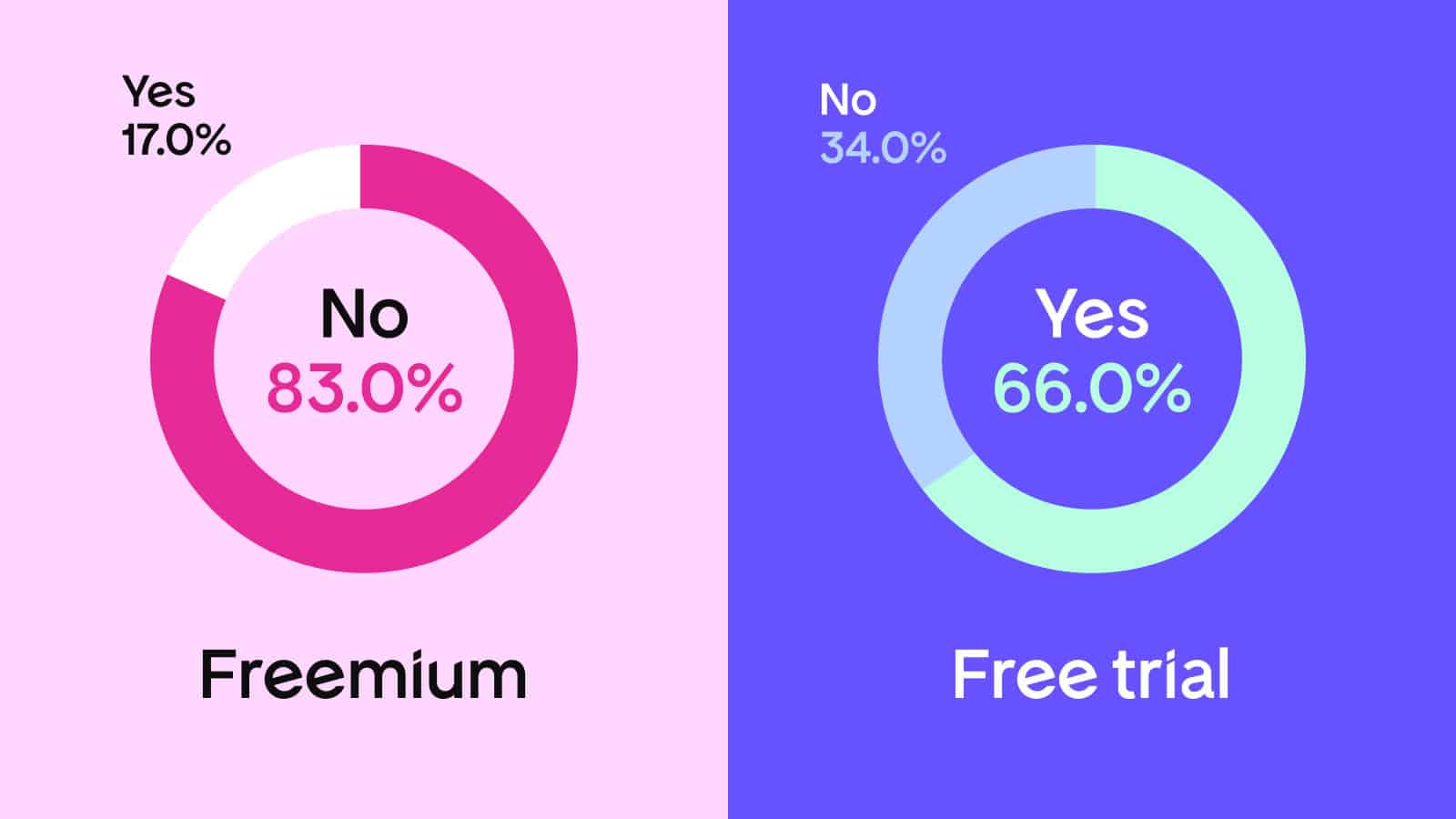

In The SaaS Playbook, Rob Walling shares that:

- Only 17% still maintain a freemium tier

- 66% of SaaS products now offer a free trial

Instead of debating models in theory, founders let the numbers guide their decisions. First Page Sage analyzed data from 80+ SaaS clients to calculate typical SaaS conversion rates:

| Entry model | Typical conversion |

| Freemium → Paid | 3%–4% |

| Opt-in trial (no card required) → Paid | 18% |

| Opt-out trial (card required) → Paid | 50% |

This is reflected in how Freemius makers structure their trials. Among SaaS products offering trials, 70.6% require a credit card at signup, suggesting most have found card-required trials convert better in practice.

The pattern shows up broadly across the ecosystem as well. MicroConf’s survey found 70% now ask for a credit card upfront.

But not everyone abandoned freemium entirely. Some kept the free tier but added reverse trials. Users get temporary access to all paid features, then drop to the free tier if they do not convert.

Even with that fallback, a 1,000+ product benchmarking survey by OpenView, Pendo, and Growth Unhinged shows reverse trials usually hit around a 20% conversion rate.

That is far higher than freemium alone, without forcing teams to support a large base of non-paying users long term.

Those numbers can climb higher when users truly depend on the product. One of our SaaS makers, Tiago Alves, hit an 83% conversion rate with Bake That Batter.

He’d built the bakery order management software for his sister, but word spread through the baking community and soon 150 bakers were using it for free. When he introduced paid subscriptions, 125 subscribed immediately.

What This Means for You

If you’re running freemium, consider testing a more deliberate entry point:

- Create a clear moment to decide: Use a 7–14 day trial so users either commit to the product or move on, instead of lingering indefinitely on a free tier.

- Require a credit card to qualify buyers: Card-required trials attract users who are more likely to pay and give useful feedback.

- Use reverse trials to keep freemium without the drag: Give users full access for a short period, then move them back to the free tier if they don’t upgrade. This lets users experience the paid value early without committing you to supporting free users long-term.

Watch how users behave when they see the full product early: when they choose to pay, which features they rely on, and what questions they ask. In practice, this helps founders understand what drives upgrades much sooner.

Profitability As the New Badge of Honor

More micro-SaaS founders built businesses without outside capital. Instead of raising money to extend the runway, they focused on keeping scope tight, costs low, and revenue close to the product.

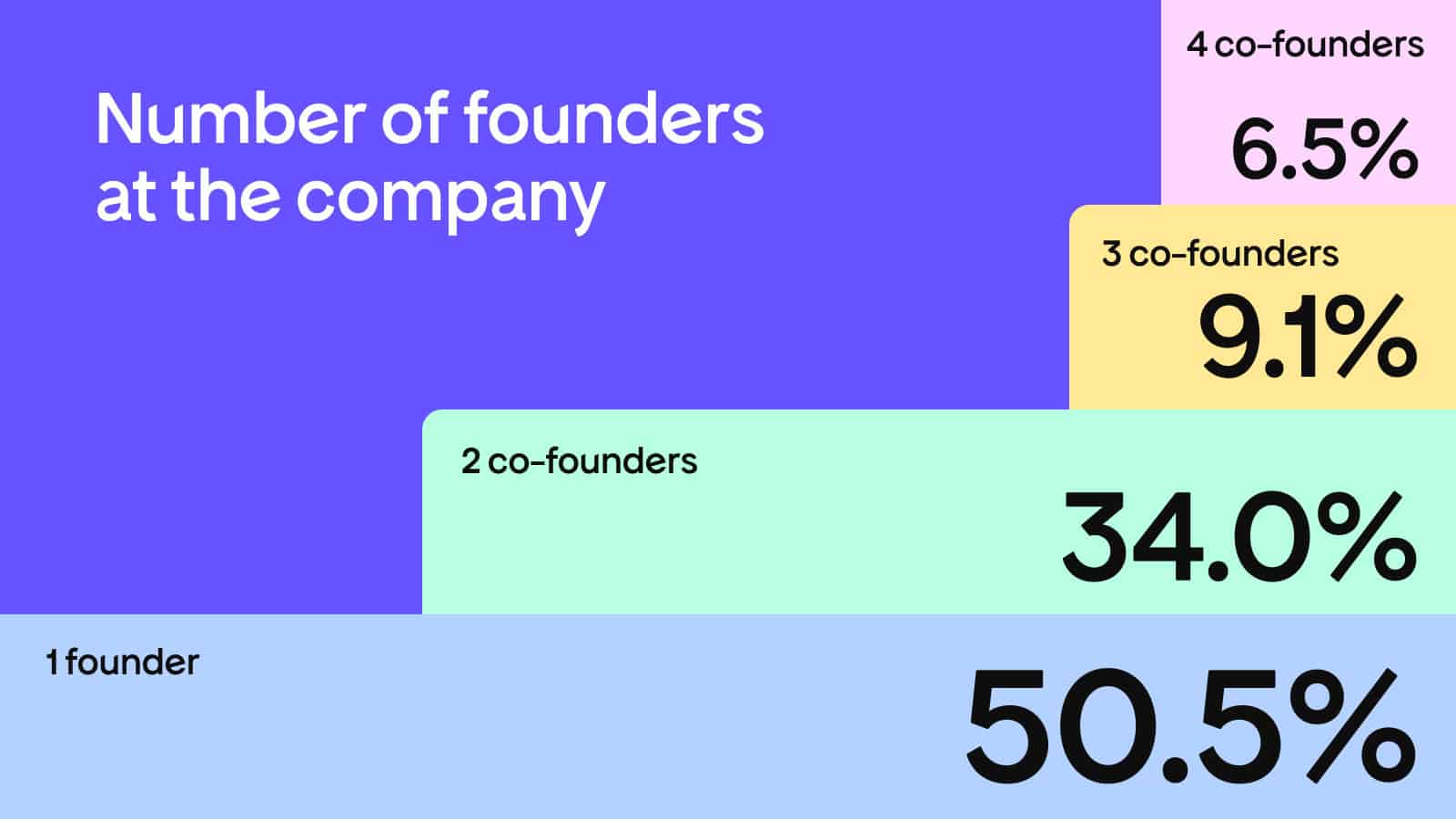

About half of independent SaaS products in MicroConf’s survey are solo-founded, while roughly 95% of the micro-SaaS businesses analyzed by Rocking Web reach profitability within their first year.

We see similar patterns on Freemius — 45.7% of our SaaS makers are solo founders.

While revenue varies widely, the opportunity is real: a one or two-person software business today can realistically reach the ARR that used to require a whole startup.

Rocking Web data also shows that most don’t rush to scale. Instead, revenue tends to cluster at a few clear stages:

- ~70% earn under $1,000 MRR, using that early revenue phase to validate product-market fit

- 18% sit in the $1K–$5K MRR range, covering costs and buying time to decide what’s worth scaling

Once products cross into profitability, revenue stabilizes:

- The median profitable micro SaaS makes about $4.2K MRR, enough to fund ongoing development without external capital

- The top 1% exceed $50K MRR (roughly $600K ARR) — often run by teams of one to three people

The chart above reflects the broader micro-SaaS market. The MicroConf 2025 conference audience skewed far more heavily toward higher-revenue businesses:

- 28% of 230 founders reported more than $100K in MRR — all without venture funding.

What This Means for You

Take profitability as a constraint that guides how you build and grow:

- Aim to cover costs before chasing growth: Focus first on reaching break-even (even at low MRR), so hosting, tools, and basic expenses are paid for by the product itself.

- Keep the model simple while you learn: Limit plans, features, and fixed costs so small revenue gains have an immediate impact on stability.

- Let revenue justify expansion: Add complexity (hiring, infrastructure, or new channels) only when existing revenue comfortably supports it.

- Use profit to stay flexible: A profitable base gives you the option to grow, pause, or pivot without urgency or outside pressure.

When revenue pays the bills, you control the pace. That leverage is what allows small teams to compete sustainably against much larger ones.

Read also: Build Small on Purpose: How to Find a SaaS Niche That Pays

The Road Ahead — The AI-Native Indie Era

The data points in one clear direction:

New SaaS products are increasingly built on AI from day one.

Instead of starting as traditional software and adding intelligence later, founders are designing products where AI sits at the core. With the AI-in-SaaS market expected to reach $775B by 2031, this is quickly becoming the default.

AI now absorbs much of the overhead that once forced early hiring, expanding what a solo founder or tiny team can build and run.

You can see this in where micro-SaaS is growing fastest: automation tools, developer utilities, analytics, add-ons… These products stay intentionally narrow, while the system carries the repetitive work in the background.

This is what “AI-native” looks like in practice. The product helps interpret inputs, suggests next actions, and reduces effort for the users — without taking control away from them.

Put together, this changes how SaaS companies get built.

The next wave won’t reward bigger teams by default. It will reward makers who design for leverage early: AI as infrastructure, pricing that evolves with usage, and distribution channels that compound over time.

If you’re ready to build this way, our VP of Engineering Swashata Ghosh has created a comprehensive course on building and monetizing SaaS with AI as infrastructure.

It walks through the entire stack — from using AI tools to build faster, to implementing usage-based pricing that scales with your product.

For micro-SaaS founders, this is the opening. The tools are better, the costs are lower, and the path to sustainability is clearer than it’s been in years.

Staying small is no longer a constraint — it’s often the advantage.