|

|

Choosing the wrong payment processor for your software business can quietly stall your growth. Hidden fees, messy integrations, compliance issues, and missing growth tools usually show up only after you’re locked in — when switching is costly and painful.

We’ve worked with hundreds of SaaS makers, plugin developers, and theme shops who hit these roadblocks the hard way. So before you pick your platform, read this guide.

By the end, you’ll know how to protect your margins, save time, and choose a platform that actually supports your growth — instead of holding you back.

Cost Traps

At first glance, a 2.9% transaction fee might seem like a sweet deal. But if you zoom in, the real costs start stacking, and you end up saying goodbye to a much larger portion of your revenue.

Foreign exchange (FX) conversion, payout fees, and “optional” features can quietly chip away at your margins. If you sell low-ticket or global products, these costs become even more painful.

Here are the most common pricing traps and how to steer clear:

Not-So-Obvious Fees

Many platforms advertise low base rates but hide extras in the fine print. You’ll often pay:

- Up to 2.5% just to withdraw your earnings

- Up to 0.4% for invoicing

- Up to $30 for dispute fees

- +0.7% for subscription payments

- +1.5% for international cards

- +1.5% for PayPal transactions

- Extra fees for affiliate payouts

- Dunning and cart abandonment recovery (which often requires third-party tools)

Key takeaway: Always request a full fee breakdown upfront — including FX, payouts, and “premium” features — so you know your real cost before committing.

The Multi-Currency Penalty

Selling globally but receiving payouts in a single local currency means forced FX conversions. These losses can add up fast, as many platforms don’t support multi-currency balances.

For instance, if you sell in USD but live in the UK, most platforms convert your payouts to GBP (usually at a 2%–4% loss).

Key takeaway: Choose a platform that pays out in your top currencies (USD/EUR/GBP) to keep the portion of the revenue you’d otherwise lose to conversions.

Low-Ticket Items

The fixed fee portion of a transaction (for example, $0.50) doesn’t scale down. If you sell a $10/mo SaaS:

- $0.30 = 3% of the sale

- $0.50 = 5%

Suddenly, your “low” 2.9% fee is now 8%. For high-volume, low-price businesses, that’s a silent killer.

Key takeaway: If you sell low-ticket products, pick a platform with %-based fees or microtransaction pricing, and not one that takes a fixed cut of every sale.

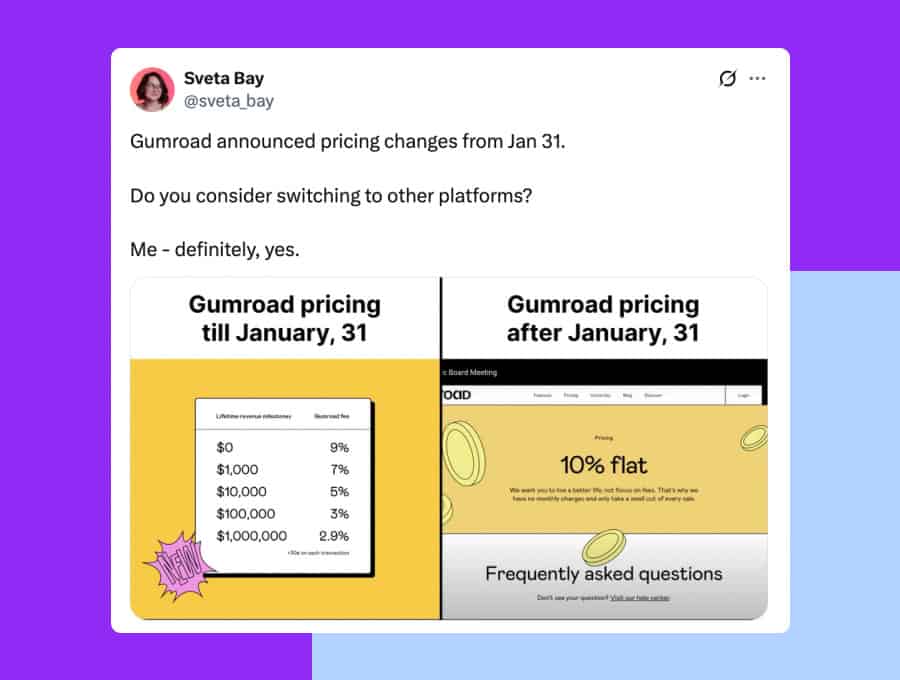

Unsustainable Pricing

Cheap now doesn’t mean cheap forever.

Just ask Gumroad sellers. Their fees jumped from 2.9% to 10% + gateway fees overnight. Why? Because the original pricing model wasn’t built to scale. This change pushed many software makers to consider switching to another platform.

Key takeaway: Evaluate the platform’s pricing history (and sustainability) before joining. Avoid solutions with loss-leader pricing that may spike later.

For a deeper dive, check out our breakdown of Stripe vs. merchant of record services and how their true costs compare.

Avoiding cost traps: The case for Freemius

|

Operational Traps

Even if you dodge high fees, there’s another silent cost that kills momentum: your time. Most software founders underestimate how much operational overhead comes with managing payments, subscriptions, tax, and integrations until they’re buried in it.

The Developer Time Sink

Building your own payments stack seems flexible, but it actually eats up weeks (or months) of your time.

“I spent up to 200 hours customizing WooCommerce: designing the checkout, building thank-you pages, wrangling hooks, fixing email templates, and integrating Stripe.

And after all that, all I could do was send a ZIP file after purchase. No licenses, no updates, no easy refunds, no visibility into where my product was used. As a solo developer, building that infrastructure myself was impossible,” says Mikuláš Karpeta, founder of Minimalio and former WooCommerce user.

That’s time that could’ve gone into shipping features or landing users.

Key takeaway: Pick a platform that reduces dev overhead, not adds to it. This way, you’ll avoid spending 200+ hours building payment infrastructure instead of growing your product.

Tax Compliance Leads to Founder Burnout

Proper tax handling is time-consuming and expensive — more than just a box to check. Collecting, calculating, and remitting sales tax and VAT across borders is complex, constantly changing, and costly to get wrong.

Every country sets its own tax rates, thresholds, and invoicing rules. For example, in Europe, when selling to consumers, you need to register and pay VAT in the customer’s country.

For B2B sales, the reverse charge schema applies, so you don’t have to collect VAT, yet you still need to store evidence to prove it was a B2B sale, like VAT number, IP of the buyer, and more.

So, your options are to a) handle the taxes yourself, or b) choose a vendor that manages these taxes for you.

If you go with the former, be ready for the challenge that Diego Imbriani, founder of PolylAI Translator, faced.

“Tax management was so overwhelming that I restricted sales to businesses only. I knew this meant losing many potential customers, but the alternative was spending endless hours with consultants and accountants.”

Going with a merchant of record (MoR) platform means global taxes are handled for you — from calculation and collection to remittance. That means you can focus on product growth, not paperwork.

Key takeaway: Only choose platforms with built-in global tax handling, otherwise you’ll spend more time on accounting than product growth.

Unreliable Webhooks

Most platforms use webhook systems to notify your app when a payment fails or renews. But if a webhook fails silently, it can:

- Lock users out of paid features

- Trigger refunds

- Generate support tickets you shouldn’t have to deal with

Key takeaway: Confirm webhook reliability before signing on — missing or delayed webhook events can cost you users, refunds, and trust.

Avoiding operational traps: The case for Freemius

|

Next up: the platform decisions that quietly limit your growth from day one.

Growth Traps

Some platforms are great for selling one-off courses, ebooks, or consulting calls. But if you’re building a software business, you may discover that generic “sell anything” platforms lack the tools you need to grow MRR.

These gaps rarely reveal themselves until your churn spikes or growth stalls:

Platform Not Built for Your Use Case or Business Size

Generic payment processors like Stripe or PayPal focus on flexibility, not depth. That means features essential for software businesses (like licensing, free trials, cart recovery, retention flaws, or coupons and discounts) are missing, clunky, or outsourced to third-party tools.

“Platforms like Stripe and PayPal are powerful, but their strength lies in flexibility, not specialization. If your priority is speed, scale, and peace of mind, you need a merchant of record built for software makers,” explains Vova Feldman, CEO of Freemius.

When you’re forced to build a stack from scratch just to match your needs, growth takes a back seat to maintenance.

There’s another layer many founders overlook: who the platform is really built to serve.

For example, some platforms are optimized for software companies already making millions in revenue. But if you’re a small business, a platform that will best serve you is purpose-built for indie devs, micro-SaaS, and small plugin/theme shops.

One key differences is the level of attention and support you get. On platforms chasing whales, you may feel like a number in a queue with days-long wait times for support tickets, no chance to ever get on a call with someone, and no proactive help when you hit a roadblock.

But if you’re running a $10K, $20K, or $30K/month software company on a platform that’s made for businesses like yours, you’re a VIP customer. You’ll get strategic support, hands-on onboarding, and actual conversations with humans who know your space.

Another major difference is the platform’s features roadmap. One that is focused on large companies will spend meaningful resources into various security compliances like ISO 27001 and SOC2.

One like Freemius, focused on indie makers and small software companies, takes the time to develop a feature to easily share charts on social media to support makers building in public.

Key takeaway: You can build a duct-taped stack on a generic processor and wait in line for support, or choose a platform made for software businesses your size — where you’re treated like a partner, not a ticket number.

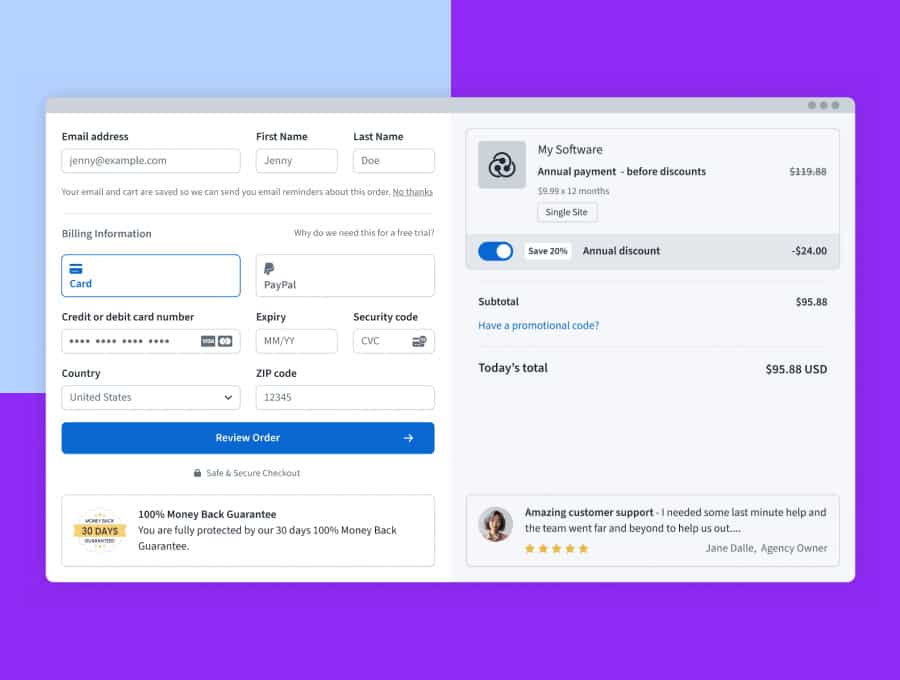

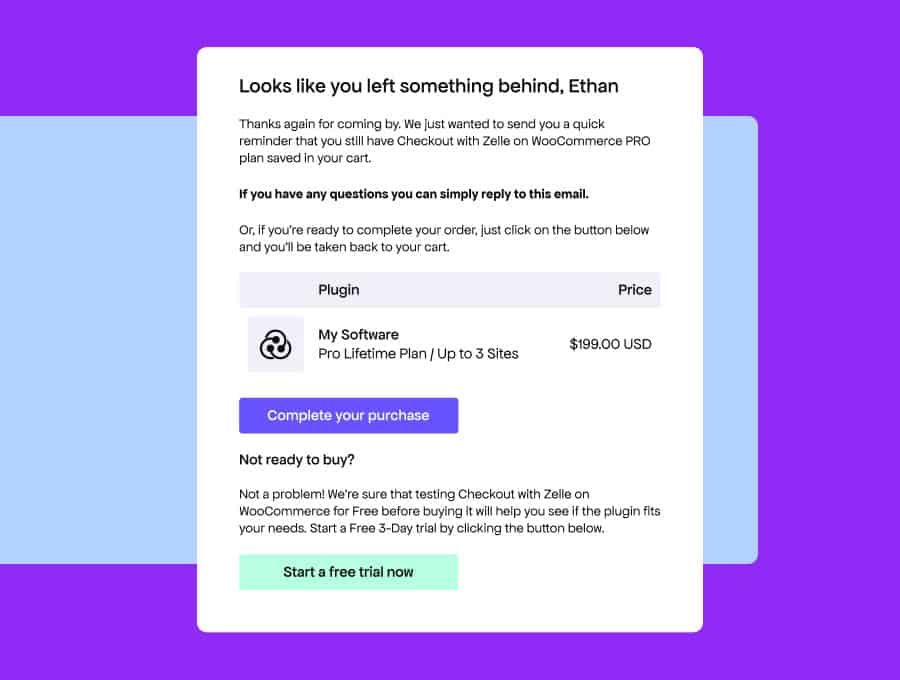

No Built-In Marketing Tools

If your payment processor doesn’t help you recover lost revenue or drive new sales, it’s just slowing you down. A weak checkout bleeds revenue, while a strong one builds and sustains it. Many platforms ignore this completely. They give you a payment form and nothing else.

Without tools like:

- Affiliate management

- Cart abandonment recovery

- Smart upsells and bundles

You’re missing low-effort, high-impact ways to grow.

“We’ve seen makers on the Freemius platform recover millions in lost revenue with automated cart abandonment recovery, all without writing a single line of code,” highlights Vova.

Key takeaway: Prioritize platforms with built-in revenue boosters (affiliates, upsells, cart recovery) so you don’t leave money on the table.

No Dunning Means Lost Revenue

Involuntary churn (users who don’t cancel but whose payments fail) can quietly cost you 5%–20% of your monthly revenue.

For example, our data show that around 30% of renewals fail on the first attempt. So, let’s say 50% of your income is from renewals. If you don’t have a recovery mechanism in place, that’s 15% of your monthly revenue lost.

Much of it’s preventable with a proper dunning setup.

If the platform doesn’t offer:

- Pre-dunning emails (before a card expires)

- Smart retries after failure

- Embedded update flows

You’ll lose revenue you never intended to lose.

Key takeaway: Make sure dunning (pre-expiry notices + retry logic) is included. It’s one of the easiest ways to protect 5%–20% of MRR.

Avoiding growth traps: The case for Freemius

|

If a platform isn’t actively helping you grow, it’s quietly holding you back.

But growth blockers aren’t the only threat. Next, let’s look at the hidden risks that can derail your business overnight.

Risk and Compliance Traps

When your business depends on recurring revenue, trust in your payment platform is everything. If that trust breaks, especially at scale, the consequences are immediate and painful. Many software makers don’t realize how fragile things are until it’s too late.

Here are the risk factors that most platforms won’t mention upfront.

Account Freezes During High Volume

Some platforms treat growth like fraud. Founders have reported getting their accounts frozen during Black Friday/Cyber Monday simply for processing too many payments at once. That means no payouts, no access, and a support ticket lost in the queue.

“We’ve seen aggressive compliance protocols kick in at the worst possible moments, and makers left scrambling to get their revenue unlocked,” confirms Vova.

Key takeaway: Before signing on, ask — how does this platform handle volume spikes and can I quickly talk to a human when a problem occurs?

Weak Security Means Business Liability

Your payment stack must be rock-solid. Without built-in two-factor authentication, fraud monitoring, or GDPR and PCI DSS compliance, you’re exposing your business (and customers) to unnecessary risk.

Security and data privacy gaps imply more than just shattered trust; they can become legal liabilities.

Key takeaway: Check for PCI DSS, GDPR compliance, fraud monitoring, and 2FA — don’t assume security is “handled.”

Chargebacks That Cost More Than the Sale

Most platforms charge dispute fees even when you win. Some even charge you an extra fee for countering the dispute. Worse, they don’t refund their processing fees when you issue a refund, meaning you lose money on both ends of the transaction.

Key takeaway: Read the fine print on refunds and disputes. A lenient chargeback policy on their side usually means tighter margins on yours.

Avoiding risk and compliance traps: The case for Freemius

|

If your platform becomes a liability the moment your business takes off, it’s not built for long-term success.

Read more: How to Deal with the New Stripe Chargeback Fee (And Why There’s a Better Way)

Future-Proofing Traps

What works now might break later, especially if your payment platform can’t scale with your business. From technical debt to company risk, some decisions don’t show their consequences until you’re trying to sell, migrate, or grow.

Here’s what to watch out for.

Lock-In With No Way Out

If your platform doesn’t offer a clean way to migrate subscriptions, you’re stuck.

“We’ve seen product acquisitions fall through simply because there was no clean way to transfer subscriptions. If they’re tied to a Stripe account with multiple products, migrating just one becomes a nightmare,” Vova adds.

Key takeaway: Confirm you can export subscription data cleanly, otherwise your business becomes unsellable or impossible to migrate.

Read more: Are you looking to switch? Schedule a free consultation call with our migrations specialist.

Currency Inflexibility

If your platform doesn’t support multi-currency payouts, you’re forced to accept FX conversion losses every single time you get paid. Even if you don’t sell globally now, once you do, this can silently erode thousands in profit.

Key takeaway: If you (are planning to) sell globally, pick a platform with multi-currency payout support — don’t sacrifice margin to forced FX conversions.

Avoiding future-proofing traps: The case for Freemius

|

If your platform creates exit friction or can’t scale with your growth, it’s not future-proof — it’s a liability waiting to happen.

Bonus: The Mindset Trap

Many founders obsess over the lowest fee and forget to ask the more important question: what will this platform cost me in time, growth, or missed revenue?

A 1% fee difference means nothing if you’re losing 5% to churn, 3% to FX, 2% for payouts, … and countless hours for setup and support.

“You may think you’re paying X, but effectively you’re paying 2x or 3x depending on your tech stack, sales model, geolocation, and the hidden costs your platform introduces.” — Vova Feldman, Freemius CEO

Key takeaway: Don’t optimize for the lowest fee. Optimize for total cost of ownership (time, churn, FX, support).

Choose a Partner in Growth, Not Just a Low-Cost Tool

The wrong payments processor choice will eat into your margins, drain your time, and introduce risks that compound as you scale. The right choice protects your revenue, reduces overhead, and actively helps you grow.

If you’re serious about building a sustainable software business, don’t optimize for the cheapest fee — optimize for total cost of ownership and long-term growth.

What can you do next?

- Audit your current platform against the 15 traps outlined here

- Calculate your real cost, including hidden fees, time spent, and lost revenue from churn

- Compare it to a purpose-built solution designed for software makers

If you’re serious about building a sustainable software business, make sure your payment partner supports that vision, not just your checkout.

Interested in learning more about how Freemius supports software makers in growing their businesses?

Talk to our founder and get all your questions answered so that you can make an informed decision.