|

|

Imagine losing a sale, fighting to get your money back, and then getting slapped with a $30 fee for trying! 😵💫

That’s the reality many indie developers and software makers are waking up to after Stripe announced a major update to its chargeback fees.

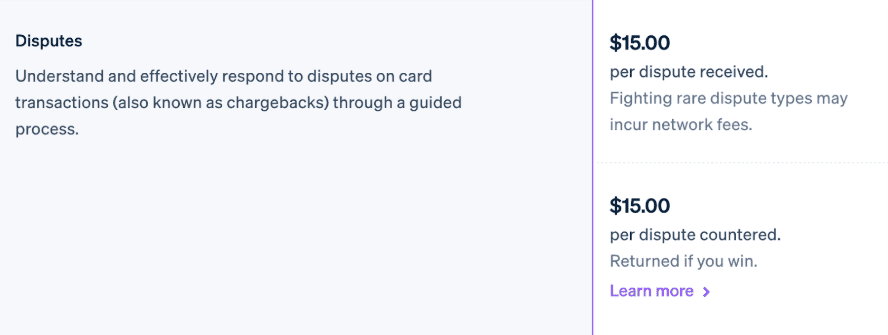

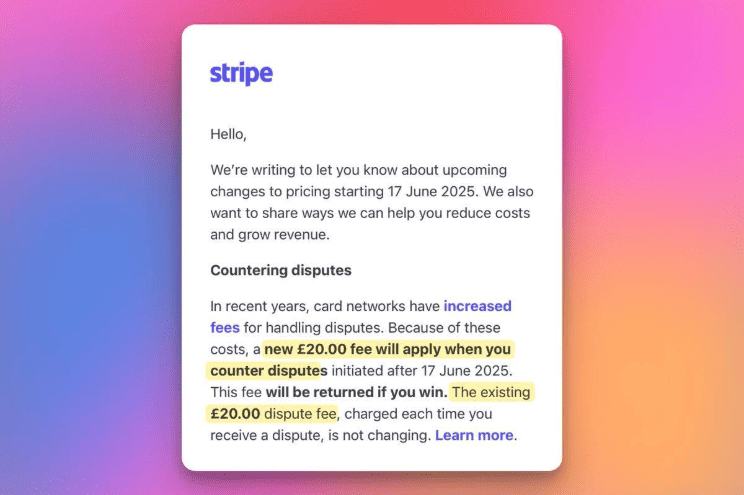

According to recent emails sent to Stripe users — after June 17th, 2025, a new $15 fee will apply just for countering a dispute (on top of the existing $15 chargeback fee).

Note that the fees for UK Stripe accounts are £20+£20 — which is even more painful. See the example email below:

For big companies with automated dispute systems, chargebacks are still a pain, but it’s a frog they can swallow without losing sleep.

For indie developers and small software businesses handling disputes manually, though, it’s less of a frog and more like stepping barefoot on a LEGO.

In this article, we’ll break down exactly what this new Stripe chargeback fee means, why it’s especially tough on indie makers, and how Freemius offers a more maker-friendly approach to payments, subscriptions, and disputes (without the above-mentioned fees).

Breaking Down the Stripe Chargeback Fee

The new Stripe dispute fee policy isn’t just a price hike—It fundamentally changes the economics of handling chargebacks.

Here’s what’s new:

- $15 (£20) Counter dispute fee: If you choose to fight a chargeback, Stripe will now charge an additional fee (just for submitting your defense).

- Non-refundable dispute fee: The original $15 (£20) dispute fee remains non-refundable, even if you win.

- Partial refunds: If you successfully overturn the dispute, Stripe will refund the counter fee, but you’re still going to be charged the initial dispute fee, which is a massive bummer.

For indie developers and small software businesses, the hidden impact goes beyond the dollar amount. This new policy opens the door to a whole new set of issues:

- More risk to fight back: Every chargeback now carries a financial penalty, even when you’re in the right. It’s like getting fined for defending your own wallet. This setup discourages makers from contesting disputes, practically rolling out the red carpet for bad actors to stroll in and exploit the system.

- A tax on small transactions: For developers selling apps, SaaS, or digital products at lower price points, this change is brutal. If you sell a $10 per month subscription, a failed dispute now costs 3-4 times the original sale, leaving you not only unpaid but in the red.

- An additional risk for newcomers: The new Stripe fee can jeopardize and demotivate a maker just getting started. Say a customer forgets to cancel their $9 monthly subscription, or they think they canceled, but they actually didn’t. After six months, they realize the subscription is still active and dispute all last six renewals. The dispute fees end up at $90, and if you want to contest, you’re risking an additional $90, which means you’re potentially losing $234, more than two years of customer value 🤯. It’s less “startup hustle” and more “subscription Russian roulette.”

- The higher effective rate of Stripe: On average, you get one dispute per 100 charges. If you charge $10 per transaction, it means there’s an additional cost of $15 for every $1,000 you make, potentially $15 more to contest it. If you lose, you’re losing $30 for the dispute and $10 for the charge. That’s $40 out of $1,000, which adds 4% to the effective cost of Stripe. This shows the illusion of Stripe’s base of 2.9% + .3 rate. Just the disputes alone more than double Stripe’s effective rate. And that doesn’t even include billing, cross-border, invoice, and the countless other extra fees essential for running a global subscription business.

Bottom line: This fee isn’t just a number, it reshapes how small makers handle disputes, forcing them to think twice before standing up for their hard-earned revenue.

1 dispute in Stripe now costs -$30 🥲 pic.twitter.com/FYpuP1IPrV

— Marc Lou (@marc_louvion) March 20, 2025

The Hidden Costs of Chargebacks

The financial hit isn’t the only problem. Let’s talk about the other ways chargebacks hurt your business:

- Lost revenue: Not only do you lose the sale, but for downloadable digital products like apps and plugins, customers may still retain access after a chargeback, creating a double loss for your business. Basically like allowing people to steal your stuff and then handing them a bonus for their troubles.

- Time drain: Fighting chargebacks is time-consuming. Gathering evidence, writing up a case, and responding to disputes eats up hours that smaller software makers could spend improving their product or marketing.

- Reputation damage & account suspension: Many chargebacks can lead to higher fees or even account suspension. Stripe tracks chargeback rate, and exceeding 0.75% flags your business as “high risk.” It’s like getting detention because the school bully keeps stealing your lunch money.

- Psychological toll: Let’s be real, dealing with disputes, especially unjust ones, is demoralizing. It’s frustrating enough to lose a sale; adding a hefty fee on top of it feels like taking that LEGO you earlier stepped on and jamming it into your eye.

I agree. Just been a victim of Card Testing attack which is another angle of receiving dispute. And it’s such a pain.

So not just customers but Stripe should own and be made to pay as well.

Why does a founder has to bear it all!— Vivek (@vivekalogics) March 22, 2025

Users are unhappy with the new Stripe chargeback fee

What Should You Do If You’re on Stripe Now?

As the new Stripe dispute fees take effect, many small businesses and indie developers are feeling this is the last straw in a series of mounting fees and price hikes.

Here are just a few examples from the past few years:

- Cross-border fee quietly increased from 1% to 1.5%

- Stripe stopped refunding processing fees on customer refunds

- The original $15 dispute fee became non-refundable—even when winning disputes

- The cost of Stripe Billing rose from 0.5% to 0.7%

These changes can hit hard, particularly if your business relies on a high volume of transactions or is susceptible to chargebacks.

Here’s how you can navigate the short-term challenges and lay the groundwork for a more sustainable, growth-focused payment strategy in the long term.

1. Short-Term: Minimize the Damage

If you plan to stick with Stripe for now, you need to be proactive in managing the impact of the higher fees and chargebacks. While you may not be able to reverse the policy changes, there are several strategies you can implement immediately to protect your revenue and minimize additional costs:

Track Chargebacks More Closely

Chargebacks are now more expensive than ever, and proactive tracking is essential to stay ahead. Use tools like Stripe’s Radar or third-party fraud prevention software to monitor transaction patterns and identify potential risks. Regularly review your chargeback ratio. Anything above 0.75% could raise a flag and potentially lead to penalties or account termination.

Tighten Your Refund Policies

Revisit your refund and cancellation policies to ensure they are clear, concise, and easily accessible to your customers. Consider adding more robust terms that outline specific conditions under which refunds or chargebacks will be accepted, and be transparent with customers about the consequences of abuse.

Strengthen Fraud Detection

Protecting your site against fraud is crucial, especially in an environment where chargebacks are becoming more common. Add CAPTCHA to your checkout forms to reduce card testing, and consider adding purchase limits for regions with higher fraud rates.

Dispute Handling: Submission is Key

If a dispute arises, submit detailed, compelling evidence when contesting chargebacks. The more information you can provide, the higher your chances of winning the dispute. Stripe’s Dispute Management API offers tools to help streamline this process and improve your chances of success, but you still have to think about the original dispute fee you’ll need to pay.

Automate Refunds for Dispute “Enquiries”

To prevent disputes from escalating into (often unwinnable) chargebacks, you can set up a system to automatically attempt a refund during the preliminary — or enquiry — phase. By integrating with Stripe webhooks, this process can run seamlessly. For smaller transactions, the minor loss is often a worthwhile trade-off to avoid a costly dispute. This approach ensures you issue a full refund early, resolving the enquiry before it has a chance to escalate.

2. Long-Term: Rethink Your Payment Setup

While the short-term fixes are necessary, you should also be considering your long-term strategy. Ask yourself: Is Stripe still the best fit for your business?

For some businesses, Stripe’s advanced API & billing capabilities might outweigh the increased costs. But if you’re feeling the squeeze from rising fees, chargebacks, and limited support, it could be time to explore more maker-friendly alternatives that align with your business goals.

It’s essential to take a step back and analyze whether your current payment processor is still the best option. Factor in not just transaction fees, but also the costs associated with chargebacks, customer support, global tax compliance, and additional fees for international transactions. Alternative platforms like Freemius offer a comprehensive solution for micro SaaS and software businesses.

But you should also think beyond the fees. Think about what you’re really getting to help grow your business.

Many payment processors only provide transactional services. At Freemius, we go beyond that by positioning ourselves as a partner in your business growth. We help you build a revenue model that scales without the constant fear of unexpected costs and account suspension.

How Freemius Handles Chargebacks Differently

We have a different model than Stripe. Let’s get into the specifics:

| Feature | Stripe | Freemius |

|---|---|---|

| Chargeback Prevention | General fraud detection. | Proactive fraud detection + transaction pattern & buyer behavior analysis. |

| Handling Chargeback Disputes | Disputed amount immediately deducted from balance. | Funds stay in your account during dispute. |

| Chargeback Win Rate | Standard industry rates. | Higher win rate (33.9% for Stripe disputes, 54.96% for PayPal). |

| Chargeback Fees | $15 fee per dispute, even if you win (on top of the $15 fee for just countering). | No dispute fees—Freemius absorbs the cost. |

| Dispute Support | You handle disputes alone. | Freemius handles disputes for you, improving success rates. |

| Impact on Cash Flow | Funds locked for 60-90 days during dispute. | Funds stay available unless you lose the dispute. |

| Automated Revenue Recovery | Basic failed payment retries. | Automated exit-intent offers, renewal reminders, retention flows. |

Preventing Chargebacks Before They Happen

“We believe that chargebacks are more than a financial hit. They’re a distraction from building and growing your product”, says Freemius CEO, Vova Feldman.

That’s why Freemius tackles this at the source with proactive fraud detection built for software businesses.

By analyzing transaction patterns and buyer behavior, our multi-layer protection system flags potentially fraudulent purchases before they’re completed. “Fewer fraudulent sales mean fewer disputes, saving you time, revenue, and frustration”, adds Vova.

Better Cash Flow Management

Stripe immediately deducts the disputed amount from your balance the moment a dispute is filed (before it’s even reviewed, before anyone knows if it’s legitimate).

Freemius does things differently.

“We believe in presumed innocence for our makers. Your revenue stays in your account while the dispute is being resolved,” explains Freemius CEO, Vova Feldman.

This difference has a real impact on businesses:

- With Stripe: A $500 subscription dispute means $500 is instantly removed from your balance (along with an additional $15 fee) regardless of whether the chargeback is valid. That money is locked up for 60-90 days while the dispute is processed.

- With Freemius: The $500 stays in your account during the entire dispute process. If you win (which happens more often with our expert team handling the case), you never lose a cent. If the dispute is lost, only then is the amount deducted.

“Cash flow is the lifeblood of any software business, especially for indie makers and small teams,” adds Vova. “Our approach ensures you can continue running and growing your business without unexpected financial roadblocks whenever a dispute arises.”

This philosophy goes beyond just chargebacks. It’s part of Freemius’ core commitment to being a true partner in your success, not just another payment processor.

No Surprise Fees (Even When Disputes Happen)

Stripe’s new policy means makers now face a double penalty: losing the sale and paying a hefty fee for the privilege of defending it.

Freemius takes a different approach: we absorb the chargeback fees.

“If you win the dispute, you keep your money without any dispute fees or extra penalties. It’s about fairness. Makers shouldn’t be punished for defending their hard-earned revenue”, says Vova.

Your Dispute Support Team

Fighting a chargeback alone is overwhelming especially when you’re focused on running a business.

Freemius has your back.

Our team handles the dispute process on your behalf, from gathering evidence and creating compelling responses to representing you directly. Many solo software makers lose disputes not because they’re wrong but because they don’t have enough experience handling the process.

We have 10+ years of dispute-contesting experience. In addition, we developed robust systems and processes and improved our system to win disputes at an exceptionally high rate compared to market standards.

With Freemius, you’re never fighting solo — you’ve got a team that knows the system and works to protect your income:

“We handle the process seamlessly for software makers with an optimized process that drives way more dispute wins than the market average. We do involve the makers all the way through, giving transparency and allowing them to provide additional insights, but it’s completely optional. So, makers using Freemius don’t even need to think about disputes,” says Vova.

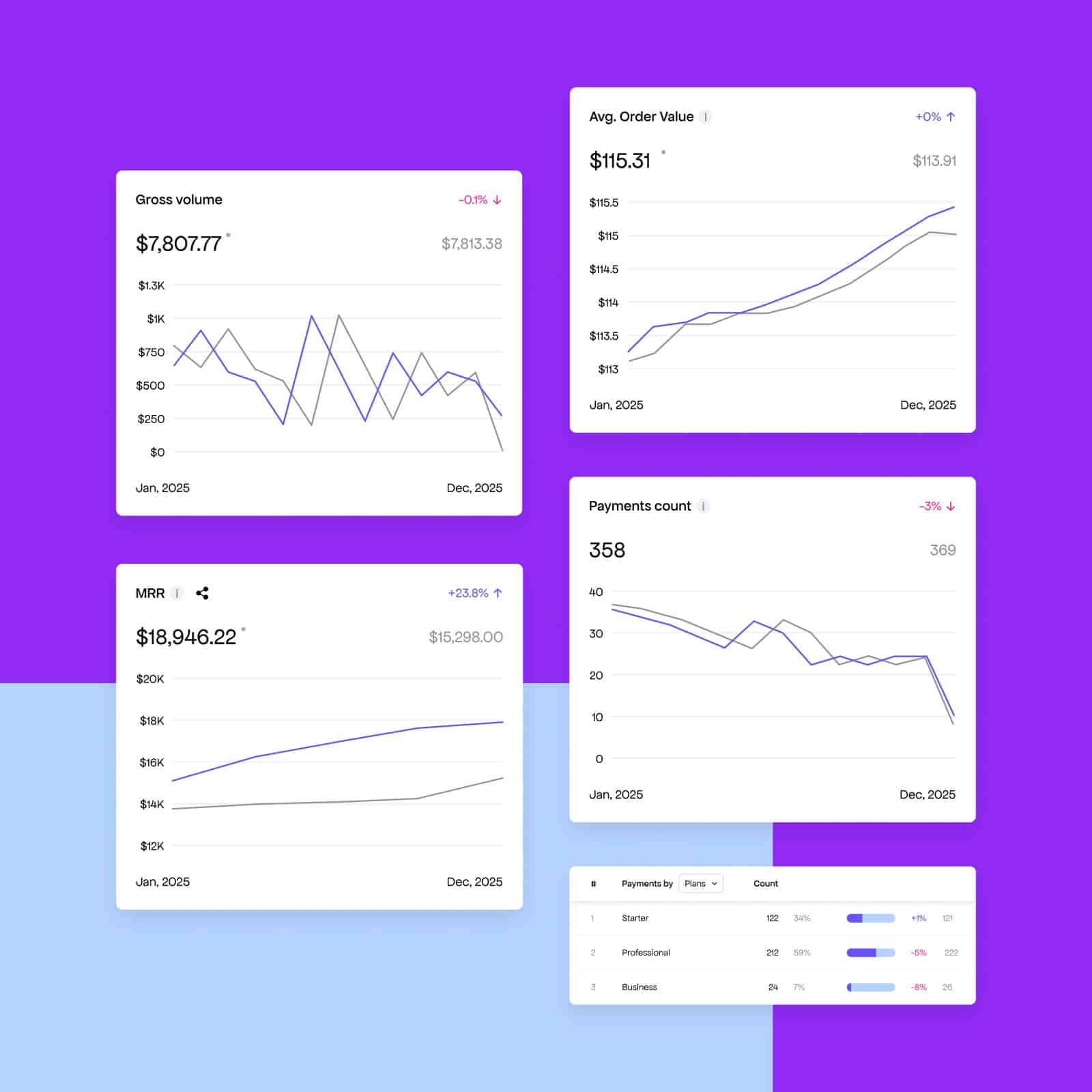

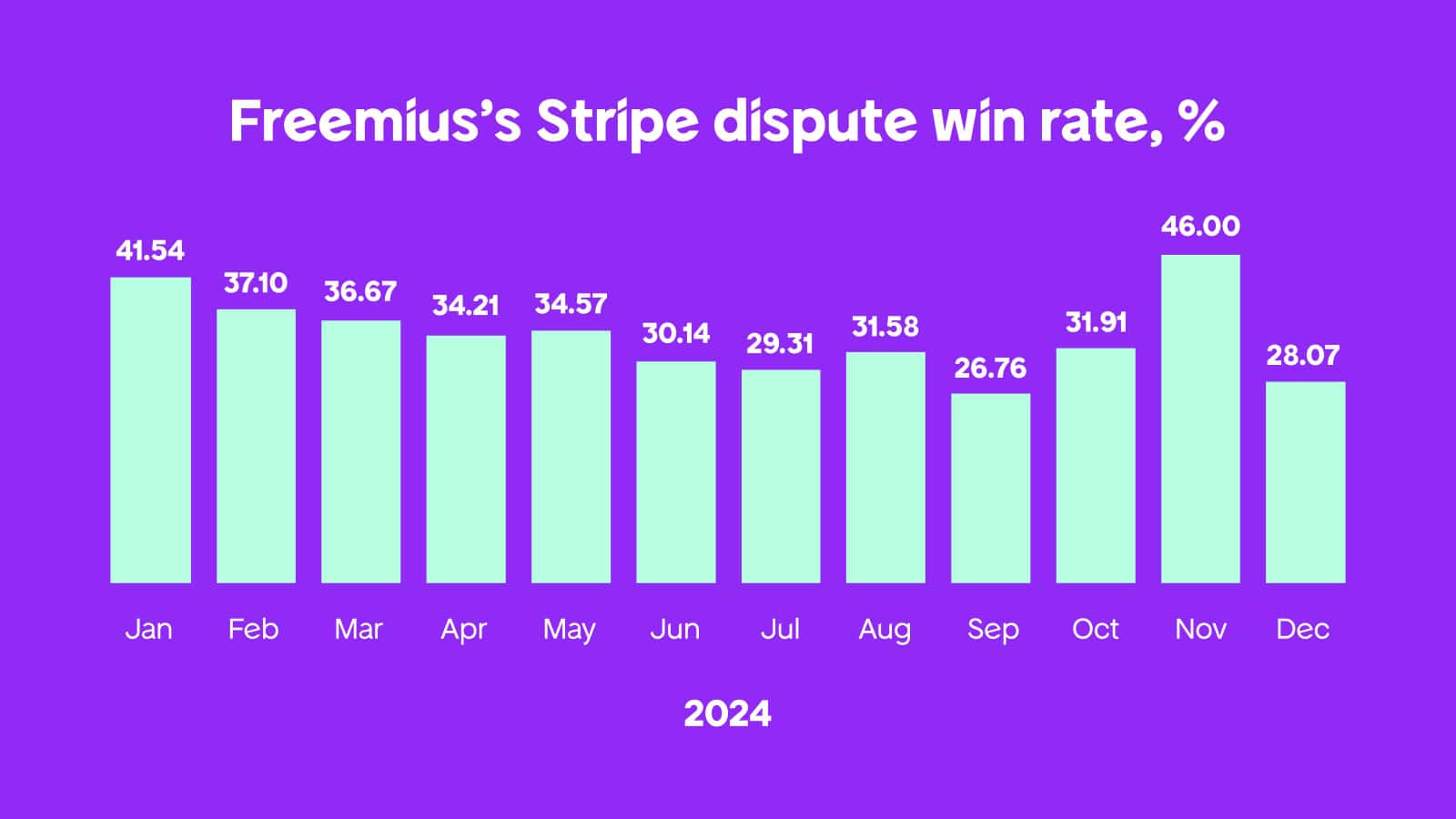

Take a look at Freemius’ Stripe dispute win rate data in the graph below — the average for 2024 was 33.9%.

Note: It’s worth mentioning that our average win rate for PayPal disputes was 54.96% in 2024.

Recovering Revenue Automatically

Chargebacks aren’t the only way you lose money. Failed payments, expired cards, and declined renewals silently chip away at your revenue.

Freemius provides multiple automated systems designed specifically to recover potentially lost revenue at different stages of the customer journey, from pre-purchase recovery, like targeted exit-intent coupons, to automated renewal reminders to cancelation retention flows.

These automated tools work together to maximize conversion rate and CLTV, and minimize churn throughout the customer lifecycle, all while requiring minimal setup or management from the software maker.

Beyond Fees: Why Freemius Is More Maker-Friendly

When it comes to selling software, most platforms stop at processing payments. But, Freemius is different.

While Stripe and others focus primarily on transactions, Freemius supports your entire business journey — from your first customer to your potential exit. We’ve built a platform that doesn’t just process payments but actively helps you maximize revenue at every customer touchpoint.

Let’s explain this a bit more in detail.

Our full lifecycle support approach is built on three powerful pillars that transform how software makers monetize their products:

1. Complete Growth Infrastructure

Most payment processors just handle the transaction, and then you’re on your own. We optimize your entire customer lifecycle with the focus on CRO and marketing automation:

- Before purchase: Capture abandoning visitors with smart exit coupons before they even enter an email

- During checkout: Implement best practices that increase conversion by up to 30%

- After purchase: Deploy retention flows that can save a portion of cancellations with targeted offers

This means you can focus on building exceptional products while our infrastructure works 24/7 to maximize your revenue potential through several features, and eliminate the need for multiple fragmented tools:

- Licensing management: Issue, verify, and manage software licenses without building your own system

- Subscription handling: Manage recurring billing, trial periods, and cancellations seamlessly

- Customer portal: Give users a self-service dashboard to manage their subscriptions, downloads, and licenses

- US sales tax and VAT handling: we calculate, collect, and remit taxes for you. No extra costs, no legal headaches.

Read more: Charging Sales Tax on Your Software: A Guide for Subscription-Based Businesses

2. Your Growth Team

We only win when you win. That’s why we don’t just provide tools — we become an extension of your team:

Data-driven guidance: With insights from 1000+ software businesses, we can help optimize your pricing and packaging for maximum results. Freemius allows you to make smarter business decisions with detailed analytics on every aspect of your software business, for example:

- Revenue analytics: Break down income by plan, region, and customer segments to optimize your pricing strategy

- Churn risk identification: Identify at-risk customers before they cancel to improve retention

- Proactive optimization: Identify revenue opportunities you might miss when you’re heads-down in code

- Strategic support: Marketing, compliance, and business growth systems and advice at critical moments

Unlike conventional payment processors that leave you to figure things out alone, we’re actively invested in your growth.

3. Powerful Growth Network

Most software makers build in isolation. And no matter the benefits, this can sometimes lead to frustration and feelings of loneliness. With Freemius, you gain access to:

- Maker community: Freemius takes a creator-first approach. We offer direct guidance from experts, plus a community of 1,700+ like-minded software makers who share tips, insights, and encouragement in a dedicated Slack space, but also during physical Makers’ Meetup events we organize all around the globe.

- Affiliate connections: Tap into established relationships with promoters and YouTubers who can amplify your reach. Freemius helps you turn users into brand advocates through our built-in, fully-featured affiliate platform that requires zero additional setup when using their payment infrastructure.

- Buyer & investor network: When you’re ready to scale or exit, we can connect you with the right people. We have a network of investors and buyers looking to buy micro and small software businesses.

Read more: The Ultimate Guide To An Affiliate Program

We’re uniquely positioned to help throughout your entire business lifecycle — from launch through growth and scale, all the way to exit.

While others hit you with surprise fees when things go wrong, we’re busy optimizing your entire commercial operation to prevent problems before they happen. We’re not just facilitating transactions; we’re helping build sustainable businesses.

Conclusion: Adapt and Protect Your Revenue

For indie developers and small businesses Stripe’s new chargeback fees hit harder than a bug right before launch day.

But don’t let this shakeup define your future. By adapting your payment policies, strengthening fraud detection, and exploring more cost-effective alternatives like

Freemius, you can turn this setback into a setup for sustainable growth..

At Freemius, we’re more than just a payment processor; we’re your monetization team. Our platform includes everything from fraud prevention and chargeback management to subscription handling and tax compliance—minus the surprise fees that sneak up on you like a bad plugin update..

If you’re tired of watching your profits vanish into the chargeback abyss, let’s chat. Freemius can help you ditch the hidden fees, fight fraud, and get back to what you do best: growing your software business.

Ready to make a change? Check out our transparent pricing and contact us to explore how Freemius can help your business thrive without the burden of expensive chargeback fees.